Category Archive: 6b) Austrian Economics

Censorship and Official Lies: The End of Truth in America?

"Truth is treason in an empire of lies." – George Orwell

The State is tightening its stranglehold on its own narrative as its web of lies unravels. The government's lapdogs in the news media continue to bark and howl on TV even though a majority of American households have cut the cord. And of course, nothing resembling the truth can be heard in the softball press conferences at the White House and the Federal Reserve.

Newspapers, both...

Read More »

Read More »

The War on Producers and Entrepreneurs Is Based on False Notions of Profits

The war on the producer is raging on, and the assault on free enterprise and the entrepreneur is hitting an all-time high. Whether it be politicians, academics, or the mainstream media, there’s a relentless effort to paint those who create wealth and prosperity as villains who do nothing but exploit the masses.

This is not just a misguided moral crusade, but it also amounts to an egregious intellectual fraud as it completely ignores fundamental...

Read More »

Read More »

Macro Framework Briefing – Investing in 2024

Mauldin Economics Publisher and COO Ed D’Agostino believes we are at an inflection point in the markets.

For years, investors have been able to buy broad-based ETFs and do pretty well. Those days are over.

Ed details how he and his elite team within Mauldin Economics use themes to focus their investment research—a must in this new investing environment. Ed also unpacks three of his themes for you and shares specific recommendations.

Go here to...

Read More »

Read More »

Warum ist sparen sexy?

Faszination-Freiheit heute aus :

Warum ist Sparen sexy? #sparen #sexy #finanzielleintelligenz

Thorsten Wittmann® Finanzielle Freiheit leben

Du kannst dir die heutige Ausgabe hier auf YouTube ansehen oder auch bei deinem gewünschten Podcastanbieter anhören (Suche: Thorsten Wittmann / Faszination Freiheit).

Hier geht es zu meinem Podcast: https://thorstenwittmann.com/podcast/

Gratis unsere besten Finanztipps und Geldanlagen:...

Read More »

Read More »

Fractional Reserve Banking (Part II)

We have already described one part of the contemporary flight from sound, free market money to statized and inflated money: the abolition of the gold standard by Franklin Roosevelt in 1933, and the substitution of fiat paper tickets by the Federal Reserve as our “monetary standard.” Another crucial part of this process was the federal cartelization of the nation’s banks through the creation of the Federal Reserve System in 1913.

Banking is a...

Read More »

Read More »

The Decisive Driving Force to Victory for Javier Milei

Much has been written in the international press, including within Argentina, about recently inaugurated Argentinian president Javier Milei, mostly about how he is an extreme right-winger (really wanting to taint him as a fascist among left-wing circles). Some independent journalists and observers have commented on how his announced plans could transform Argentina into a prosperous country by following classical liberal policies. One significant...

Read More »

Read More »

MADURO SÍ QUE ES UN ERROR DE LA HISTORIA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

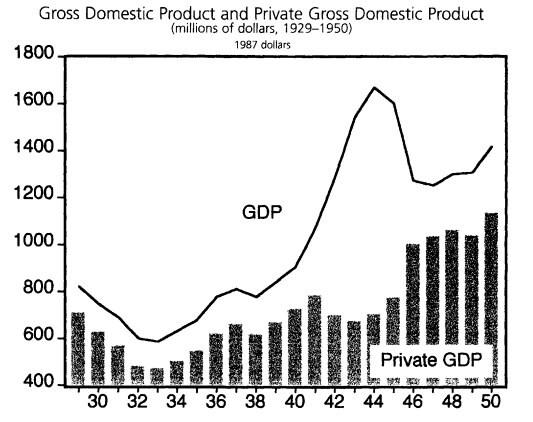

The Government Is Making the Economy Appear Better than It Is

As the 2024 general election gets closer, Democrats and proestablishment pundits are growing frustrated with the American public for not feeling as good about the economy as the so-called experts say they should. The elitism of this view aside, it is true that traditional economic indicators are pretty good and that, at the same time, people aren’t feeling good about the economy.

Center-left economists have been locked in a debate over whether...

Read More »

Read More »

Taking Money Back (Part I)

Money is a crucial command post of any economy, and therefore of any society. Society rests upon a network of voluntary exchanges, also known as the “free-market economy”; these exchanges imply a division of labor in society, in which producers of eggs, nails, horses, lumber, and immaterial services such as teaching, medical care, and concerts, exchange their goods for the goods of others. At each step of the way, every participant in exchange...

Read More »

Read More »

Spring 2024 Mises Book Club

By special request, the Mises Institute will hold its next in-person Mises Book Club, our new program to promote deep reading in Austrian economics, on campus at Oklahoma State University beginning Tuesday, February 6.

