Category Archive: 6b) Austrian Economics

JEDER kann erfolgreich werden – Willst DU es auch? Interview mit Dr. Dr. Rainer Zitelmann

Trotz Behinderung unglaublicher Erfolg

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Thorsten Wittmann Homepage: https://thorstenwittmann.com/

Dr. Dr. Rainer Zitelmann Homepage: https://www.rainer-zitelmann.de/

Buch „Ich will“: https://www.amazon.de/Ich-will-erfolgreichen-Menschen-Behinderung/dp/3959724691

Behinderte Erfolgsmenschen – bei einer Anekdote lief es mir eiskalt den Rücken herunter

Dr. Dr. Zitelmann hat sein 25....

Read More »

Read More »

Why There Is No Free Lunch

Caleb Fuller, an economist who teaches at Grove City College, thinks that many people have a mistaken conception of economics. It is, they think, a dull and dry subject, the “dismal science,” of primary interest to specialists. Fuller disagrees. He says that “economics changed my life” (p. 11; all page references are to the Amazon Kindle edition), and in this wonderful short book, which can be read in an hour or so, he conveys his infectious...

Read More »

Read More »

Ernst Wolff – Betrug am Volk – Das verschweigen SIE uns! FOLGEN werden gravierend sein!

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung,

Read More »

Read More »

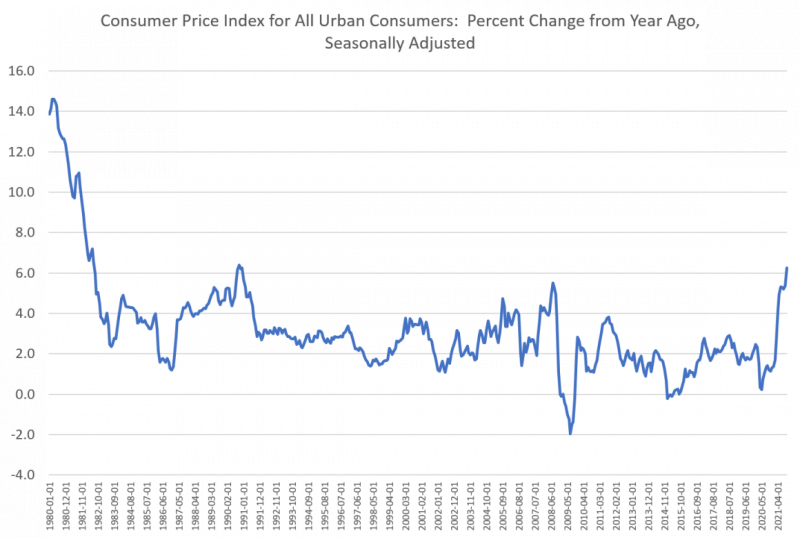

Price Inflation Hits a 31-Year High as Janet Yellen Insists It’s No Big Deal

The Bureau of Labor Statistics reported Wednesday morning that prices rose 6.2% on a year-over-year basis in October. That’s the highest YOY rate since December 1990 when the CPI was also up 6.2 percent. October’s rate was up from 5.3 percent in September, and remains part of a surge in the index since February 2021 when year-over-year growth was still muted at 1.6 percent.

Read More »

Read More »

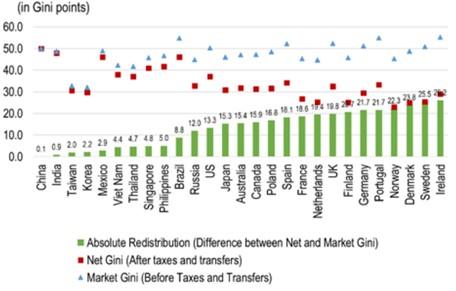

The Problem with “Stakeholder Capitalism”

Writing in the Investment Monitor on March 18, 2021, Klaus Schwab, the founder of the World Economic Forum, was urging the replacement of the present economic system. According to Schwab, the present system is deficient, since it only benefits a small minority of the population while leaving all the others at a visible disadvantage.

Read More »

Read More »

INFLATION – die legale Enteignung! (Interview Dr. Ingo Sauer)

In Deutschland haben wir ein 28 Jahreshoch bei der Inflation mit 4,5 %. In den USA sogar ein 31 Jahreshoch mit 6,2 %. Was ist Inflation? Wie kann man sich schützen? Kommt automatisch eine Hyperinflation? Wie lange bleibt der Euro uns noch erhalten und können Notenbanken Pleite gehen? Als das heute in einer neuen Folge "Marc spricht mit" Dr. Ingo Sauer.

Kleine Information:

Der Link zu dem neuen Papier von Dr. Ingo Sauer wird am 26.11.2021...

Read More »

Read More »

Cashkurs präsentiert: HEADWIND“21 – Als die Krise zum Business wurde

Filmemacher Marjin Poels blickt in seiner neuen Dokumentation kritisch auf das Thema Energiegewinnung und deckt mit Alexander Pohl die Schattenseiten des „grünen Wunderlands“ auf.

Die ernüchternde Botschaft: Es gibt bisher keine perfekte Form der Energiegewinnung! Genau wie bei den herkömmlichen Energiequellen müssen wir uns auch den kritischen Blick auf die Erneuerbaren bewahren, um festzustellen, dass auch hier keine im ökologischen Sinne...

Read More »

Read More »

Cronyism, Not Welfare, Is China’s Big Problem

After three decades of promarket reforms, extreme poverty in China has been virtually eradicated. So President Xi Jinping now has the leverage to shift his attention to reducing the wealth gap in Chinese society. In a speech to the Chinese Communist Party in August, Xi touted "common prosperity" for all Chinese as an essential requirement of socialism and modernization.

