Category Archive: 6b.) Mises.org

The American Revolutionaries Didn’t Need a Central Government. Neither Do We.

Rothbard on the American Revolution: "There was no particular need for the formal trappings and permanent investing of a centralized government, even for victory in war."

Original Article: "The American Revolutionaries Didn't Need a Central Government. Neither Do We."

Read More »

Read More »

Regulation in the Free Market: It’s Not What Most People Believe

When the idea of a totally free market is floated in economic discussion, a widely accepted critique of such an idea is often related to the issue of how goods and services could be guaranteed safe for consumption. After all, without a government sending inspectors and decreeing standards of safety for products, it is often assumed companies, in their everlasting quest for profits without mercy, would have no incentive against selling whatever...

Read More »

Read More »

Is Javier Milei Argentina’s Ron Paul Moment?

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop are joined by Mises Summer Fellow Manuel Garcia Gojon to discuss the recent strong performance by Argentinian libertarian presidential candidate Javier Milei. The three discuss the economic conditions of Argentina fueling the self-proclaimed anarcho-capitalist's political rise, what separates him from other populist figures, and some of his proposed policies - such as abolishing the...

Read More »

Read More »

FedNow Isn’t a CBDC, but It Is Dangerous

While FedNow seems benign, there is the larger problem of the entire banking system itself being built on a foundation of sand. FedNow can only make that problem worse.

Original Article: "FedNow Isn't a CBDC, but It Is Dangerous"

Read More »

Read More »

China Enters the Doom Loop

China's authoritarian gerontocracy has built a Doom Loop with Chinese characteristics, with over half the economy now crashing.

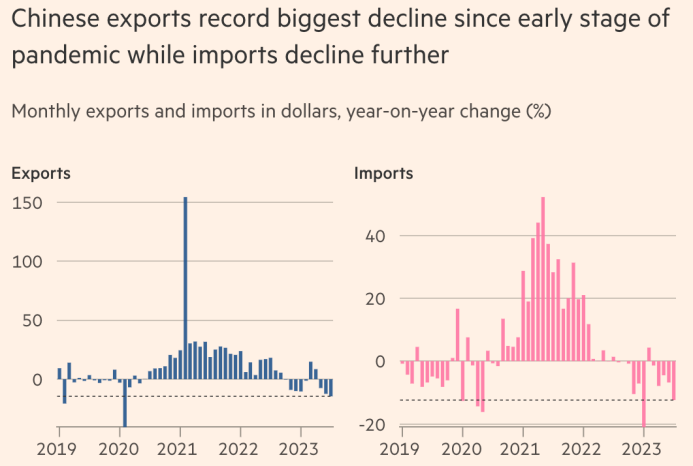

Chinese exports are now plunging at the fastest pace since the covid lockdowns: Exports fell 14.5% on the year, driven by a 21% drop in exports to Europe and a 23% drop to the US.

Meanwhile, imports to China are also falling -- 12.4% on the year -- as shrinking manufacturing buys fewer inputs and households buy less.

In...

Read More »

Read More »

Is the Monopoly Board Game Like Real Markets?

It feels like a silly thing to say, but board games are not real life. Playing a few rounds of Operation does not make you a surgeon. Unlike in Battleship, real-world battleships do not sit still on a ten-by-ten grid.

Similarly, Monopoly does not correlate to “free-market capitalism,” despite anticapitalist claims like this tweet with over a million views:

There’s literally a children’s board game that demonstrates that “free-market capitalism”...

Read More »

Read More »

Can Fractional Reserve Banking Survive the Twenty-First Century?

Banker and financial expert Caitlin Long believes that fractional reserve banking is closer than ever to collapse, and she has a 100 percent reserve banking solution in progress.

Original Article: "Can Fractional Reserve Banking Survive the Twenty-First Century?"

Read More »

Read More »

Inflation Is a Giant “Skim” on the American People

The price of a McDonald’s hamburger in the United States has inflated 3.75 percent annually over the last seventy years. McDonald’s has grown from a tiny hamburger stand in Des Plaines, Illinois, to the second largest fast-food chain on earth. Scale economies alone (never mind process and productivity improvements) should’ve allowed the price of a burger to decline materially over this period.

Why didn’t it? What forces and institutions have...

Read More »

Read More »

How East Germany’s Stasi Perfected Mass Surveillance

The East German secret police, the Stasi, developed the art of mass surveillance using pre-digital methods. Modern tech now makes the job a lot easier.

