Category Archive: 6b.) Mises.org

Taking a Closer Look at the Vaunted Scandinavian Welfare States

Welfare states in Scandinavia are revered by the American Left. Many think that America could reduce social problems by copying their policies. To such people, the success of the Scandinavian states is evidence that socialism works. Confidence in the welfare policies of these places is so great that pundits even attribute the prosperity of Scandinavia to these policies. Few ponder why socialism leads to disastrous consequences elsewhere but...

Read More »

Read More »

Would You Hire an AI-powered McRobot or a Human Employee?

The decision to use artificial intelligence–powered robots in the fast food industry depends upon differences in costs and performance between humans and robots. State minimum wage laws are pushing the industry toward robots.

Original Article: Would You Hire an AI-powered McRobot or a Human Employee?

Read More »

Read More »

Rothbard on a Priori History

Murray Rothbard is well-known as one of the greatest exponents of praxeology, which operates through a priori reasoning. He was careful, however, to distinguish praxeology from history. The latter could be studied only through empirical investigation. In this week’s column, I’d like to discuss some observations he makes about this in For a New Liberty, which was published fifty years ago.

In the section called “Avoiding a Priori History,” Rothbard...

Read More »

Read More »

The House Showdown: Separating Truth from Outright Falsehoods

Read the New York Times (or even National Review) and you'll learn that the budget standoff is between congressional “adults” and right-wing House nutjobs. This is not the case.

Original Article: The House Showdown: Separating Truth from Outright Falsehoods

Read More »

Read More »

Reaping What You Sow: The American Regime in Chaos

The word “chaos” has been the buzzword this week in Washington, largely directed toward Rep. Matt Gaetz’s successful coup against former Speaker of the House Kevin McCarthy and the resulting void in Republican leadership. In an era where most outcomes in Washington are predictable, best illustrated by yet another kick-the-can-down-the-road continuing resolution on spending passed the preceding weekend, the first successful use of a motion to vacate...

Read More »

Read More »

Dollarization Puts Foreign Economies at the Mercy of the US Regime

Argentinian presidential candidate Javier Milei—who could actually win in the general election later this month—has become famous for his fiery speeches and his libertarian views from central banking to government spending. Milei's proposed policies—if he's able to actually implement them—would do much to help the Argentinian economy recover from decades of malaise caused by runaway government spending and monetary inflation. Among Milei's...

Read More »

Read More »

Mises Wire

But once a commodity is established as a money on the market, no more money at all is needed.

—Murray Rothbard, Taking Money Back

The Fed’s distinguishing characteristic is its grant of privilege to buy assets with money it doesn’t have. No other person or institution can legally do this; those that tried would be indicted for counterfeiting.

At the very least you might think this would raise eyebrows, but it doesn’t except in fringe quarters. It...

Read More »

Read More »

Power Vacuum: How the State Wants to Suck Electricity from the SUV You Are Required to Buy

Because California’s government has hamstrung electricity producers in the state, its legislature now wants EVs to be “bidirectional,” that is, to put power from their batteries back into the grid.

Original Article: Power Vacuum: How the State Wants to Suck Electricity from the SUV You Are Required to Buy

Read More »

Read More »

True Money Supply Is the Correct Measure of Inflation, Not Consumer Price Index

Historically, inflation always referred to an increase in the money supply, whereas nowadays it refers to an increase in prices.

This shift in the definition of inflation lets central banks get away with their fraudulent business. Thus, the original definition must be reestablished. We must, by all means, switch the focus from the symptoms to the disease.

The CPI Deserves Less Attention

The lure of the Consumer Price Index (CPI) doesn’t just...

Read More »

Read More »

Mises versus Hayek on the Future of Civilization

While F.A. Hayek is known for his term “spontaneous order,” Mises saw institutional development as coming from growth in human understanding of things.

Original Article: Mises versus Hayek on the Future of Civilization

Read More »

Read More »

Public Goods Viewed through Entrepreneurship

Public goods, in mainstream economic theory, are goods that are nonrivalrous, where one person using a good does not preclude anyone else’s capacity to do the same, and nonexcludable, where owners of the public goods are generally unable to restrict anyone’s access to the good. Commonly touted examples include public lighting, like streetlights, radio, firework shows, military defenses, and flood defenses.

