Category Archive: 6b) Austrian Economics

Dirk Müller: Freier Austausch auf Telegram – ein schöner Traum!

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 14.04.2022 auf Cashkurs.com.)

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher...

Read More »

Read More »

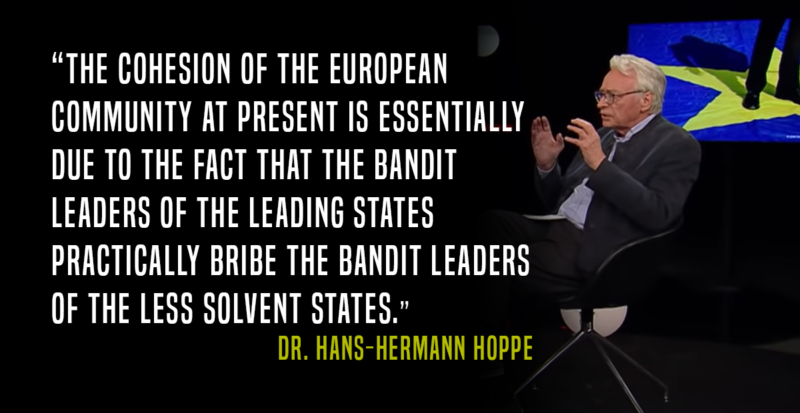

Hoppe: “My Dream Is of a Europe Which Consists of 1,000 Liechtensteins.”

Interviewer: I would like to welcome our second guest in the studio. It is the philosopher and economist with an international range Hans-Hermann Hoppe. Nice to meet you, Mr. Hoppe.

The dream of a united Europe, the eternal longing of the empire. Do you also dream this dream?

Read More »

Read More »

Dollar Dominanz am Ende – Wohlstand in Gefahr

Videoinhalte:Thorsten Polleit, Dirk Müller, Neustart, reset, der große reset, Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland, Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland, I

Read More »

Read More »

Hybris, Doppelmoral und Heuchelei (Afghanistan, Ukraine, USA)

Leidet die USA unter Größenwahn? Sehen wir gerade das Ende der Weltmacht USA und der Weltreservewährung Dollar? Vieles spricht dafür, unter anderem der Afghanistan-Krieg der ein komplettes Desaster war. Welche Parallelen hat der Ukraine-Krieg mit den Kriegen der Amerikaner in den letzten 70 Jahren? Stehen wir vor einer Hungersnot und einem zweiten arabischen Frühling dadurch, dass die Weizenproduzenten Russland und Ukraine wegfallen?

Read More »

Read More »

Darshan Mehta: Insights Are Game Changers For Business

What drives customer behavior and customer choices? It’s the existential question for business; you’ve got to know the answer. But it’s a mystery, hard to unlock. The solution to this answer lies in what market researchers call insights, based on the Austrian deductive method that we summarized in episode #164 with Per Bylund (Mises.org/E4B_164).

Read More »

Read More »

Dirk Müller: Elon Musk, Twitter und die „Meinungsfreiheit“

Sehen Sie weitere Berichte auf Cashkurs.com und erhalten Sie werbefreien Zugriff auf alle Premiuminhalte inkl. Beiträgen und Videos: http://bit.ly/ck-registrieren

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 14.04.2022 auf Cashkurs.com.)

"Machtbeben" – Der Bestseller von Dirk Müller - Jetzt als Taschenbuch: http://bit.ly/Machtbeben-Taschenbuch

Weitere Produkte von und mit Dirk Müller:

Bücher...

Read More »

Read More »

Staat und Krieg

Aus ökonomischer Sicht lässt sich argumentieren: Der Staat (wie wir ihn heute kennen) ist aggressiv. Kriegerische Auseinandersetzungen zwischen Staaten sind daher auch kein tragischer Zufallsfehler, sie sind vielmehr ein logisches Ergebnis.

Read More »

Read More »

PL2 Highlights: Albion 1 Leeds 0

Andrew Moran's first-half strike was enough to separate the two teams at the American Express Elite Football Performance Centre.

