Category Archive: 6b.) Mises.org

Why More Secession Means Lower Taxes and More Trade

[This article is Chapter 9 of Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities.]

When we hear of political movements in favor of decentralization and secession, the word “nationalist” is often used to describe them. We have seen the word used in both the Scottish and Catalonian secession movements, and in the case of Brexit. Often the term is intended to be pejorative.

When used pejoratively—as by the critics of...

Read More »

Read More »

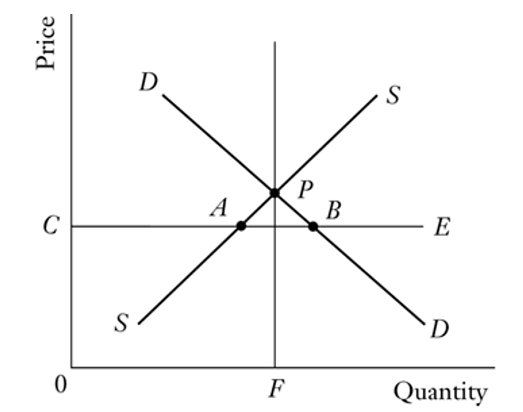

Resurrecting the Failed Policy of Rent Control

It certainly isn’t common to find much agreement between the various authors here at the Mises Institute and our favorite metaphorical punching bag: Paul Krugman. But when it comes to the recently resurrected policy corpse of rent control, we have found a common cause.

As Krugman noted back in 2000,

The analysis of rent control is among the best-understood issues in all of economics, and—among economists, anyway—one of the least controversial. In...

Read More »

Read More »

The Anti-Semitism Controversy on College Campuses Is the Direct Result of Identity Politics

Anyone following the news knows that after a bruising congressional hearing on antisemitism on elite college campuses knows that Liz Magill, the president of the University of Pennsylvania, and Claudine Gay, president of Harvard, recently lost their jobs. while the president from the Massachusetts Institute of Technology is under fire. While the issue is being framed as these presidents permitting (and sometimes encouraging) antisemitism on campus,...

Read More »

Read More »

What an Old Coin Collection Tells Us about Money from the Past

A coin collection can tell a lot about this nation's monetary history, and especially what happened nearly 60 years ago after the government debased U.S. coinage. This history is not having a happy ending.

Original Article: What an Old Coin Collection Tells Us about Money from the Past

Read More »

Read More »

The Escalating Tensions in the Red Sea Are a Bad Omen

On New Year’s Eve, US Navy helicopters in the Red Sea engaged and sank three boats belonging to Yemen’s Houthis, killing ten. According to US Central Command, the boats were attacking a container ship and fired on the helicopters as they responded to the ship’s distress call. The encounter represents a significant escalation that risks forcing a whole new war on the American public and the Middle East.

The Red Sea region has become one of the...

Read More »

Read More »

Mises and Popper on Action

Many years ago, in “The Communist Road to Self-Enslavement” (included in After the Open Society, a collection of Karl Popper’s papers edited by Jeremy Shearmur), I discovered the following sentence: “Like myself, [Ludwig von Mises] appreciated that there was some common ground, and he knew that I had accepted his most fundamental theorems and that I greatly admired him for these.”

As I respect both Popper and Mises as great thinkers, although...

Read More »

Read More »

Good Logic Prevents Bad Regulation

Much onerous and harmful government regulation can be prevented by the application of well-known and well-understood principles of logic. I will use the recent regulations placed upon Americans in response to the so-called pandemic. I refer to the panoply of regulations that government enacted starting in 2020 as the covid control program. Application of proper logic would have eliminated the debate over the possible effectiveness of the...

Read More »

Read More »

The Real Meaning of Inflation and Deflation

[Excerpted from Chapter 17 of Human Action.]

The services money renders are conditioned by the height of its purchasing power. Nobody wants to have in his cash holding a definite number of pieces of money or a definite weight of money; he wants to keep a cash holding of a definite amount of purchasing power. As the operation of the market tends to determine the final state of money's purchasing power at a height at which the supply of and the...

Read More »

Read More »

Reflections on the Rothbard Graduate Seminar

I had the good fortune of attending the Rothbard Graduate Seminar (RGS) twice in succession, during the summers of 2020 and 2021. By that time, I was already quite familiar with the ideas of the Austrian School thanks to the many podcasts and recorded Mises University lectures, among much more, the Mises Institute has made freely available online. However, I likely never would have realized my own understanding of Ludwig von Mises’s economic works...

