Category Archive: 6b) Austrian Economics

The Phillips Curve Is an Economic Fable

Keynesians and fellow travelers hold the Phillips curve to be sacrosanct. But because the Phillips curve cannot establish causality, it is useless as economic theory.

Original Article: "The Phillips Curve Is an Economic Fable"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Discutí con Yolanda Díaz hace 6 años… NO HA SERVIDO DE NADA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Dirk Müller: Credit Suisse-Rettung – Der neue „Lehmann“-Moment

𝗦𝗲𝗵𝗲𝗻 𝗦𝗶𝗲 𝗱𝗮𝘀 𝗴𝗮𝗻𝘇𝗲 𝐔𝗽𝗱𝗮𝘁𝗲 𝘃𝗼𝗻 𝗗𝗶𝗿𝗸 𝗠ü𝗹𝗹𝗲𝗿 𝗵𝗶𝗲𝗿:

https://bit.ly/230320_Marktupdate

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 20.03.2023 auf Cashkurs.com.)

👉Jetzt Cashkurs-Mitglied werden ►► 1 voller Monat für €9,90 ► https://bit.ly/Cashkurs9_90

3️⃣ Tage gratis testen ►►► https://bit.ly/3TageGratis

📧 Gratis-Newsletter ►►►https://bit.ly/CashkursNL

🔴 YouTube-Kanal abonnieren ►►►...

Read More »

Read More »

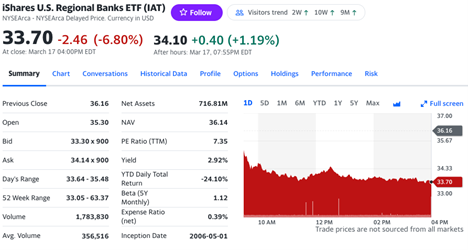

It Turns Out That Hundreds of Banks Are at Risk

It’s the weekend, but our fresh Financial Crisis does not sleep. And a recent study says we’ve only seen the tip of the iceberg.

The Washington Post yesterday wrote: “If banks were suddenly forced to liquidate their bond and loan portfolios, the losses would erase up to 91 percent of their combined capital cushion.” In other words, we were already right up against the edge.

The Post cites two studies that total unrealized losses in the system are...

Read More »

Read More »

Socialism Isn’t about Creating Economies. It Is about Amassing Political Power

Ludwig von Mises wrote Socialism: An Economic and Sociological Analysis, a small book published in 1922, which demonstrated that economic calculation in a socialist commonwealth is impossible. Of course, Mises assumed that the purpose of an economy, even a socialist one, was supposed to produce goods and services, which determined its success or failure.

Alain Besançon wasn’t an Austrian or a Misesian, but he wrote Anatomie d’un spectre: l’Économie...

Read More »

Read More »

Bankenkrise kurz erklärt #creditsuisse

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

BANKENKRISE! Credit Suisse – erklärt! (UBS)

► Mein Merch:

https://shop.marc-friedrich.de/

🎉 Marc lädt Dich ein nach Schwäbisch Gmünd!

https://www.marc-friedrich.de/marc-laedt-ein

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Bitcoin

Wo seriös BITCOIN kaufen und lagern? Alles Wichtige findest du hier:

https://www.friedrich-partner.de/bitcoin-handbuch

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller...

Read More »

Read More »

