Category Archive: 6b) Austrian Economics

Behind Klaus Schwab, the World Economic Forum, and the Great Reset: Part 2

Bob continues his series on Klaus Schwab, explaining the WEF’s plans for redesigning the world, and providing quotes from Schwab’s book on the fourth industrial revolution.

Read More »

Read More »

Andrew Moran:Miami Hoop school, NBA pre draft, Tyler Herro, Cayden & Cameron boozer, Tim Hardaway Jr

In the full podcast, you can listen to us discuss the founding of Miami Hoop School, pre-draft workout with James Wiseman and Cole Anthony, NBA rule changes into 2021- 2022 season, on coaching Cayden & Cameron Boozer both ranked top 5 freshmen in the country. and Tim Hardaway Jr

Fiye show: https://www.instagram.com/fiye.show/

Miami Hoop School: https://www.instagram.com/miamihoopsc...

Miami Hoop School website: https://www.miamihoopschool.com/

Read More »

Read More »

Dirk Müller: Faktencheck & Wahrheitsfindung: Wir brauchen den Wettstreit der Meinungen!

Sehen Sie das vollständige Video mit der gesamten Markteinschätzung von Dirk Müller hier: https://bit.ly/3u2h4ee

Ein Fall, der Aufhorchen lässt: Selbst das große #Wissenschaftsmagazin BMJ ist nicht gefeit vor #Sperrungen durch Faktenchecker auf Social Media. Wozu führt dieses Phänomen langfristig? Was bedeutet das für die #Meinungsvielfalt?

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 25.01.2022 auf...

Read More »

Read More »

Cashkurs*Wunschanalysen: Ballard Power, Amazon & Fiverr unter der Chartlupe

Mario Steinrücken nimmt Ihre Aktienwünsche unter die Lupe. Hier geht’s zum vollständigen Video mit weiteren Titeln: https://bit.ly/3GlMrDr

In diesem Video bespricht unser Experte die von der Cashkurs*Community gewünschten Titel am #Chart.

Heute Ballard Power, Amazon & Fiverr und weitere spannende #Aktien wie BioNTech, Allianz und Block (ex Square)…

Als Mitglied können Sie sich im Kommentarbereich auf https://www.cashkurs.com/ Ihren...

Read More »

Read More »

Behind Klaus Schwab, the World Economic Forum, and the Great Reset: Part 1

Bob starts a series looking into Klaus Schwab, founder of the World Economic Forum and, along with Prince Charles, proponent of the “Great Reset.”

Mentioned in the Episode and Other Links of Interest:

Klaus Schwab and Prince Charles promoting the “Great Reset”The World Economic Forum’s page on the Great ResetAn example of a session from the WEF’s Davos Agenda 2021 conferenceThe WEF’s bio for its founder, Klaus SchwabSchwab’s books...

Read More »

Read More »

Wie sicher in Währungen investieren? 3 Sofortwege

3 Wege, sofort in Fremdwährungen zu investieren mit allen Vor- und Nachteilen

Blog-Artikel und Anleihenfinder: https://thorstenwittmann.com/in-fremdwaehrungen-investieren/

Geldsicherheitstraining: https://thorstenwittmann.com/geldsicherheit-garantiert/

Auslandskonten Praxisfallstudie 13 Banken: https://thorstenwittmann.com/fallstudieauslandskonten/

Klartext-E-Letter: https://thorstenwittmann.com/klartext/

Wie Fremdwährungen kaufen?

Stabile...

Read More »

Read More »

Andrew Moran: NBA skills trainer on Tim Hardaway Jr work ethic & Starting team Hardaway in Miami

In this segment, Andrew talks about Tim Hardaway Jr work ethic, reviving his career in Dallas, and building Team Hardaway in Miami which gives local kids an opportunity to travel the country and play basketball.

Read More »

Read More »

CRISIS DE UCRANIA: RIESGO MACRO Y DE MERCADO

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Dirk Müller: Wem würde ein russischer Vorstoß tatsächlich nutzen?

Sehen Sie das vollständige Video mit der gesamten Markteinschätzung von Dirk Müller hier: https://bit.ly/3u2h4ee

Die Anspannung rund um den #Ukrainekonflikt bleibt hoch: Wird #Russland tatsächlich nach Kiew vorstoßen? Das würde nicht nur das sichere Ende von #NordStream2 bedeuten, sondern könnte für Europa - neben womöglich horrenden #Gaspreisen und einer #Energiekrise - eine dauerhafte Neuausrichtung der Energieversorgung nach sich ziehen. Wer...

Read More »

Read More »