Read More »

Read More »

Amazing Street Singer | Street Song From Young Boy (Andrew Moran) | Genius Singer Performing #Shorts

#Shorts #street_performer #street_song #Genius_Singer

Please Subscribe The Singers Channel if you love his song and vocal

https://www.youtube.com/channel/UCHGKX4lBXMbAKm2KziLJvNQ

Read More »

Read More »

In a Free Economy, Prices Would be Going down, Not Up

Whenever politicians and media outlets discuss inflation, they invariably use the Consumer Price Index (CPI) as their measure. The CPI is only one of several price indices on top of the various measures of the money supply that underlie aggregate price changes. Strictly speaking, the CPI does not measure inflation per se, but rather the consequences of monetary expansion on consumer products. In macroeconomics, the CPI is one of the key indicators...

Read More »

Read More »

Unser Rentensystem ist ein großer Betrug

Einige tolle Finanzexperten: Markus Krall, Andreas Popp, Dirk Müller, Hans Werner Sinn, Marc Friedrich, Ernst Wolff, Daniel Stelter, Max Otte, Clemens Fuest, Florian Homm

Read More »

Read More »

Thorsten Polleit: Der Ausweg aus der Fiat-Geld-Tyrannei – ein freier Markt für Geld

Hören und sehen Sie heute den Vortrag von Prof. Dr. Polleit den er bei der Geldkonferenz der Atlas Initiative gehalten hat. Herzlichen Dank für den lösungsorientierten Beitrag!

Read More »

Read More »

Why Bureaucrats Aren’t Like Private Sector Workers

Bureaucratic management means, under democracy, management in strict accordance with the law and the budget. It is not for the personnel of the administration and for the judges to inquire what should be done for the public welfare and how the public funds should be spent. This is the task of the sovereign, the people, and their representatives.

Read More »

Read More »

Blackout/Stromausfall kommt – worauf Du Dich vorbereiten musst! (Insider Tipps)

Ist ein Blackout auch in Deutschland möglich? Wie sicher ist das europäische Verbundnetz? Deutschland schaltet als einziges Land grundlastfähige Kern- und Kohlekraftwerke ab - haben wir Ersatz? Was passiert dann? Was passiert nach einem Stromausfall? Was ist der Unterscheid zu einem Blackout und wie bereitest Du Dich darauf am besten vor? All das und noch mehr in einer neuen Folge „Finanzielle Intelligenz“. Viel Spaß!

Notfallbroschüre:...

Read More »

Read More »

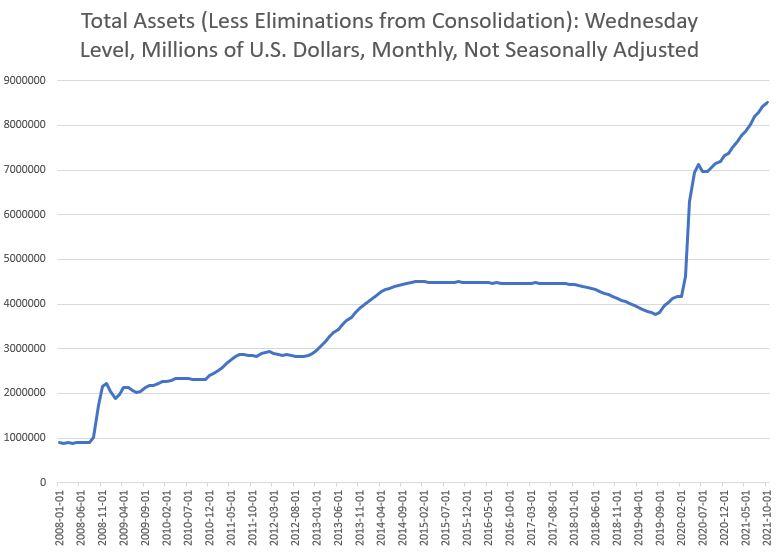

There’s Nothing Hawkish About the Fed’s New Tapering Plan

The Federal Reserve concluded its November Meeting of the Federal Open Market Committee on Wednesday. According to the FOMC’s statement, the Fed now plans to taper beginning in mid-November by cutting back its asset purchases by 10 billion in Treasury securities and 5 billion in mortgage-backed securities.

Read More »

Read More »

ESPAÑA, A LA COLA DE LA OCDE EN RECUPERACIÓN. Y OTRO HACHAZO A LAS PENSIONES.

_______________________________________________________________________

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

STRAFZINS FRISST IHR GUTHABEN AUF! DR. MARKUS KRALL ÜBER ENDPHASE DER BANKEN & NEGATIVZINSEN

Wirtschaft aktuell - Markus Krall, Dirk Müller und andere Experten beantworten: Was ist eigentlich gerade los?! Stehen wir kurz vor einer Finanzkrise?

Read More »

Read More »

Markus Krall: Deutschland 500% Inflation

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/2ZFy6lq

▶︎ KANAL Abonnieren ▶︎ https://bit.ly/MarkusKrallTotal_subscribe

Das könnte Sie auch interessieren:

▶︎ Markus Kralls Buch "Wenn schwarze Schwäne Junge kriegen: Warum wir unsere Gesellschaft neu organisieren müssen" auf Amazon: https://bit.ly/Markus-Krall-auf-Amazon

▶︎ Markus Krall bei Degussa:...

Read More »

Read More »