Original Article: "How East Germany's Stasi Perfected Mass Surveillance"

Read More »

Read More »

Thanks to Government, Maui’s Lahaina Fire Became a Deadly Conflagration

The most destructive natural disasters are never 100 percent natural. Human choices, land use, and government policies play a big role in how harmful hurricanes, tornadoes, earthquakes, flash floods, and wildfires are to the affected communities.

And after catastrophes like the wildfire that destroyed much of the historic Hawaiian city of Lahaina last week, it’s worth taking stock of how much of the disaster was the result not of natural or...

Read More »

Read More »

Decentralize and Win

Michael Rectenwald talks with Paul Gottfried about Paleoconservatism, the left, Wokism, the identity and ethos of the ruling elite, and decentralization.

Join us in Nashville on September 23rd for a no-holds-barred discussion against the regime. Use code "Rekt23" for $45 off admission: Mises.org/Nashville23

Decentralize and Win

Video of Decentralize and Win

Read More »

Read More »

How the Business Cycle Happens

Study of business cycles must be based upon a satisfactory cycle theory. Gazing at sheaves of statistics without "pre-judgment" is futile. A cycle takes place in the economic world, and therefore a usable cycle theory must be integrated with general economic theory. And yet, remarkably, such integration, even attempted integration, is the exception, not the rule. Economics, in the last two decades, has fissured badly into a host of...

Read More »

Read More »

The Taxpayers Bailed Out Yellow Trucking. It Went Bankrupt Anyway.

The Trump administration doled out $700 million in CARES “loans” to trucking firm Yellow. Now Yellow has gone bankrupt, and the taxpayers may foot the bill.

Original Article: "The Taxpayers Bailed Out Yellow Trucking. It Went Bankrupt Anyway."

Read More »

Read More »

Golf Merger Is Opposed by Congress. This Is Misguided

The PGA Tour and the Saudi-owned LIV Golf are seeking to move past their cutthroat competition and merge together, but United States regulators are stepping in and framing the potential merger as a threat to US sovereignty and an expansion of Saudi Arabian influence, citing the Saudi regime’s brutality and alleged involvement in the 9/11 attacks.

In questioning representatives of the two companies, Senator Richard Blumenthal stated, “Today’s...

Read More »

Read More »

Censorship through the Centuries: Free Speech Suppression by the Government and the Mainstream Media

While Americans believe the First Amendment protects their speech, the US government and mainstream media have joined together to suppress speech that does not coincide with government policies.

Original Article: "Censorship through the Centuries: Free Speech Suppression by the Government and the Mainstream Media"

Read More »

Read More »

Family Flourishing and State Denigration

There is little doubt that the institution of the family in the West is in crisis. Birth rates have been declining in the USA, and most Western countries have fertility rates below replacement level. Abortions number over five hundred thousand per year, most of which are concentrated among low-income individuals. Famously, around half of all marriages in the USA end in divorce. Rather than ignoring these problems, it is important for all on the...

Read More »

Read More »

The European Energy Crisis May Be Back Soon

European natural gas prices soared almost 40 percent on the risk of a global liquefied natural gas shortage. European wholesale power prices remain below the record highs of the energy crisis but have steadily climbed as the volatility in the international commodity spectrum underscores the fragility of the European energy system.

Unfortunately, the European Union bureaucrats declared the end of the energy crisis as if it were the result of...

Read More »

Read More »

Taking Back the Meaning of “Inflation”

By corrupting the meaning of inflation, mainstream economists have given a false picture of what happens when monetary authorities expand the money supply. Mises and Rothbard understood.

Original Article: "Taking Back the Meaning of "Inflation""

Read More »

Read More »

Eurodollars as a Fractional Reserve Market

Austrian economics properly understands the ability of commercial banks to create money by mismatching their depositor liabilities with their issuing of money substitutes (i.e., the creation of credit). One possible place for further exploration is the role that nonbank or foreign financial institutions play in the creation of credit and the broader implications on business-cycle creation.

Let us take the dollar as an example. Say Deutsche Bank...

Read More »

Read More »

The Dead End of Catholic Nationalism

The Christian nationalist state is one in which civil rulers—for a time—regard the Church as a convenient ally. Once this comes to an end, however, the "Christian" state transforms into a state hostile to those it was once designed to protect.

Original Article: "The Dead End of Catholic Nationalism"

Read More »

Read More »