Category Archive: 6b) Austrian Economics

Jeff Bezos, Charity, and Economic Well-Being: Wealth Creation Reduces Poverty

Billionaire Jeff Bezos has become a target of ridicule because his ex-wife MacKenzie Scott has been doling out colossal sums to charity. Compared to Scott, Bezos’s donations are quite slim and many are painting him as stingy. But are critics misguided in how they perceive the utility of philanthropy?

Read More »

Read More »

Declining Prices Do Not Destroy Wealth; They Enable Its Creation

Most economists believe that a general decline in the prices of goods and services is bad news because it is associated with major economic slumps such as the Great Depression. In July 1932, the yearly growth rate of US industrial production stood at –31 percent whilst in September 1932 the yearly growth rate of the US Consumer Price Index (CPI) stood at –10.7 percent.

Read More »

Read More »

Decentralized Revolution #92—Per Bylund, author of How to Think About the Economy

Per Bylund (Senior Fellow at the Mises Institute) discusses his new book How to Think About the Economy, which is perhaps the best concise introduction to the economic thought of Ludwig von Mises and the Austrian School.

Read More »

Read More »

Dirk Müller auf dem Anlegerkongress 2022 – “Kampf der Titanen – zweite Runde!” – 1. Teil

????? ??? ??? ?. ???? ??? ????????? ????:

(Bei diesem Video handelt es sich um den 1. Teil des Vortrags von Dirk Müller auf dem Anlegerkongress - Digital 2022 der Dirk Müller Premium Aktien Fonds.)

???? ??? ???? ?ü????? ?????? ??? ?? ????????.???!

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre...

Read More »

Read More »

EL DÓLAR SE DISPARA. NO HAY ALTERNATIVA EN MONEDAS ESTATALES

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Today’s Inflation Surge Should Discredit Modern Monetary Theory Forever

It’s been a rough year for advocates of Modern Monetary Theory (MMT). After nearly two years with all the budget deficits and money printing MMTers could have wanted, the doctrine’s popularity seems to have faded now that we’re well passed the honeymoon phase.

Read More »

Read More »

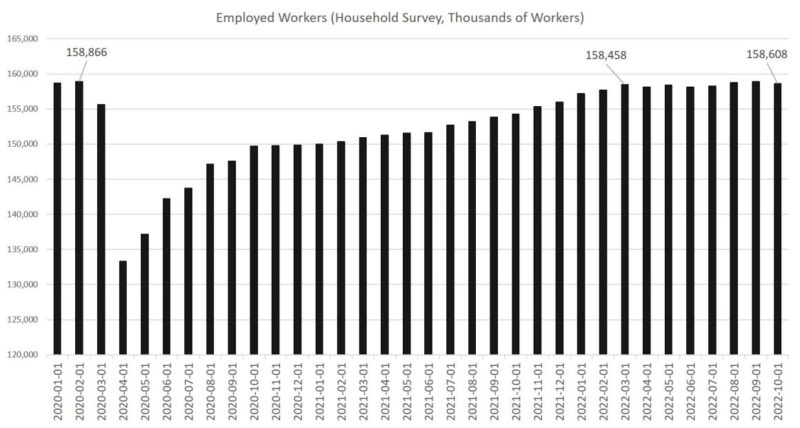

The Number of Employed Workers Fell in October and Price Inflation Continues to Outpace Wages

In another sign of weakness for the job market, the total number of employed persons in the United States fell, month over month, in October. That's the third time in the last seven months this total has fallen, dropping to approximately 158 million.

Read More »

Read More »

Are Robots and AI Really Going to Displace All Workers? Probably Not

Among the components of the World Economic Forum’s Great Reset are a drastically reduced population and the replacement of human labor with robots and artificial intelligence (AI). The question immediately comes to mind: can robots and AI really make all the stuff for the elites after they have gotten rid of the people?

Read More »

Read More »

BullionStar Perspectives – Ronald Stöferle – Global Macro and Gold: A European Perspective

Filmed in October 2022

In this not to be missed episode of BullionStar Perspectives, Ronald Stoeferle of Incrementum AG talks to Ronan Manly about the current precarious state of financial markets.

The interview covers everything from the macro interactions of interest rates, inflation, gold and economic growth, to the feeling on the ground in Europe, and from how Incrementum manages its portfolios, to why German speaking populations have an...

Read More »

Read More »

NOTENBANKEN außer Kontrolle? Wirtschaftscrash droht!