Read More »

Read More »

Global Macro Update With Ed D’Agostino and John Mauldin

In this episode of Global Macro Update, Ed D’Agostino and John Mauldin, co-founder of Mauldin Economics, discuss the most challenging environment for investors in years, the near daily shifting global landscape, the likelihood of the Fed engineering a “soft landing” and much more.

If you enjoyed this interview and want more incisive commentary on the most important global economic issues, take a look at the speaker lineup for the upcoming Strategic...

Read More »

Read More »

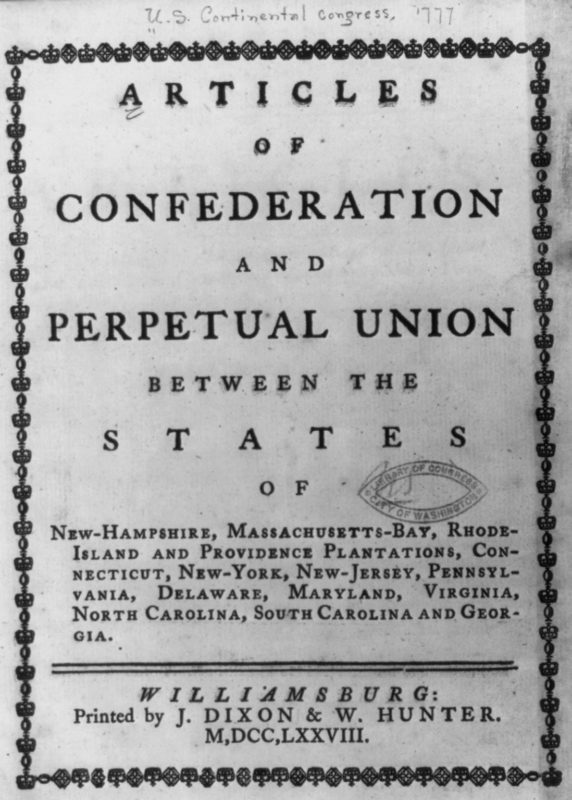

The Biggest Threat to Our Freedom and Well-Being

There are some important things to note about the Constitution and the Bill of Rights. Our rights do not come from the Constitution or the Bill of Rights. As the Declaration of Independence states, our rights come from nature and God, not from the federal government, not from the Constitution, and not from the Bill of Rights.

Read More »

Read More »

Krieg in der Ukraine sorgt WELTWEIT für knappe Rohstoffe – was jetzt tun und wo investieren?

Die Rohstoffknappheit merken wir spürbar bereits jeden Tag, doch die Knappheit wird voraussichtlich noch explosiver.

Heute interviewe ich mit einer Schaltung nach Zypern den Rohstoffanalysten und Autoren des „Putin-Faktors“ Andreas Lambrou. Wir klären dort u.a. folgende Fragen:

* Ist dies der Anfang einer großen Rohstoff-Hausse, also einem großen Aufschwung?

Read More »

Read More »

Achtung Inflation: Wohlstand in Gefahr! (JF-TV Interview mit Thorsten Polleit)

Seit 2021 steigt die Inflationsrate kontinuierlich an, lag im März dieses Jahres bei besorgniserregenden 7,3 Prozent. In Medien und Politik wird diese Entwicklung oft mit dem Krieg in der Ukraine assoziiert, in Wahrheit liegen die Gründe jedoch viel tiefer, wie der Chefökonom der Degussa Goldhandel, Thorsten Polleit, im JF-TV Interview erklärt. Und Polleit fürchtet: "Diese Inflation ist gekommen um zu bleiben", selbst eine vorrübergehend...

Read More »

Read More »

Achtung Inflation: Wohlstand in Gefahr!

“So act that your principle of action might safely be made a law for the whole world.”

| Immanuel Kant (1724–1804)

Read More »

Read More »

Frei mit Immobilien, Auswandern und Leben in Costa Rica – Interview mit Alexander Raue

Ortsunabhängig Geld verdienen, Auswandern und Costa Rica

Alexander YouTube-Kanal: https://www.youtube.com/c/Vermietertagebuch

Alexander Homepage: https://vermietertagebuch.com/ueber/

Thorsten Homepage: https://thorstenwittmann.com/

Freitagstipps Abonnieren: https://thorstenwittmann.com/klartext/

Frei mit Immobilien, Auswandern und Leben in Costa Rica

Ortsunabhängig Geld verdienen, Auswandern und Costa Rica. Das sind die heutigen Themen im...

