Category Archive: 6b) Austrian Economics

Lyn Alden: Öl MUSS ins Depot! – Vorsicht vor Währungen

Lyn Alden ist das erste Mal in einem deutschen Interview. Sie verrät euch in diesem Interview worauf sie bei Gold, Bitcoin, Anleihen und Aktien achtet und warum sie kein Fan von Ethereum ist.

Seid gespannt!

Lyn Alden Twitter: https://www.lynalden.com/

Lyn Alden Website: https://twitter.com/lynaldencontact

Lyn Alden Ethereum Blogeintrag: https://www.lynalden.com/ethereum-analysis/

► Timestamps:

00:00 - 00:55 Intro

00:55 - 03:01 Wer ist Lyn...

Read More »

Read More »

Andy Moran – CM – 2003 – Brighton

Http://www.patreon.com/scoutsourced

http://www.twitter.com/scoutsourced

http://www.instagram.com/scoutsourced

Read More »

Read More »

Dr. Markus Krall warnt – SIE wollen es VERHEIMLICHEN!! Dieser GEHEIME PLAN läuft aktuell…AUGEN AUF

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise,

Read More »

Read More »

Review: Sohrab Ahmari’s New Attack on Laissez-Faire Liberalism

Sohrab Ahmari’s new book The Unbroken Thread: Discovering the Wisdom of Tradition in An Age of Chaos is so disappointing I don’t know where to begin. This may seem to be a harsh invective, but in reality, it is a confession. My previous attempts to review this book have resulted in little more than hours and hours of frustration and discarded drafts.

Read More »

Read More »

Dr. Markus Krall sagt voraus: Der Zusammenbruch des Fiat-Geldes kommt bald, seien Sie vorbereitet!

Ähnliche Meinungen teilen andere bekannte Experten, unter anderem: Mr. Dax, Dirk Müller, Dr. Markus Krall, Prof. Hans Werner Sinn, Marc Friedrich, Ernst Wolff, Dr. Daniel Stelter, Prof. Max Otte, Prof. Clemens Fuest, Andreas Popp, Florian Homm und viele andere!

Read More »

Read More »

Worauf DU beim Investieren achten musst! (Anfängerfehler vermeiden)

Es gibt viele Dinge auf die man beim Geld anlegen achten muss. Was die größten Fallen sind, wie du typische Fehler vermeidest und was erfolgreiche Investoren beachten, erfährst du heute in einem neuen Video “finanzielle Intelligenz”!

► Mein neues Buch

Du möchtest "Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3bfKWdN oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung...

Read More »

Read More »

Partei DIE KOMPETENTE vs. Markus Krall GemeinWohl-Ökonomie Christian Felber Wagenknecht H-W Sinn FFF

Gemeinwohlorientierte Wirtschafts-Ordnung gegen all die Verbreiter gefährlicher Irrtümer Richard David Precht BGE Bedingungsloses Grundeinkommen GWÖ Rainer Mausfeld Greta Thunberg Fridays For Future Hans-Werner Sinn Sahra Wagenknecht Ulrike Herrmann Bundeskanzler Sebastian Kurz Warren Buffett Luisa Neubauer Arnold Schwarzenegger Niko Paech Postwachstums-Ökonomie Die Wirtschaftsweisen ( Sachverständigenrat ) ifo Institut .

Read More »

Read More »

Kommt ein Impfzwang durch die Hintertür? (Kassenarztchef fordert Impfpflicht)

Darf man bald nur noch mit Impfung in den Urlaub? Das fordert der Landes-Kassenarztchef Peter Heinz. Damit wird die Spaltung der Gesellschaft immer weiter vorangetrieben und durch die Hintertür in der Salamitaktik eine indirekte Impfpflicht implementiert. Zudem hat das Statistikamt die Corona Zahlen des RKI kassiert und deutlich reduziert. Parallel liebäugelt man mit dem Überwachungssystem der kommunistischen Partei Chinas und findet gefallen am...

Read More »

Read More »

Cryptocurrencies and China Imperil the Reserve Currency Status of the US Dollar

In his book Denationalisation of Money, F.A. Hayek argued that governments have never devoted their power to providing proper money over time. They “have refrained from grossly abusing it only when they were under such a discipline as the gold standard imposed.”

