Category Archive: 6b.) Mises.org

2024 Predictions (and New Years Resolutions)

On the final Radio Rothbard of 2023, Ryan McMaken and Tho Bishop are joined by Patrick Newman. At a recent Mises event, Newman made some bold predictions about the Federal Reserve's actions in 2024, some of which already look to becoming true. The three talk about what may be on the table for the new year for the economy, politics, and foreign affairs.

"Are We Headed for a Recession in 2024?" by Patrick...

Read More »

Read More »

Why Secession Offers a Path to Wealth and Self-Determination

[This article is chapter 5 of Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities. Now available at Amazon and in the Mises Store.]

One of the most consistent and enthusiastic defenders of human rights and “natural rights” in the twentieth century was the economist and historian Murray Rothbard. A self-described libertarian, Rothbard would also have fit in well among the more radical liberals of the nineteenth...

Read More »

Read More »

The Problems with Post-Trump Populism

When Murray Rothbard established a realignment in libertarian thought, his standard was determined by sovereignty rather than bipartisanship. A right-wing populist platform might be the most popular campaign strategy in the last few years. Since Brexit, a trend has swept a wide range of the globe. The question remains what this political revolution should be called. If it were a daring step away from the establishment, spectators might be concerned...

Read More »

Read More »

From Bastiat’s Defense of Exchange to Ideal Government

Frédéric Bastiat is justifiably famous among believers in liberty. His many classic contributions include The Law and his essays “Government” and “That Which Is Seen and That Which Is Not Seen,” not to mention some of the best reductio ad absurdum arguments ever (such as “The Candlemakers’ Petition” and “The Negative Railway”) and more. Less well known are other essays, such as his election manifesto of 1846, which illustrated what a principled...

Read More »

Read More »

Modern Portfolio Theory Is Mistaken: Diversification Is Not Investment

According to modern portfolio theory (MPT), financial asset prices always fully reflect all available and relevant information, and any adjustment to new information is virtually instantaneous. Thus, asset prices respond only to the unexpected part of information since the expected portion is already embedded in prices.

For example, if the central bank raises interest rates by 0.5 percent, and if market participants anticipated this action, asset...

Read More »

Read More »

A Free and Open Internet Is a Threat to the Establishment

Last week, a video clip of Francis Fukuyama went viral. In the clip, the political scientist called freedom of speech and a marketplace of ideas “18th century notions that really have been belied (or shown to be false) by a lot of what’s happened in recent decades.”

Fukuyama then reflects on how a censorship regime could be enacted in the United States.

But the question then becomes, how do you actually regulate content that you think is noxious,...

Read More »

Read More »

The State Does Not Compromise and Neither Will We

I often think of the great Henry Hazlitt, a hero and supporter of the Mises Institute. He was a tireless voice of reason. He once said at a Mises birthday celebration, “We have a duty to speak even more clearly and courageously, to work hard, and to keep fighting this battle while the strength is still in us. Even those of us who have reached and passed our seventieth birthdays cannot afford to rest on our oars and spend the rest of our lives...

Read More »

Read More »

The State Does Not Compromise and Neither Will We

I often think of the great Henry Hazlitt, a hero and supporter of the Mises Institute. He was a tireless voice of reason. He once said at a Mises birthday celebration, “We have a duty to speak even more clearly and courageously, to work hard, and to keep fighting this battle while the strength is still in us. Even those of us who have reached and passed our seventieth birthdays cannot afford to rest on our oars and spend the rest of our lives...

Read More »

Read More »

COP28: Climate Catastrophism Wins as the World Loses

World elites gathered in yet another attempt to remake the world in a different image, with so-called climate change invoked as the catalyst for the meeting. As one can imagine, their "good" society is not very good for those who are not elites.

Original Article: COP28: Climate Catastrophism Wins as the World Loses

Read More »

Read More »

The Immorality of COP28

As the delegates gather for COP28 to set an agenda to "fight climate change," we should remember what they are seeking to do: destroy the world's economy as we have known it.

Original Article: The Immorality of COP28

Read More »

Read More »

Will Powell’s Pivot Bail Out Biden?

With a doveish pivot, Jerome Powell is declaring victory over inflation. It would be extraordinarily naive to ignore the influence of next year’s presidential election on the Fed’s new outlook.

Original Article: Will Powell's Pivot Bail Out Biden?

