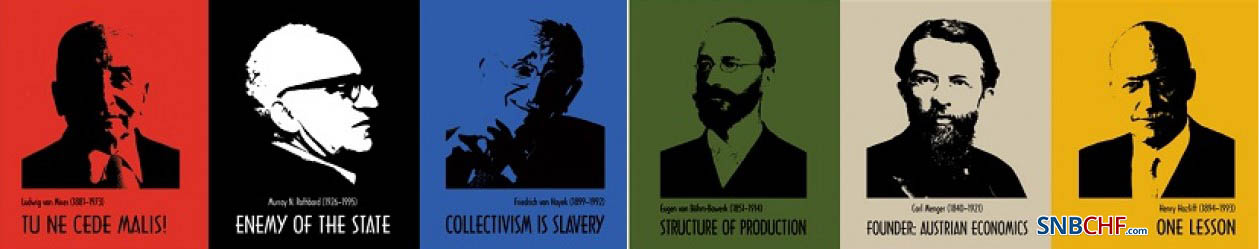

Category Archive: 6b) Austrian Economics

Inflation IS Money Supply Growth, Not Prices Denominated in Money

In the recent Wall Street Journal article “Inflation Surge Earns Monetarism Another Look,” Greg Ip writes that a recent surge in inflation is not likely to bring authorities to reembrace monetarism. According to Ip, money supply had a poor record of predicting US inflation because of conceptual and definitional problems that haven’t gone away.

Read More »

Read More »

Goldanalyst Dimitri Speck: „Ein steigender Goldpreis ist nicht im Interesse der Politik“

Steigende Inflation bei gleichzeitig niedrigen Zinsen sind prinzipiell „gute“ Rahmenbedingungen für einen steigenden Goldpreis. Doch warum gibt es derzeit keine Hausse bei dem Edelmetall?

Read More »

Read More »

Nine Ways Debt and Deficit Spending Severely Harm African Societies

Systemic debt and deficit spending are intrinsic features of today's economic system. Unlike classical economics, where markets play the leading role and governments the supporting one, the existing economic model, driven by Keynesian theory, has inverted the roles.

Read More »

Read More »

When We Started the Idea of Health Insurance & Jeff Deist’s Medical Model with Shawn & Janet Needham

On this clip of Health Solutions, Shawn & Janet Needham RPh talk to Jeff Deist about his medical model and when we started the idea of health insurance. Human natures tells us that people are more likely to consume more free medicine than they might need.

Read More »

Read More »

Erst künstlicher Corona-, jetzt realer Gas-Notstand? – Boehringer Klartext (175)

- 25 Millionen Steuergeld für nicht zugelassenen Affenpockenimpfstoff

- Ludwig Erhard über „verbrecherische“ Inflationspolitik

- Prognose eines dauerhaften Handelsbilanzdefizits

- Deutschland kann bald nicht mehr Zahlmeister EUropas sein …

Read More »

Read More »

RECESIÓN, INFLACIÓN y OPORTUNIDADES

Charla con Ignacio de la Torre, economista jefe de Arcano cortesía del Círculo de Empresarios.

Charla original aquí: https://circulodeempresarios.org/sala-de-prensa/conversaciones-del-circulo-daniel-lacalle-inflacion-crecimiento-economico-ajuste-fiscal/

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook -...

Read More »

Read More »

Federalism, Not Centralization, Is the Way out of the Current Conflicts

The overturning of Roe v. Wade is a historic decision, upholding the highest principle of a republic. A republic is born through freedom of association in the same manner as individuals band together to form a family, families band together to make a community, and communities band together to make a society.

Read More »

Read More »

HYPERINFLATION IN CHINA!

Wirtschaft aktuell: Was passiert jetzt? Aktiencrash oder Börsenrally? Werden Aktien weiterfallen? Jetzt nachkaufen? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf!

Read More »

Read More »

How Bad Were Recessions before the Fed? Not as Bad as They Are Now

The Federal Reserve was supposed to prevent recessions that people blamed on the lack of central banking. Not surprisingly, the post-Fed recessions have been worse.

Read More »

Read More »

How the Government Ruined the Free Market in Healthcare with Jeff Deist from Mises Institute

On this podcast we will be talking with Jeff Diest from Mises Institute about How the government ruined the free market in healthcare. Jeff Deist is president of the Mises Institute, where he serves as a writer, public speaker, and advocate for property, markets, and civil society.

Read More »

Read More »

Die Zerstörung der Landwirtschaft! (Farm to Fork)

Was ist eigentlich in den Niederlanden los? Seit Tagen gibt es starke Proteste der Bauern. Die Polizei hat sogar scharf geschossen. Ein Insider erklärt uns die Hintergründe! Warum bereiten sich die Proteste auch auf Spanien und Italien aus?

Read More »

Read More »

JOE BIDEN DROHT IHR JETZT!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »

Dirk Müller: Massiver Gewinneinbruch ⏬⏬ steht bevor!

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate220704

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 04.07.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

The Role of Ideas

1. Human Reason Reason is man's particular and characteristic feature. There is no need for praxeology to raise the question whether reason is a suitable tool for the cognition of ultimate and absolute truth. It deals with reason only as far as it enables man to act.

Read More »

Read More »

Global Macro Update With Ed D’Agostino and Peter Boockvar

In this episode of Global Macro Update, Ed D'Agostino and Peter Boockvar, chief investment officer and portfolio manager for Bleakley Advisory Group, discuss unique challenges in today’s inflationary environment. Peter discusses how many investors have never lived through an investing environment like today’s and why that matters… how what happens at the ECB affects the US Fed and vice versa… the unique challenges facing central banks in combating...

Read More »

Read More »

Soflaa talks about La Jama tv, food truck, upcoming projects, & future plans for the brand.

In this segment, Soflaa talks about La Jama tv and his partnership with chef Frankie, La Jama food truck that opened this year, upcoming projects with Vice, and future plans for the brand.

FIYE SHOW Instagram: https://www.instagram.com/fiye.show/

Soflaa instagram: https://www.instagram.com/soflaaa/

La Jama tv:https://www.instagram.com/lajamatv/

Read More »

Read More »

Cashkurs*Wunschanalysen: ASML, Qualcomm und Equinor unter der Chartlupe

Cashkurs*Academy: Schnuppern Sie kostenlos in den Kurs Charttechnik rein – Jetzt den Code „Wunschanalysen“ einlösen und das erste Modul gratis belegen: https://bit.ly/CKA_charttechnik

In diesem Video bespricht unser Experte Mario Steinrücken die von der Cashkurs*Community gewünschten Titel am Chart: Heute sehen Sie hier die kurz, knackigen Analysen von ASML, Qualcomm und Equinor. Weitere analysierte Aktien finden Sie im vollständigen Video auf...

Read More »

Read More »

Wie sieht es mit dem Euro aktuell aus? Währungsupdate mit Jürgen Wechsler

EZB-Notfallsitzung und wie geht es weiter mit Euro, Dollar, Rubel und China? Der ehemalige Top-Investmentbanker Jürgen Wechsler dürfte dir bereits als unser regelmäßiger Interviewgast bekannt sein.

Read More »

Read More »

Foreign Policy Fail: Biden’s Sanctions are a Windfall For Russia!

It’s easy to see why, according to a new Harris poll, 71 percent of Americans said they do not want Joe Biden to run for re-election. As Americans face record gas prices and the highest inflation in 40 years, President Biden admits he could not care less.

Read More »

Read More »