Read More »

Read More »

The Phillips Curve Myth

According to a popular way of thinking, the central bank can influence the rate of economic expansion by means of monetary policy. It is also held that this influence carries a price, which manifests itself in terms of inflation.

Read More »

Read More »

Marcelo Lopez: “URAN ist das BESTE Investment meines Lebens!”

Marcelo Lopez ist einer der bekanntesten Rohstoff Hedgefonds Manager der Welt. Seit einigen Jahren ist er im Uranmarkt tätig und sieht darin die größte Investmentchance seines Lebens. Was ihn daran reizt und wie er auf Kritik reagiert, erfahrt ihr in dieser neuen Folge des Rohstoff Superzyklus!

Marcelo Lopez Twitter: https://twitter.com/malopez1975

► Mein neues Buch

Du möchtest "Die größte Chance aller Zeiten" bestellen?

mit Signatur:...

Read More »

Read More »

Keynes Said Inflation Fixed the Problems of Sticky Wages. He Was Wrong.

Britain’s economy had been suffering chronic unemployment for a decade prior to 1936. Economic theory as it was then understood clearly showed that the cause of a market surplus was sellers asking a price in excess of what buyers are willing to pay.

Read More »

Read More »

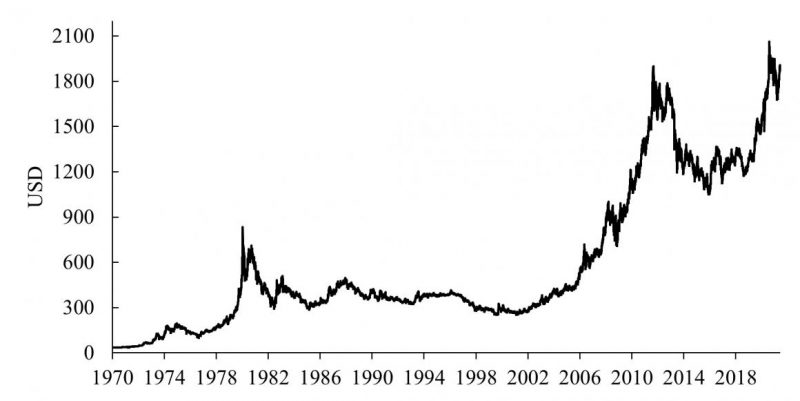

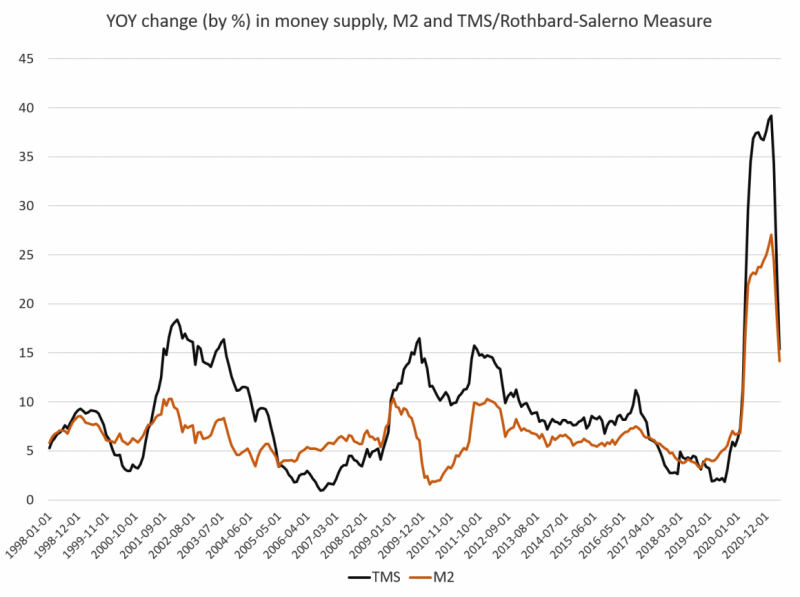

Money Supply Growth Dropped in May to a 15-Month Low

Money supply growth slowed again in May, falling for the third month in a row, and to a 15-month low. That is, money supply growth in the US has come down from its unprecedented levels, and if the current trend continues will be returning to more "normal" levels.

Read More »

Read More »

DEUDA IMPRODUCTIVA: ¿Qué Es Y Por Qué Debería Preocuparte?

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Dirk Müller: Sozialpunktesystem in Deutschland? – Wo bleibt die Distanzierung?