Read More »

Read More »

Privatizing Roads Solves the Problem of Road Closures

While traveling recently, I was stuck in a terrible bout of traffic. Unbeknownst to me, West Virginia University’s fall graduation just ended, and I was caught in the middle of the seemingly endless stream of parents, relatives, and friends who were leaving the ceremony. To deal with this problem, the City of Morgantown closed down lanes and reserved them for exclusive use by graduation attendees. Though the city may have done a fine job handling...

Read More »

Read More »

When Nationalism Fuels Decentralization and Secession: Lessons from the Cold War

[This article is chapter 6 of Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities. Now available at Amazon and in the Mises Store.]

During the early 1990s, as the world of the old Soviet Bloc was rapidly falling apart, the economist and historian Murray Rothbard saw it all for what it was: a trend of mass decentralization and secession unfolding before the world’s eyes. The old Warsaw Pact states of Poland,...

Read More »

Read More »

Last Day to Give in 2023!

YOUR GIFT WILL HELP US DO MORE IN 2024.

With your gift of $25 or more, you will receive a copy of Joe Salerno's The Progressive Road to Socialism.

Recurring donors of $10 who give $100 will also receive a copy of The Progressive Road to Socialism and renew their Membership through 2024.

DONATE TODAY!

Read More »

Read More »

2023: A Year Reviewed

In this episode, Mark looks back at 2023 as a great year for the goals and prospects of the Mises Institute moving forward, but a very bad year for the State.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Get your free copy of Murray Rothbard's Anatomy of the State at Mises.org/IssuesFree.

Read More »

Read More »

Sound Money Movement Strikes Gold in 2023

Against the backdrop of high inflation rates and geopolitical uncertainty, states are increasingly enacting measures that encourage saving in precious metals and even using gold and silver as money.

With five bills signed into law in 2023, sound money reforms are gaining momentum across the United States.

Money Metals Exchange’s Sound Money Defense League project has emerged as an influential force, actively engaging in legislative battles by...

Read More »

Read More »

Time Is Running Out!

YOUR GIFT WILL HELP US DO MORE IN 2024.

With your gift of $25 or more, you will receive a copy of Joe Salerno's The Progressive Road to Socialism.

Recurring donors of $10 who give $100 will also receive a copy of The Progressive Road to Socialism and renew their Membership through 2024.

Donate today!

Read More »

Read More »

How the American Revolution Turned North American Foreign Trade on Its Head

[Chapter 1 of Rothbard's newly edited and released Conceived in Liberty, vol. 5: The New Republic: 1784–1791.]

After peace came in 1783, the new republic faced a two-fold economic adjustment: to peacetime from the artificial production and trade patterns during the war, and to a far different trading picture than had existed before the war. The largest change between the two eras of peace was the shift in trading patterns resulting from...

Read More »

Read More »

Central Banks Brought Inflation. Now they Bring Stagnation.

Although the Federal Reserve and the European Central Bank’s message regarding interest rate cuts seems clear, reiterating their commitment to reducing inflation, the market is expecting between five and six interest rate cuts, between 125 and 150 basis points, in the next twelve months.

This shows us the bubble bias of many investors. We live in a world where two generations of market participants have only seen rate cuts and massive liquidity...

Read More »

Read More »

Federal Student Loans Drive Up College Tuition Levels

Like every other government program designed to make something “more affordable,” the student loan program has managed to drive college tuition to atmospheric levels and saddle students with massive levels of debt.

Original Article: Federal Student Loans Drive Up College Tuition Levels

Read More »

Read More »

Let them Merge: Foreign Acquisition of US Steel

Nippon Steel's proposal to merge with US Steel is meeting opposition from the usual suspects in Washington, not to mention Tucker Carlson. Their hysteria is off the charts.

Original Article: Let them Merge: Foreign Acquisition of US Steel

Read More »

Read More »

America’s Corn Crop Comes from “Corny” Subsidies

America's famous Corn Belt should better be known as the nation's Subsidy Belt.

Original Article: America's Corn Crop Comes from "Corny" Subsidies

Read More »

Read More »