In celebration of the 80th anniversary of F. A. Hayek's Road to Serfdom, this classic work in political philosophy, intellectual and cultural history, and economics will be the focus of the next meeting.

For eight riveting weeks, ten...

Read More »

Read More »

Mises Circle in Fort Myers

Save the date!

Join the Mises Institute for a special Circle in Fort Myers, FL this November.

Registration, speaker details, and agenda forthcoming.

Read More »

Read More »

Warum eine Rolex nicht nur eine Rolex ist?

Faszination-Freiheit heute aus :

Warum eine Rolex nicht nur eine Rolex ist? #rolex #rolexgefühl #besonders

Thorsten Wittmann® Finanzielle Freiheit leben

Du kannst dir die heutige Ausgabe hier auf YouTube ansehen oder auch bei deinem gewünschten Podcastanbieter anhören (Suche: Thorsten Wittmann / Faszination Freiheit).

Hier geht es zu meinem Podcast: https://thorstenwittmann.com/podcast/

Gratis unsere besten Finanztipps und Geldanlagen:...

Read More »

Read More »

2024 Political Circus Begins in Iowa

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop discuss the results of the Iowa Caucuses. What does Trump's overwhelming win mean for American politics, and what is the future for candidates like Vivek Ramaswamy and Ron DeSantis? Also, did anyone know Asa Hutchinson was still around? Ryan and Tho discuss this and more.

Claim your free book: Mises.org/RothPodFree

Be sure to follow Radio Rothbard at Mises.org/RadioRothbard....

Read More »

Read More »

KISS. SUS MEJORES… Y PEORES DISCOS

Dividimos la #discografía de #kiss en dos partes: Con y sin maquillaje. Y elegimos nuestros favoritos de cada una. #Rock #vinilos

¿Cuáles son tus favoritos?

No olvides seguir a Tony Hernando y Lords of Black:

@TonyHernando

www.tonyhernando.com

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook -...

Read More »

Read More »

Can Classical Economics Explain the Approaching Fiscal Disaster?

Today’s US fiscal predicament includes unprecedentedly high federal spending financed by inadequate tax revenue and high federal budget deficits. There is a lack of sufficient buyers of US Treasury debt. Rating agencies have recently downgraded the US debt, and entitlement benefits are forecast to outstrip their trust funds in a few years. How might a nineteenth-century English economist be relevant to this predicament?

Might this fiscal...

Read More »

Read More »

Dirk Müller: Die Proteste zeigen Wirkung – Finanzminister Lindner konnte nur verlieren!

? ????????.???: ????? ? ????? ?ü? ?€ ?????? ►► https://bit.ly/Cashkurs_1

? Gratis-Newsletter inkl. täglichem DAX-Update ►►► https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►► https://www.youtube.com/@cashkurscom

Bildrechte: Cashkurs.com / Juergen Nowak - Shutterstock.com

#dirkmueller #lindner #cashkurs #demonstration #informationsvorsprung

https://www.cashkurs.com – Ihre unabhängige Finanzinformationsplattform zu den Themen Börse,...

Read More »

Read More »

The Oregon Problem: It’s Not Drugs! It’s the Socialistic Political Culture

Not many people know that Oregon decriminalized all drugs through a ballot initiative. The Wall Street Journal recently ran an article: “Oregon Decriminalized Hard Drugs: It Is Not Working.” The question here is, why not?

In 2020, the State of Oregon decriminalized all drugs, including hard drugs such as heroin, crystal meth, which you will remember as the centerpiece of the hit series Breaking Bad, and fentanyl, a highly dangerous synthetic...

Read More »

Read More »

Warum harte Arbeit allein nicht funktioniert?

Faszination-Freiheit heute aus :

Warum harte Arbeit allein nicht funktioniert? #hartundsmart #schlüsselzumerfolg #finanziellefreiheit

Thorsten Wittmann® Finanzielle Freiheit leben

Du kannst dir die heutige Ausgabe hier auf YouTube ansehen oder auch bei deinem gewünschten Podcastanbieter anhören (Suche: Thorsten Wittmann / Faszination Freiheit).

Hier geht es zu meinem Podcast: https://thorstenwittmann.com/podcast/

Gratis unsere besten...

Read More »

Read More »

Why You Should Read Human Action—Very Carefully

May 16–18, 2024: Join Dr. Joseph T. Salerno, Dr. Thomas J. DiLorenzo, Dr. Jörg Guido Hülsmann, Dr. Joseph T. Salerno, Dr. Mark Thornton, and more for a conference in honor of the 75th anniversary of Human Action at our campus in Auburn.

Read More »

Read More »

The New York Times DIFAMA (otra vez) a Javier Milei

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »