Category Archive: 6b.) Mises.org

The Heroic Julian Assange

Julian Assange may soon be extradited to the United States, where he will face prosecution that could end in his imprisonment for life. He is in fact a hero, who should be honored rather than punished. American foreign policy is based on the pursuit of global hegemony and to achieve this goal, our “leaders” engage in torture and murder. Assange brought these crimes to public attention through his publication of the “WikiLeaks” documents he got from...

Read More »

Read More »

How State-Funding of Activist Groups Makes Britain Less Safe

Recently in the United Kingdom, an asylum claimant named Abdul Ezedi threw a corrosive substance over a woman, leaving her with life-changing injuries. Ezedi, who had arrived illegally in the back of a lorry in 2016, had been denied asylum twice. In 2018, he was given only a suspended sentence after being convicted of sexual assault. Finally, in 2020 he was granted asylum to protect him from prosecution after he claimed to have converted to...

Read More »

Read More »

After Two Years, Neocons Desperate For More War in Ukraine

In a recent CNN interview, the normally very confident US Under Secretary of State Victoria Nuland sounded a little desperate. She was trying to make the case for Congress to pass another $61 billion dollars for the neocons’ proxy war project in Ukraine and she was throwing out the old slogans that the neocons use when they want funding for their latest war.Asked by CNN whether she believes that Congress will eventually pass the bill, Nuland...

Read More »

Read More »

How the Fed Caused America’s Great Depression

[This review of Rothbard America's Great Depression was originally published by the Foundation for Economic Education.]It may not be conventional to review the fifth edition of a book that appears several years after its author’s passing. But America’s Great Depression is not a conventional book. It is written with verve and aplomb. And its rendition of the Austrian theory of the business cycle, critique of alternative theories, and detailed...

Read More »

Read More »

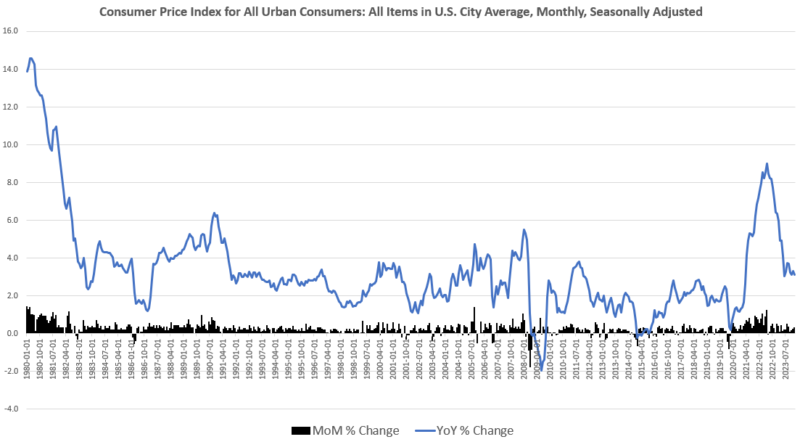

Real Wages Turn Negative Again as Price Inflation Refuses To Go Away

According to the Bureau of Labor Statistics' latest price inflation data, CPI inflation in January accelerated, and price inflation hasn't proven nearly as transitory as the regime's economists have long predicted. According to the BLS, Consumer Price Index (CPI) inflation rose 3.1 percent year over year during January, after seasonal adjustment. That’s the thirty-fifth month in a row of inflation well above the Fed’s arbitrary 2 percent inflation...

Read More »

Read More »

The War of 1812 and the Panic of 1819: The Unholy Alliance between Government and Banking

War has generally had grave and fateful consequences for the American monetary and financial system.—Murray N. Rothbard, A History of Money and Banking in the United StatesGovernments have three ways to tax: direct taxes (the requirement to pay money to the government), debt (present government spending without tax revenue to pay for it with the assumption that it will be paid for in the future), and inflation (“printing money,” or the artificial...

Read More »

Read More »

After Trump, Then What?

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

In the Aftermath of the $355 Million Ruling Against Trump, Business Owners Are Even Less Safe than Before

Willing buyer and willing seller. These five words form the very basis from which the system of capitalism is based on. You have something you want to sell and if I want to buy it then we either agree or disagree on a price. If we agree then I give you money, take the product, and walk away. And if we disagree then we move on with our days.

In his book, Basic Economics, Samford Professor Thomas Sowell described the role of prices in the economy as...

Read More »

Read More »

Does the Balance of Payments Determine Exchange Rates?

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Javier Milei Understands the Road to Serfdom

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

What Can We Learn from the Latest Pentagon Audit? Both Plenty and Not Much

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The Double-Edged Sword of School Choice

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The “New” South Africa Is Now a Newly-Failed State: Don’t Look for Things to Improve

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

How Governor Whitmer Doomed Detroit Autoworkers

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Highway Robbery Continues to Be the Law of the Land

Seizure fever is toxifying law enforcement across the nation. For more than thirty years, federal, state, and local government agencies have plundered citizens on practically any harebrained accusation or pretext.

You could be at risk of being pilfered by officialdom anytime you sit behind a steering wheel. Between 2001 and 2014, lawmen seized more than $2.5 billion in cash from sixty thousand travelers on the nation’s highways—with no criminal...

Read More »

Read More »

Who Hijacked Our Free Will?

Imagine someone giving a State of the World address that begins with a reminder that people possess free will and ought to be doing a better job of exercising it. This could possibly raise doubts about the speaker’s mental stability—at least until the talk went into the dark details of civilization’s condition.If the state of the world reflects the choices people make, and if those choices are autonomous, originating from within the minds of...

Read More »

Read More »

Is Taiwan a De Facto Sovereign Nation or a Province of the PRC?

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Who Hijacked Our Free Will?

Imagine someone giving a State of the World address that begins with a reminder that people possess free will and ought to be doing a better job of exercising it. This could possibly raise doubts about the speaker’s mental stability—at least until the talk went into the dark details of civilization’s condition.

Read More »

Read More »

Is Taiwan a De Facto Sovereign Nation or a Province of the PRC?

The “One-China” policy assumes Taiwan to be a runaway province. The people of Taiwan, however, see their country as sovereign, and their reasons have merit.

Original Article: Is Taiwan a De Facto Sovereign Nation or a Province of the PRC?

Read More »

Read More »

What Can We Learn from the Latest Pentagon Audit? Both Plenty and Not Much

Another Pentagon audit, another massive failure. But the Pentagon's problems are not just simple accounting. They reflect the reality of an unaccountable rogue empire that tries to prop up the US empire.

Original Article: What Can We Learn from the Latest Pentagon Audit? Both Plenty and Not Much

Read More »

Read More »