Https://bit.ly/3AxUeft - Sehen Sie das vollständige Video mit Dirk Müller, u.a. zu den Themen Delta-Variante und kommende Maßnahmen, Impfzwang, Totimpfstoffe und Intensivbetten-Lüge, auf Cashkurs.com: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 05.07.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:...

Read More »

Read More »

Marc Friedrich auf dem PRÜFSTAND! (Streitgespräch zu Bitcoin, Politik, Geld)

Marc Friedrich ist mehrfacher Bestseller-Autor. In seinem aktuellen Buch „Die größte Chance aller Zeiten” beschreibt er welche Lehren aus der Krise zu ziehen sind und welche Chancen er in dem Markt sieht. Marc Friedrich stößt mit seinen Aussagen zu Bitcoin, Geld, Politik und Wirtschaft immer wieder auf Kritik. Er selbst bezeichnet sich aber nicht als „Crash-Prophet”, sondern als „Realist”. In dem Talk mit Rolf Benzmann werden z.T. sehr...

Read More »

Read More »

Dirk Müller: Willkür in Höchstform! Kretschmann auf ganz dünnem Eis

Https://bit.ly/3AxUeft - Sehen Sie das vollständige Video mit Dirk Müller, u.a. zu den Themen Delta-Variante und kommende Maßnahmen, Impfzwang, Totimpfstoffe und Intensivbetten-Lüge, auf Cashkurs.com: http://bit.ly/ck-registrieren

Auszug aus dem Cashkurs.com-Update vom 05.07.2021.

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:...

Read More »

Read More »

MARKUS KRALL ERMAHNT ENERGISCH : “ETWAS” GEWALTIGES KOMMT”, wie Marc Friedrich, Hans-Werner Sinn

Unter der Wirtschaftsstruktur versteht man in der Wirtschaftstheorie das Verhältnis der einzelnen Wirtschaftssektoren zueinander und zur Wirtschaft einer Region oder eines Staates.

Read More »

Read More »

Dr. Markus Krall zeigt UNFASSBAREN Chart! Die EZB gibt weiter MASSIV Vollgas! Es betrifft uns ALLE!

Videoinhalte: EZB, Zentralbanken, PEPP, APP, Bundesbank, Pandemic Emergency Purchase Programme, Staasanleihen, Anleihekäufe, Kredite, Warnung, Niedrigzinspoltik, Negativzinsen, Kredite, Verschuldung, Staatsschulden, Rendite, Geld Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise, Währungsreform, Finanzmarkt,

Read More »

Read More »

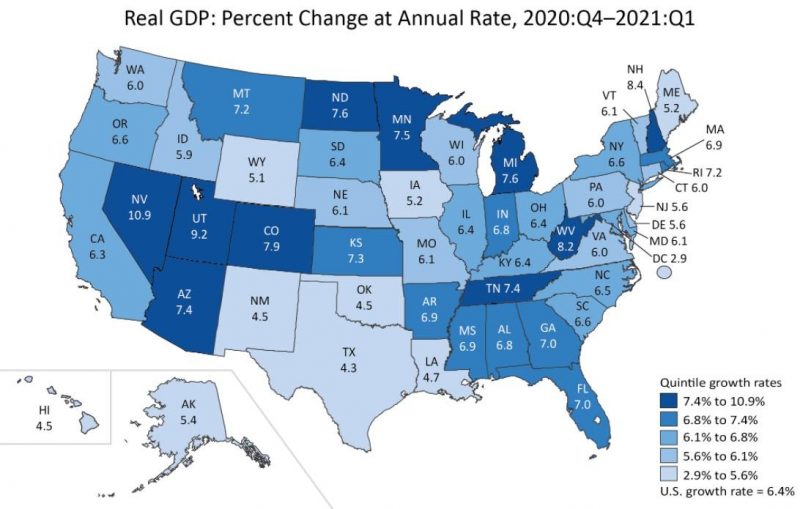

Experts Said Ending Lockdowns Would Be Worse for the Economy than the Lockdowns Themselves. They Were Wrong.

Here’s something we often heard in 2020 from experts who wanted long and draconian covid lockdowns: “Yes, these say-at-home orders are causing economic turmoil, but if you don’t lock everyone down now—and keep them locked down for a long time—your economy will be even worse off!”

Read More »

Read More »