Read More »

Read More »

Political Authorities and Covid: Creating Crises in the Name of Public Health

In the name of dealing with a so-called public health crisis, U.S. political and medical elites created even more crises. David Gordon reviews Tom Woods' new book that deconstructs the disastrous decisions made by progressive politicians and medical authorities.

Original Article: Political Authorities and Covid: Creating Crises in the Name of Public Health

Read More »

Read More »

Sustainability of Eden: Can the UN’s Sustainability Agenda Succeed in a World Full of Conflict?

To achieve sustainability, the world needs stability. Yet two-thirds of countries are facing major economic, political, and social problems. Most of them are also experiencing ethnic or civil conflicts, mass migration and poverty crises. The question is whether the UN's sustainability agenda can succeed in the context of ongoing or simmering conflicts.

Paradoxically, preventing wars and conflicts isn't one of the UN's seventeen sustainable...

Read More »

Read More »

The Economic Wisdom of Antony C. Sutton’s The War on Gold

I.

Antony C. Sutton (1925–2002) was a British economist and economic historian who taught at California State University, Los Angeles. Sutton was also a research fellow at the Hoover Institution at Stanford University.

His work focused primarily on the financial and commercial cooperation between major United States banks and corporates (call it “Wall Street interests”) and foreign states that were openly hostile to America.

In his book Wall Street...

Read More »

Read More »

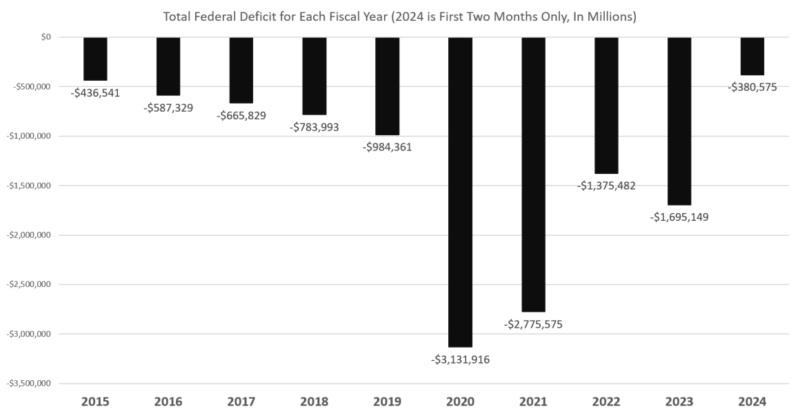

2024’s Deficit Is Already on Track to Be the Worst Since Covid

Weakness in the US economy continues to hide behind surging debt levels and government spending. As noted last month by Daniel LaCalle,

[A] large part of the growth in GDP came from bloated government spending financed with more debt and inventory revaluation, adding 0.8 and 1.4 percentage points to GDP growth. ...

The increase in gross domestic product between the third quarter of 2022 and the same period of 2023 was a mere $414.3 billion,...

Read More »

Read More »

The Christmas Truce of World War I

The Christmas truce, which occurred primarily between the British and German soldiers along the Western front in December 1914, is an event the official histories of the "Great War" leave out, and the Orwellian historians hide from the public. Stanley Weintraub has broken through this barrier of silence and written a moving account of this significant event by compiling letters sent home from the front, as well as diaries of the soldiers...

Read More »

Read More »

Africa Doesn’t Need More Government Aid; It Needs Free Markets

Africa, while being rich in natural resources, is hobbled by government corruption, socialistic policies, and a lack of economic freedom. One only can hope for change.

Original Article: Africa Doesn't Need More Government Aid; It Needs Free Markets

Read More »

Read More »

Unraveling the Roots of the German Mark’s Collapse

A century ago, the German reichsmark went into freefall as the most famous hyperinflation in history exploded the German economy. The repercussions still are with us.

Original Article: Unraveling the Roots of the German Mark's Collapse

Read More »

Read More »

Can a Libertarian Find Hope in Prison? Maybe

One usually does not equate libertarian thinking with a US prison, but prison life does offer some surprises, especially when it comes to internal governance

Original Article: Can a Libertarian Find Hope in Prison? Maybe

Read More »

Read More »

Murray N. Rothbard: A Legacy of Liberty

"On the free market, everyone earns according to his productive value in satisfying consumer desires. Under statist distribution, everyone earns in proportion to the amount he can plunder from the producers."

Murray N. Rothbard (1926-1995) was just one man with a typewriter, but he inspired a world-wide renewal in the scholarship of liberty. During 45 years of research and writing, in 25 books and thousands of articles, he battled every...

Read More »

Read More »