Category Archive: 6b) Austrian Economics

How Money Printing Destroyed Argentina and Can Destroy Others

Inflation in Argentina is far worse than neighboring countries. It has only one cause: an extractive and confiscatory monetary policy—printing pesos without control and without demand.

Read More »

Read More »

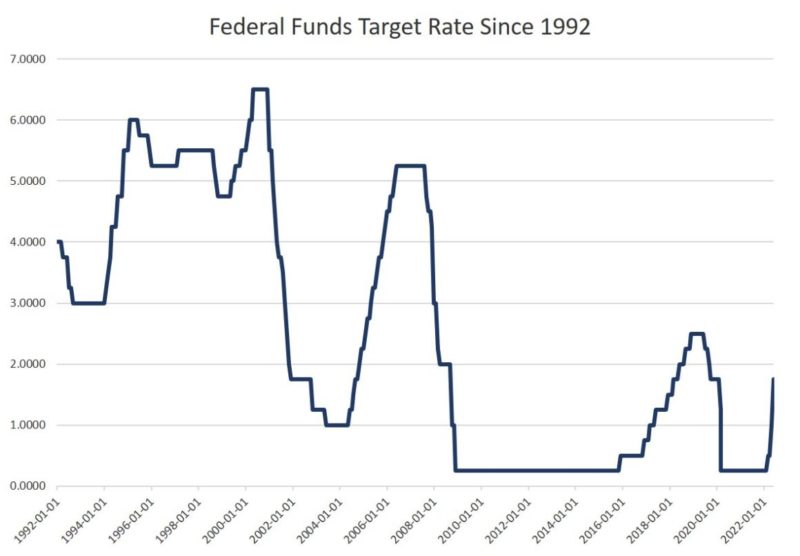

Powell Is the New Arthur Burns, Not the New Paul Volcker

Last year, just as it was becoming increasingly clear that price inflation was mounting, Jerome Powell repeatedly denied there was any reason for concern. He called inflation "transitory." A few months later, he admitted it was not transitory, but denied it was "entrenched." Then, by late 2021, he admitted price inflation was getting out of control but still took no action of any consequence.

Read More »

Read More »

Peter Lewin and Steven Phelan: How Do Entrepreneurs Calculate Economic Value Added? Subjectively.

At the core of the entrepreneurial orientation that is the engine of vibrant, growing, value-creating, customer-first businesses, we find the principles of subjectivism and subjective value. Subjective value embraces not only the value the customer seeks, but also the value that entrepreneurs establish in their companies: capital value.

Read More »

Read More »

Stagflation 2.0 Is Here To Stay | Ronald Stöferle and Mark Valek

Ronald Stöferle and Mark Valek of Incrementum AG are pioneers in the world of hard assets, stern devotees of gold and Bitcoin, and deep skeptics about the sustainability of debt-based monetary systems.

Read More »

Read More »

Who Really Makes US Foreign Policy? Who Benefits and Who Loses?

In a piece of news that shocked the mainstream media, but which shocked no one familiar with the academic industry writ large, retired US Army general John Allen was forced to resign as president of the Brookings Institution after it was revealed the FBI was investigating him for lobbying on behalf of the Qatari monarchy.

Read More »

Read More »

Cashkurs*Wunschanalysen: Standard Lithium, Siemens und BYD unter der Chartlupe

Mario Steinrücken hat wieder die Aktienwünsche unserer Mitglieder unter die Chartlupe gelegt: Hier geht’s zum vollständigen Video mit weiteren spannenden Titeln wie Disney, Linde oder Volkswagen: https://bit.ly/Wunschanalysen01Juli

Als Mitglied können Sie sich im Kommentarbereich auf https://www.cashkurs.com/ Ihren Favoriten für die nächste Runde wünschen - Unsere Experten nehmen jeden Freitag die Wunschaktien unter die Chartlupe!

***Bitte...

Read More »

Read More »

How Bad Were Recessions before the Fed? Not as Bad as They Are Now

With a recession looming over the average American, the group to blame is pretty obvious, this group being the central bankers at the Federal Reserve, who inflate the supply of currency in the system, that currency being the dollar. This is what inflation is, the expansion of the money supply either through the printing press or adding zeros to a computer screen.

Read More »

Read More »

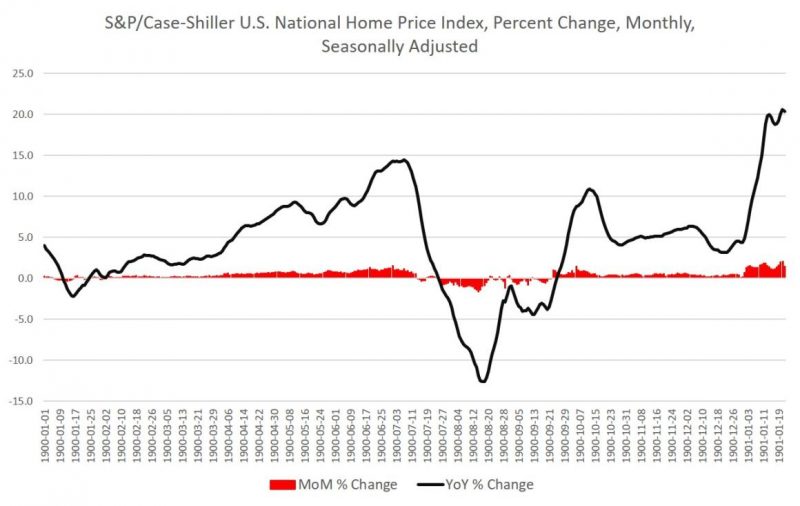

What Will It Take to End Rampant Home-Price Inflation?

