Category Archive: 6b) Austrian Economics

Wolfgang Grupp: “STOPPT die Waffenlieferungen und verhandelt!”

Heute wird mein Format "Marc spricht mit.." besonders spannend! Mit dem bekannten TRIGEMA-Chef Wolfgang Grupp bespreche ich, ob er für seine offene Meinung schon diffamiert wurde, was seine Gedanken zur momentanen Sanktionspolitik sind, wie sein Unternehmen mit der aktuellen Krise umgeht und wann auch er die Koffer packen würde, da sich der Industriestandort Deutschland nicht mehr rentiert. Viel Spaß!

Website Trigema:...

Read More »

Read More »

The Rise and Fall of Trussonomics

On July 8 this year, UK prime minister Boris Johnson resigned as Conservative Party leader after a Cabinet revolt over a series of ethics scandals had made his position untenable. A leadership election was then set in motion to allow party members to elect the next party leader who would succeed Johnson as PM.

Read More »

Read More »

Tom Malengo on Brandjectory, An Innovative New Platform for Launching and Growing Entrepreneurial Businesses

A great benefit of the internet age is the capacity to accumulate, accelerate, and intensify connections between entrepreneurs, knowledge sources, investors, mentors, collaborators, and service providers. Businesses with a valid value proposition who are in the launch and early expansion phases can interconnect a network of powerful and qualified resources to support their growth.

Read More »

Read More »

How to Lose $143 Billion Trading Stocks

Now here’s the headline! Swiss National Bank loses nearly $143 billion in first nine months Reuters reported the Q3 result last week, in which Switzerland’s publicly traded central bank (SNB) suffered its largest loss in its 115-year history.

Read More »

Read More »

Nationality and Statelessness: The Kuwaiti Bidoon

In his Nations by Consent, Murray Rothbard reminds us that the concept of a nation “cannot be precisely defined; it is a complex and varying constellation of different forms of communities, languages, ethnic groups, or religions.”

Read More »

Read More »

John Mauldin: Understanding the Threats in the Global Financial Markets

Want a transcript? Sign up for our free weekly e-letter and you’ll get a transcript every week, plus a summary and link to the video: https://www.mauldineconomics.com/go/JM499G/MEC

Any one of the problems we currently face—energy prices, housing, high inflation—by itself wouldn’t break our back, says John Mauldin, co-founder of Mauldin Economics and one of the most brilliant minds in macroeconomics. But all of them coming together, as they are...

Read More »

Read More »

Sven Hannawald – Wie funktioniert Erfolg? (Interview)

Skisprunglegende Sven Hannawald im Interview

Sven Hannawald Homepage: https://www.sven-hannawald.com/

Thorsten Wittmann Homepage: https://thorstenwittmann.com/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Skisprunglegende im Interview

Dieser Mann steht für Höchstleistung, denn er hat in seinem Sport alles erreicht, was man erreichen kann:

Olympiasieger

Weltmeister

Vierschanzentournee-Sieger

Sportler des Jahres...

Read More »

Read More »

“Antidemocratic” Just Means “Something the Regime Doesn’t Like.”

In the old Marxist regimes, anything that displeased the ruling communist regime was said to be contrary to "the revolution." For example, in the Soviet Union, national leaders spoke regularly of how the nation was in the process of "a revolutionary transformation" toward a future idealized communist society.

Read More »

Read More »

Warum CRASHED Bitcoin? (Live-Analyse) #ftx

Warum crashed Bitcoin? Ist es jetzt zu Ende? Wann steige ich ein und wann aus? Wie ist meine Sicht zu Altcoins? Doch noch einmal von Anfang an...Was ist eigentlich los im Kryptospace? In diesem Livestream analysiere ich live mit euch und beantworte zudem eure offenen Fragen. Viel Spaß! #fragmarc

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon:...

Read More »

Read More »

Was ist mit Bitcoin los? (Livestream Ankündigung)

Später spannender Livestream zu Bitcoin, Politik und Finanzen!