Read More »

Read More »

Die Lage ist katastrophal – leere Regale und Bauernsterben (Ukraine)

Die Preise für Lebensmittel explodieren. Immer öfter steht man auch vor leeren Regalen im Supermarkt. Durch den Ukraine-Krieg fallen Weizen, Sonnenblumenöl und Düngerexporte aus. Welche Auswirkungen hat dies auf die Lebensmittelversorgung und auf die Landwirtschaft? Darüber spreche ich heute mit dem Landwirt Anthony Lee.

► Timestamps:

00:00 - 02:23 Intro & Vorstellung

02:23 - 07:17 Droht eine Hungersnot? Stehen wir bald vor leeren Regalen?...

Read More »

Read More »

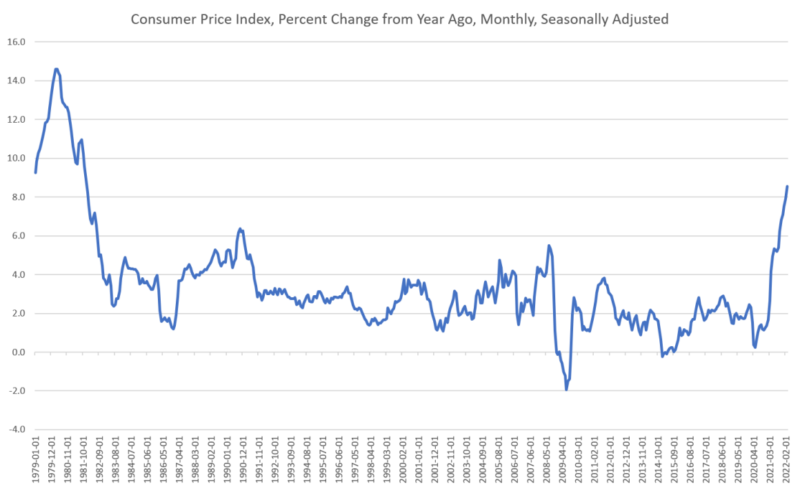

Real Wages Fall Again as Inflation Surges and the Fed Plays the Blame Game

According to a new report released Wednesday by the US Bureau of Labor Statistics, the Consumer Price Index increased in March by 8.6 percent, measured year over year (YOY). This is the largest increase in more than forty years. To find a higher rate of CPI inflation, we have to go back to December 1981, when the year-over-year increase was 9.6 percent.

Read More »

Read More »

We Still Haven’t Reached the Inflation Finale

Inflations have an inbuilt mechanism which works to burn them out. Government (including the central bank) can thwart the mechanism if they resort to further monetary injections of sufficient power. Hence inflations can run for a long time and in virulent form. This occurs where the money issuers see net benefit from making new monetary injections even though likely to be less than for the initial one which took so many people by surprise.

Read More »

Read More »

The Future of Gold and Money (Jeff Deist, James Dale Davidson, Keith Weiner, David Gornoski)

Classic roundtable from September, 2020.

In this roundtable discussion, David Gornoski is joined by Mises Institute’s Jeff Deist, Keith Weiner of Monetary Metals, and James Dale Davidson, author of the Sovereign Individual. Together, they discuss the history and future of gold as an investment asset for the average Joe, general misconceptions of investing in gold, the Fiat money system, the economic effects of foreign policy, and more.

Read More »

Read More »

Russia’s “gold peg”: Lessons for Western investors

It is undeniable that the ongoing crisis in Ukraine has polarized Western societies to an extent unseen in decades in any other foreign conflict. For over a month, we have been bombarded unceasingly by all mainstream media sources with reports and stories about Russia’s invasion and this conflict has already created deep social rifts in many other nations, and EU members in particular.

Read More »

Read More »