Bankenkrise spitzt sich zu – 2 Billionen, CREDIT SUISSE, USA #shorts

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

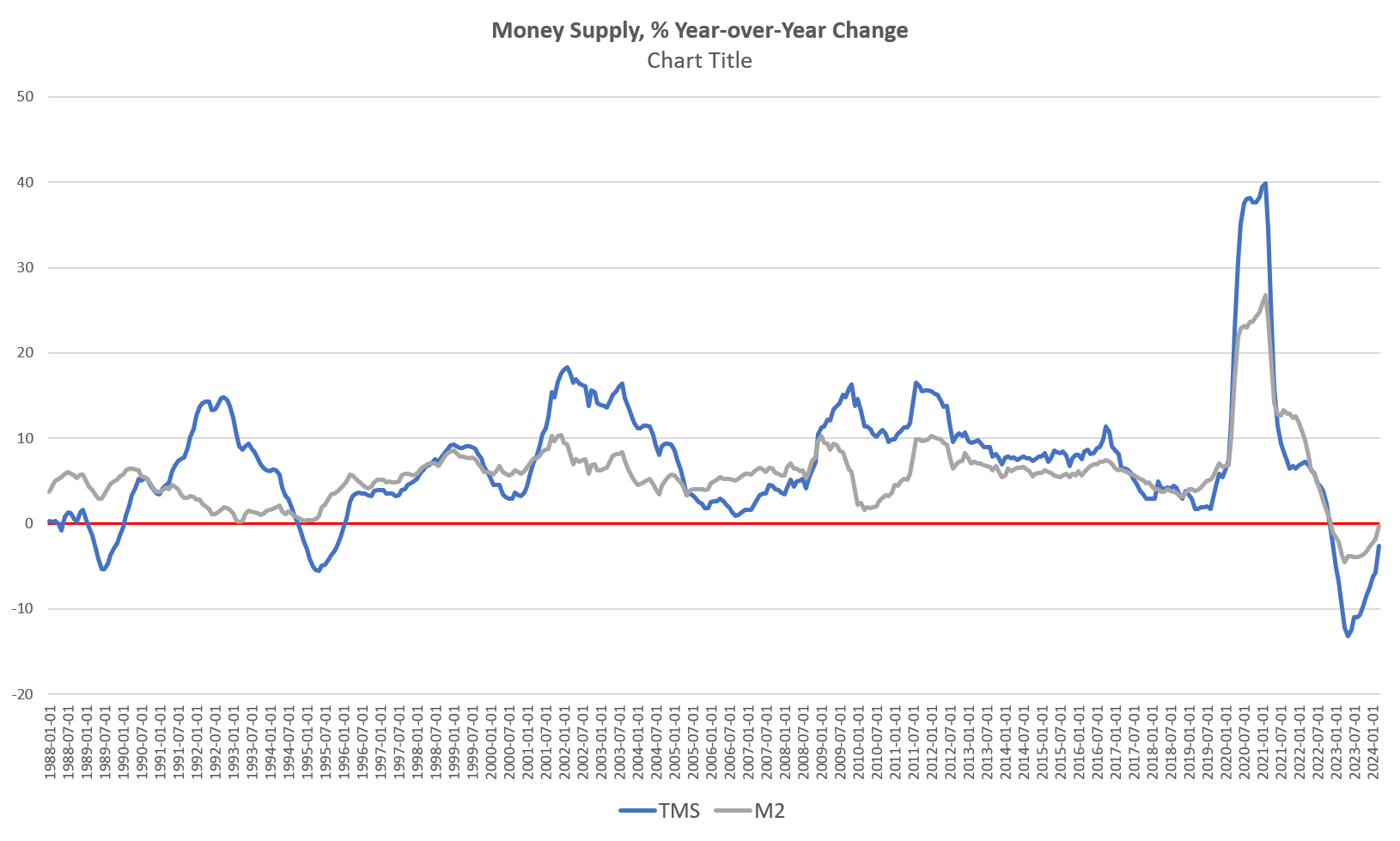

How Easy Money Killed Silicon Valley Bank

The incredible growth and success of SVB could not have happened without negative rates, ultra-loose monetary policy, and the tech bubble that burst in 2022.

Original Article: "How Easy Money Killed Silicon Valley Bank"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Steuerzahler werden entlastet – Bundestag schrumpft!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

¿Cómo puede QUEBRAR un BANCO?

#crisis #economia #bancos #bancoscentrales #inversiones #mercados #macroeconomía

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

The Fed’s Huge Monetary Overhang Keeps Job Totals Up as Real Wages Fall

The current job market strength partly reflects the ongoing monetary overhang from years of breakneck growth in money-supply inflation. The $6 trillion in money that was newly created since 2020 is still very much a factor.

Original Article: "The Fed's Huge Monetary Overhang Keeps Job Totals Up as Real Wages Fall"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Der Sinn des Lebens von Dr. Daniele Ganser

🎉 Marc lädt Dich ein nach Schwäbisch Gmünd!

https://www.marc-friedrich.de/marc-laedt-ein

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

►...

Read More »

Read More »

The Fed’s Malfeasance after SVB

This past weekend saw extraordinary actions by the Fed to address the meltdown of Silicon Valley Bank. Did the central bank break the law by effectively authorizing unsecured loans to banks based on the face value—rather than significantly lower market value—of those banks' Treasury holdings?

Bob's study guide to A Theory of Money and Credit: Mises.org/HAP387a

Jeff on the Fed as the ultimate bank: Mises.org/HAP387b

[embedded content]

Read More »

Read More »

The Balfour Declaration

Teaching high schoolers economics means teaching Austrian principles.

Original Article: "The Balfour Declaration"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Central Bank Digital Currencies Would Bring Hyperinflation

There are many excuses often used to explain inflation. However, the fact is that there is no such thing as “cost push inflation” or “commodity inflation.” Inflation is not an increase in prices, it is the destruction of the purchasing power of the currency.

Cost-push inflation is more units of currency going to relatively scarce real assets. The same can be said about all other, from commodities to demand and my favorite, “supply chain...

Read More »

Read More »

Bank Failures: Runs and Funds

SVB Bank and Signature Bank failed this week and were bailed out. Mark explains why the banks failed and why it was bound to happen. The minor issue is that the total FDIC bailout fund is actually smaller than either one of the banks.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Read More »

Read More »

¿Una CRISIS más dura que el 2008?

#crisis #economia #inversiones #mercados #macroeconomía #bancos #bce #ecb

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

How the Fed’s 2008 Mortgage Experiment Fueled Today’s Housing Crisis

How should Congress assess the Federal Reserve’s track record as an investor in residential mortgage-backed securities (MBS)? Regardless of Fed spin, it merits a failing grade.

The Fed’s COVID-era intervention in the mortgage markets fueled the second real estate bubble of the 21st century. The bubble ended when the Fed stopped purchasing MBS and raised rates to fight inflation. While time will tell whether recent increases in home prices are...

Read More »

Read More »

Anatomy of the Bank Run

[This article is featured in chapter 79 of Making Economic Sense by Murray Rothbard and originally appeared in the September, 1985 edition of The Free Market]

It was a scene familiar to any nostalgia buff: all-night lines waiting for the banks (first in Ohio, then in Maryland) to open; pompous but mendacious assurances by the bankers that all is well and that the people should go home; a stubborn insistence by depositors to get their money out;...

Read More »

Read More »