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3bfKWdN oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

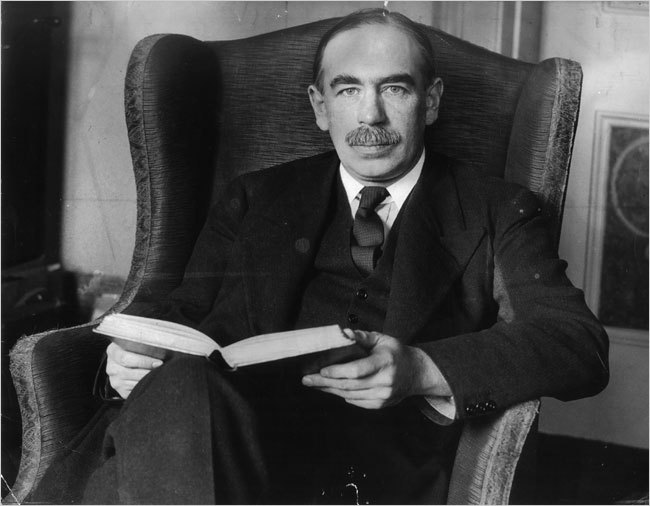

“Keynes is the winner of the day, not Milton Friedman”

To many of us, no matter how well versed in history, in political affairs or in socioeconomic issues, the present conditions in the West, and especially in Europe, can sometimes seem like the plot of a bad movie. It is often said that history doesn’t repeat itself, but it does rhyme, and what we’re seeing today is a great example of that.

Read More »

Read More »

The End of World Dollar Hegemony: Turning the USA into Weimar Germany

In a recent essay, I explained how over time the US abused its responsibility to control the supply of dollars, the world’s premier reserve currency for settling international trade accounts among nations. This abrogation of its duties is leading to the likely adoption of a new reserve currency, commodity based and controlled not by one nation but by members, all watchful that the currency is not inflated.

Read More »

Read More »

ERSTE IMMOBILIE ENTEIGNET!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen?

Read More »

Read More »

Die POLITIK muss sich entschuldigen! | Best-of Fairtalk Marc Friedrich

Marc wie man ihn kennt und liebt (oder hasst):

Er nimmt kein Blatt vor den Mund und redet Tacheles über:

Steigende Energiepreise, Inflation und Rezession

Sanktionen

Die Inkompetenz der Politik und deren enormen Fehlentscheidungen

Read More »

Read More »

Enthüllung! Christian Lindner offenbart Unfassbares!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

US REGIERUNG FORDERT FRIEDENSGESPRÄCHE! KIEW UND MOSKAU BALD EINS!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

Dirk Müller auf dem Anlegerkongress 2022 – “Kampf der Titanen – zweite Runde!” – 2. Teil

????? ??? ??? ?. ???? ??? ????????? ????::

(Bei diesem Video handelt es sich um den 2. Teil des Vortrags von Dirk Müller auf dem Anlegerkongress - Digital 2022 der Dirk Müller Premium Aktien Fonds.)

Read More »

Read More »

SCHLIMMSTE FINANZKRISE SEIT 2. WELTKRIEG!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

AUFGEFLOGEN ! ANDREAS POPP SEHR EMPÖRT : WASSER PREDIGEN ABER SELBER WEIN TRINKEN !

Als Rücktritt oder Demission wird das Niederlegen eines Amtes vor Ablauf der Frist bezeichnet. Rücktritte aus befristeten Anstellungen bzw. Ernennungen gibt es etwa beim Sport (Trainer), in der Wirtschaft (Manager) oder in der Politik (Minister, Regierungschef, Parteivorsitzender).

Read More »

Read More »

Jeff Bezos, Charity, and Economic Well-Being: Wealth Creation Reduces Poverty

Billionaire Jeff Bezos has become a target of ridicule because his ex-wife MacKenzie Scott has been doling out colossal sums to charity. Compared to Scott, Bezos’s donations are quite slim and many are painting him as stingy. But are critics misguided in how they perceive the utility of philanthropy?

Read More »

Read More »