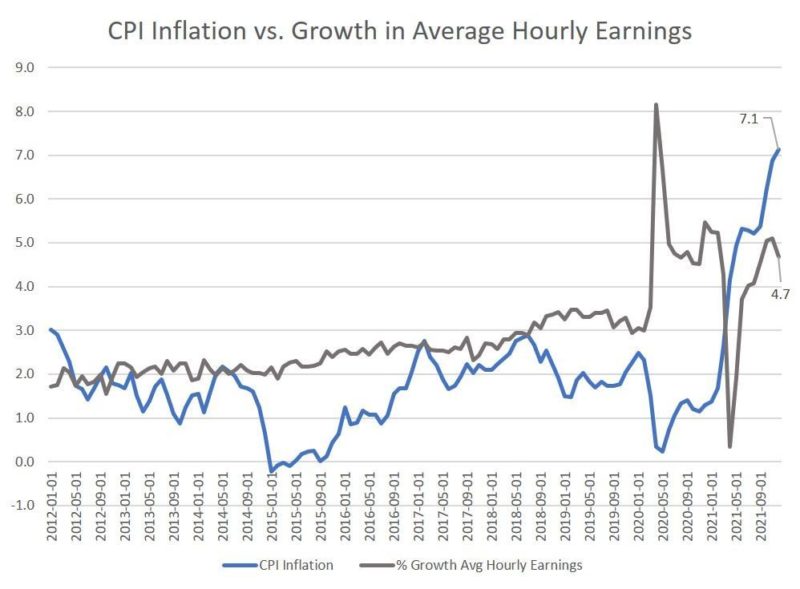

The Fed Has No Real Plan, and Will Likely Soon Chicken Out On Rate Hikes

The Fed’s Federal Open Market Committee (FOMC) released a new statement today purporting to outline the FOMC’s plans for the next several months. According to the committee’s press release: With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.

Read More »

Read More »

Das Corona-Narrativ wankt! (Bundesregierung bestellt 544 Millionen Impfdosen)

Das Narrativ um Corona wankt. Die Menschen verlieren das Vertrauen in die Politik und die Maßnahmen durch Corona Regel Chaos. Der Genesenenstatus wird willkürlich auf 3 Monate reduziert, aber für den Bundestag gelten weiterhin 6 Monate. Parallel kommen immer mehr Wahrheiten heraus und die wahren Zahlen aus England sind überraschend, werden aber nirgendwo in den Medien kommuniziert. Das alles und noch viel mehr im Video!

Quelle zu den Zahlen aus...

Read More »

Read More »

Andrew Moran: NBA skills trainer on Tyler Herro offseason workout, and strong start to the season.

In this segment NBA skills trainer Andrew Moran talks about Tyler Herro offseason workout, mindset, comments about being one of the top players, and a strong start to the season

Fiye show: https://www.instagram.com/fiye.show/

Miami Hoop School: https://www.instagram.com/miamihoopsc...

Miami Hoop School website: https://www.miamihoopschool.com/

Miami hoop school academy Instagram: https://www.instagram.com/miamihoopschool_academy/

Read More »

Read More »

INFLACIÓN: Un Problema Monetario

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Dirk Müller: Zockerei im Bärenmarkt – Jetzt die Füße stillhalten

Sehen Sie das vollständige Video mit der gesamten Markteinschätzung von Dirk Müller auf Cashkurs.com: https://bit.ly/3r0mR23

Hohe Volatilität an der #Börse: Vor der #Notenbanksitzung in den USA sollten Anleger die Füße stillhalten – niemand kann wissen, wie die Märkte auf die Entscheidung der #Fed reagieren. Auch wenn aktuell eine kleine Erholung im #Bärenmarkt zum Aufatmen einlädt, sind die Risiken nicht vom Tisch...

(Bei diesem Video handelt...

Read More »

Read More »

Dr. Markus Krall besorgt – ESKALATION! Es wird im Übergang zu absolutem CHAOS kommen!

? JETZT AUCH BEI TELEGRAM ! Folgt uns um nichts mehr zu verpassen ? ? https://t.me/financeexperience ❤️ ____________________ ❌KRISENVORSORGE - EMPFEHLUNGEN❌ (*) Krisenvorsorge Ausrüstung: https://www.amazon.de/shop/financeexperience-geldfinanzenwirtschaft?listId=3VXBJI1FZWZPB&ref=cm_sw_em_r_inf_list_own_financeexperience-geldfinanzenwirtschaft_dp_1ZFs28sKehRzJ (*) Krisenvorsorge - Erste Hilfe und Hygiene:...

Read More »

Read More »

Andrew Moran: NBA skills trainer on NBA pre-draft workout with James Wiseman and Cole Anthony

In this segment, Andrew talks about pre-draft workouts and how he prepares players such as James Wiseman and Cole Anthony. Also, discuss how being drafted by a certain team can lead to certain expectations and roles.

Fiye show: https://www.instagram.com/fiye.show/

Miami Hoop School: https://www.instagram.com/miamihoopsc...

Miami Hoop School website: https://www.miamihoopschool.com/

Read More »

Read More »

Economists Response to the Fed’s Central Bank Digital Currency

CEO of Monetary Metals Keith Weiner breaks down the The Federal Reserve paper titled "Money and Payments: The U.S. Dollar in the Age of Digital Transformation."

Every monetary change from the Founding of America through present has been to move away from free markets, and to adulterate our currency and this one will be no different.

You might also enjoy our related podcast and research on Fedcoin here:...

Read More »

Read More »

Geld sparen? NEIN DANKE! Hans Werner Sinn ENTLARVT ENTEIGNUNG | Bargeld Entwertung Inflation 2022!!!

Ähnliche Meinungen teilen andere bekannte Experten, unter anderem: Mr. Dax, Dirk Müller, Dr. Markus Krall, Prof. Hans Werner Sinn, Marc Friedrich, Ernst Wolff, Dr. Daniel Stelter, Prof. Max Otte, Prof. Clemens Fuest, Andreas Popp, Thorsten Polleit,

Read More »

Read More »

It’s Time to Break Up New York State

Neil Sedaka said it best – “breaking up is hard to do”. Ask any 16-year-old and they’ll tell you that’s certainly true, but Rep. Marjorie Taylor Greene (R-GA) recently made headlines when she suggested not just a breakup, but a “National Divorce” on social media.

Read More »

Read More »