To the mainstream, public goods present an...

Read More »

Read More »

States Are Dying from Corruption and the Exponential

The state is held together by violence and nothing else. There is no such thing as "the social contract." But even violence cannot make a state last past its time, as we saw with the USSR.

Original Article: States Are Dying from Corruption and the Exponential

Read More »

Read More »

How Is the Fed Insolvent and Why Should We Care?

Alex Pollock has decades of experience in financial markets, including a position as President of the Federal Home Loan Bank of Chicago. He explains to Bob the mechanics of the Fed's current insolvency and its implications for ordinary Americans.

Join us in Fort Myers on November 4 to cut through the campaign talking points and offer an uncompromising look at what is coming next. Use Code "FL2023" for $10 of-f admission: Mises.org/FL23...

Read More »

Read More »

Statism Stands against Free Trade and Free Association

Free trade has its enemies on the left and the right. However, despite the supposed “sophistication” of their antitrade arguments, when we break them down, those arguments really are sophistry.

Original Article: Statism Stands against Free Trade and Free Association

Read More »

Read More »

Physician Burnout: Another Consequence of Medical Socialism

Obamacare's forced electronic medical recordkeeping is denying patients the care they need.

Original Article: Physician Burnout: Another Consequence of Medical Socialism

Read More »

Read More »

The Data Shutdown—Smokescreen?

This episode examines the impending Government Shutdown, which will suspend new releases of the government's "vital" economic statistics. How will the "Data Dependent" Fed manage its policy behind the cloak of missing data? Mark suggests it's best to consider that the Fed is playing its typical confidence game.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Read More »

Read More »

Last Day to Double Your Gift

The Mises Institute sends a big THANK YOU to everyone who already donated to our Fall Campaign this week.

Your support helps us continue to make the sound economic principles of Mises, Rothbard, Hazlitt, and Hayek free to the world at a time when they are needed more than ever.

If you haven’t had time to donate, please do so today. Hunter Lewis, a generous donor and author of numerous books, is passionate about educating a future generation of...

Read More »

Read More »

Will Dollarization Work in Argentina?

In Argentina, the libertarian presidential candidate Javier Milei made headlines when he came in first in the primary on August 13. His economic program calls for a strong reduction in government spending and the role of government in general and would, if implemented, greatly improve the conditions of economic life in Argentina.

There is, however, one weak point—namely, his proposed monetary reform. Faced with high inflation rates and a...

Read More »

Read More »

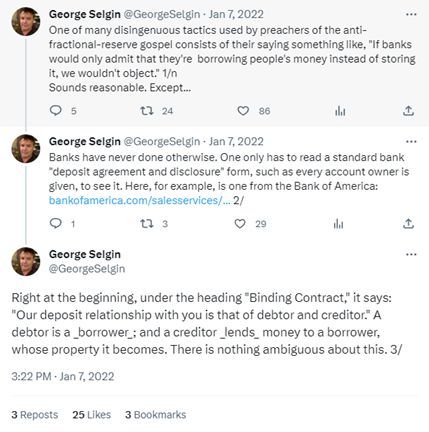

Is the Money in Your Checking Account Yours or the Bank’s?

When Silicon Valley Bank and other banks failed earlier this year, the debate over the sustainability of fractional reserve banking resurfaced. Under fractional reserve banking, banks keep only a fraction of customers’ deposits in reserve. The difference is bank credit, such as government debt, mortgages, business loans, and many other kinds of loans. This practice leaves the bank open to a run, in which panicky depositors attempt to withdraw their...

Read More »

Read More »

Totalitarian Ideals and Not Living by Lies

More than forty years ago, Aleksandr Solzhenitsyn urged his fellow Russians “not to live by lies.” In our politicized age, his words ring truer than ever.

Original Article: Totalitarian Ideals and Not Living by Lies

Read More »

Read More »