Real wages are falling, inflation is at a 40-year high, and the Atlanta Fed predicts we'll find GDP growth at zero for the second quarter. Meanwhile, both the yield curve and money-supply growth point to recession. But when it comes to the latest data on home prices, there's still no sign of any deflation or even moderation.

Read More »

Read More »

Economic Winter Has Arrived

The average card-carrying Austrian would say that the Federal Reserve is creating money by the bale, with evidence being Consumer Price Index prints of 8.6 percent per the Bureau of Labor Statistics or over 15 percent per John Williams’s shadowstats.com computation based on the way the government calculated CPI back in 1980.

Read More »

Read More »

Marc exklusiv live! „Wir erleben Historisches“ (Krise, Krieg, Inflation, Crash)

„Herr Friedrich, das war ihr wichtigster und bester Vortrag“ so ein Zuschauer.

Auf der Deutschen Rohstoffnacht 2022 geht es rund:

- Sind Rohstoffe in Zukunft King?

- Scheitert der Euro?

- Stehen wir vor einer Zeitenwende und erleben wahrhaftig Geschichte?

- Kommt ein Crash?

Warum Inflation erst der Anfang ist, die Politik aufzeigt, wo viele unserer Schwächen liegen und ob wir jemals wieder Zinsen sehen, erfahrt ihr in meinem Vortrag zum...

Read More »

Read More »

Jetzt geht es auch den Banken an den Kragen! Handyversion

Bisher wurden viele marode Banken durch die Null-Zins Politik der EZB vor der Pleite gerettet. Die Folge ist eine dramatische Inflation, die nicht nur die Bürger sondern auch die Wirtschaft in arge Bedrängnis bringt.

Read More »

Read More »

Contra Ben Bernanke, the Gold Standard Promotes Economic Stability

Currently the world is on a fiat money standard—a government-issued currency that is not backed by a commodity such as gold. The fiat standard is the primary cause behind the present economic instability, and is tempted to suggest that a gold standard would reduce instability. The majority of experts however, oppose this idea on the ground that the gold standard is in fact a factor of instability.

Read More »

Read More »

🆘 Folker Hellmeyer: Gnade uns Gott – Unsere Demokratie steht auf dem Spiel!

𝗦𝗲𝗵𝗲𝗻 𝗦𝗶𝗲 𝗱𝗮𝘀 𝗴𝗮𝗻𝘇𝗲 𝗜𝗻𝘁𝗲𝗿𝘃𝗶𝗲𝘄 𝗺𝗶𝘁 𝗙𝗼𝗹𝗸𝗲𝗿 𝗛𝗲𝗹𝗹𝗺𝗲𝘆𝗲𝗿, 𝗖𝗵𝗲𝗳𝘃𝗼𝗹𝗸𝘀𝘄𝗶𝗿𝘁 𝗱𝗲𝗿 𝗡𝗲𝘁𝗳𝗼𝗻𝗱𝘀 𝗔𝗚, 𝗵𝗶𝗲𝗿: https://bit.ly/CKTVHellmeyer

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus einem längeren Gespräch zwischen Folker Hellmeyer und Helmut Reinhardt auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro -...

Read More »

Read More »

ANDREAS POPP: AUF GEDEIH UND VERDERB!

Wirtschaft aktuell: Was passiert jetzt? Jetzt ein Demokonto eröffnen & in Sachwerte kaufen? Negativzinsen durch ein Online Bankkonto umgehen? Macht Forex Trading, CFD Handel und Aktien oder der sichere Hafen Girokonto und Gold Sinn?

Read More »

Read More »

How Governments Expropriate Wealth with Inflation and Taxes

In an interview with the Wall Street Journal, Treasury secretary Janet Yellen admitted that the chain of stimulus plans implemented by the US administration helped create the problem of inflation.

Read More »

Read More »

A Critique of Neoclassical and Austrian Monopoly Theory

One of the most controversial areas in Austrian economics, and one where even long-established Austrian theorists differ sharply, is monopoly theory. Indeed, as we shall see below, the differences are not merely semantic, nor are they confined to detail or some minor theoretical implication.

Read More »

Read More »

Die Zentralbanken sind schachmatt

Seit Jahrzehnten senken die Notenbanken ihre Leitzinsen bei jedem Anzeichen einer wirtschaftlichen Korrektur. Sie versuchen damit, das Problem der sich von den Konsumentenbedürfnissen entfernenden Produktionsstruktur («Zombifizierung») mit billigem Geld zuzudecken.

Read More »

Read More »

Markets Promote Real Equality Much More Than Progressive (and Conservative) Critics Claim

The economy consists of a huge chain of the division of labor that is interlocked to such a limit where there exists hardly any single individual or firm that produces the whole of the product alone. This is famously illustrated in the essay “I, Pencil,” by Leonard Read.

Read More »

Read More »

Episode 756: *Throwback* Jeff Deist And Pete Discuss Their Post-Election Predictions from Nov 2020

This is an episode Pete released on Nov 1 2020 in which he and Jeff make predictions for all possible scenarios in a post-2020 election world. What did they get right?

Read More »

Read More »