Droht uns eine harte Landung, eine Rezession und damit ein Wirtschaftscrash? Haben die Notenbanken nun letztendlich die Kontrolle verloren? Können sie das Feuer der Inflation noch löschen? Innerhalb einer Woche haben die US-Notenbank und die Bank of England die Zinsen abermals erhöht. Die erhoffte Kehrtwende ist ausgeblieben und der Ausblick ist negativ. Wieso? Das und noch mehr erfahrt ihr in dieser Folge "finanzielle Intelligenz" aus...

Read More »

Read More »

Multinational Agrichemical Corporations and the Great Food Transformation

In July 2022, the Canadian government announced its intention to reduce “emissions from the application of fertilizers by 30 percent from 2020 levels by 2030.” In the previous month, the government of the Netherlands publicly stated that it would implement measures designed to lower “nitrogen pollution some areas by up to 70 percent by 2030,” in order to meet the stipulations of the European “Green Deal,” which aims to “make the EU’s climate,...

Read More »

Read More »

Das perfekte Weihnachtsgeschenk! (Finanzen, Wirtschaft, Politik)

Das perfekte Weihnachtsgeschenk! ?

Mein Buch "Die größte Chance aller Zeiten" geht in die vierte Auflage, Wahnsinn!

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3bfKWdN oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter:...

Read More »

Read More »

“Hohe Vermögensabgabe zum Beispiel 20 %, gestundet über 20 Jahre!” – Interview Dr. Rainer Zitelmann

ENTEIGNUNGEN, Energiekrise und Sozialismus - Dr. Zitelmann im Interview

Homepage Thorsten Wittmann: https://thorstenwittmann.com/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Homepage Dr. Dr. Rainer Zitelmann: https://www.rainer-zitelmann.de/

Seminar Zitelmann Anleihen: https://thorstenwittmann.com/seminarzitelmannanleihen

Seminar Zitelmann Immobilien: https://thorstenwittmann.com/seminarzitelmann

Interview Dr. Zitelmann...

Read More »

Read More »

Ex-Wall Street Trader Explains Why Now Is the Time to Fight the Fed

Want a transcript? Sign up for our free weekly e-letter, and you’ll get a transcript every week, plus a summary and link to the video: https://www.mauldineconomics.com/go/JM499G/MEC.

“Don’t fight the Fed” is a mantra every investor knows. But what if the Fed is totally wrong in its assessments? A top contrarian investor and sentiment trader weighs in on what he thinks could be new bull market...

This week I spoke with longtime friend Jared...

Read More »

Read More »

Keith Weiner: A Lot Of People Are Buying Gold, Forced Selling Is The Problem | Gold & Silver

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3WgnDWs

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Join the official 1000x Telegram channel! Join us on the road to 1000x: https://t.me/official1000x

Keith Weiner is the founder and CEO of Monetary Metals, an investment firm that is unlocking the productivity of gold. Keith also serves as founder and President of the Gold Standard Institute USA. His work was...

Read More »

Read More »

Expanding IRS Tyranny to Reduce Inflation

One of the interesting aspects of President Biden’s Inflation Reduction Act was the allocation of $80 billion in increased funding for the Internal Revenue Service, one of the most powerful and tyrannical agencies in U.S. history.

Read More »

Read More »

Private versus Government Health Insurance: They Are Not the Same

Insurance is a market institution—i.e., it emerged through voluntary exchange aiming at satisfying the needs of the parties involved. Private health insurance should not be mistaken for public health insurance, which constitutes an element of a state’s social policy. They differ to such a great extent that one can even claim that the latter is a contradiction of the former. This essay will show the most notable differences between them.

Read More »

Read More »

Folker Hellmeyer: Die größte Krise seit 1945! (Politik, Krieg, Inflation)

Stehen wir heute vor der größten Herausforderung seit 1945? Folker Hellmeyer, ehemaliger Landesbanker und momentaner Chefvolkswirt der Netfonds AG sagt klar - JA! Warum er dieser Annahme ist, was der Ukraine-Krieg damit zu tun hat, welche Prioritäten unsere Politik wirklich setzen sollte, was uns 2023 in der Eurozone droht und wie du in Zeiten hoher Inflation und weiteren Krisen dein Geld retten kannst, das erfährst du in dieser Folge "Marc...

Read More »

Read More »

Murray Rothbard versus the Progressives

There has been a radical change in the social and political landscape in this country, and any person who desires the victory of liberty and the defeat of Leviathan must adjust his strategy accordingly. New times require a rethinking of old and possibly obsolete strategies.

Read More »

Read More »