Category Archive: 6b.) Mises.org

Personal Medical Bankruptcy: Made in DC

One unintended consequence of federal government intervention or regulation of medicine is individuals or families declaring federal bankruptcy for large unpaid medical bills. US healthcare costs and miles to the nearest star is measured in trillions. US healthcare spending reached $4.1 trillion in 2020 according to the most recent data from the Centers for Medicare and Medicaid Services. Americans spent $12,530 per person on medical care in...

Read More »

Read More »

The Fed Doesn’t Know the Natural Rate of Interest

Published in The Wall Street Journal:Mr. Levy describes the Fed’s permanent problem: It doesn’t and can’t know what the natural rate of interest is. Everyone should pity the members of the Federal Open Market Committee, who must inwardly confess that they can’t know the answers, yet have to play their parts in the Fed melodrama nonetheless.Alex J. PollockSenior fellow, Mises InstituteLake Forest, Ill.Appeared in the March 14, 2024, print edition as...

Read More »

Read More »

Self-Ownership and the Right to Self-Defense

Self-defense is an ancient common law right under which necessary and reasonable force may be used to defend one’s person or property. As Sir Edward Coke expressed it in 1604: “The house of every one is to him as his Castle and Fortress as well for defence against injury and violence . . . if thieves come to a man’s house to rob him, or murder, and the owner or his servants kill any of the thieves in defense of himself and his house, it is no...

Read More »

Read More »

Hazlitt Against Keynes on Unemployment and Wages: A Lesson for Modern Macroeconomics

The Failure of the ‘New Economics’ thoroughly demolished the Keynesian system. Unfortunately, this “economic demolition” as Rothbard called it (Hazlitt 2007 [1959], xvi), went ignored by the mainstream despite it carrying implications that would have prevented the decline in theoretical vigor of mainstream economics that was Keynesianism. Hazlitt’s argument against Keynesianism was more than a mere theoretical critique; it was a robust argument...

Read More »

Read More »

“Army Values”

Conservatives are upset that the U.S. Military Academy—West Point—has removed the phrase “Duty, Honor, and Country” from its mission statement.The phrase comes from a farewell address that retired general Douglas MacArthur—who attended West Point from 1899 to 1903—delivered to West Point cadets in 1962. The old mission statement was first formally adopted by the Academy in 1998.The change was announced in a letter from West Point superintendent...

Read More »

Read More »

Shades of Gray

The New Leviathans: Thoughts after Liberalismby John GrayFarrar, Straus and Giroux, 2023; 192 pp.John Gray is a strange case. He is a political philosopher who taught for many decades at Oxford and the London School of Economics, and he has become one of the leading British “public intellectuals.” A friend of the rich and famous, including George Soros, he abandoned long ago the classical liberal beliefs he held in the late 1970s and early 1980s....

Read More »

Read More »

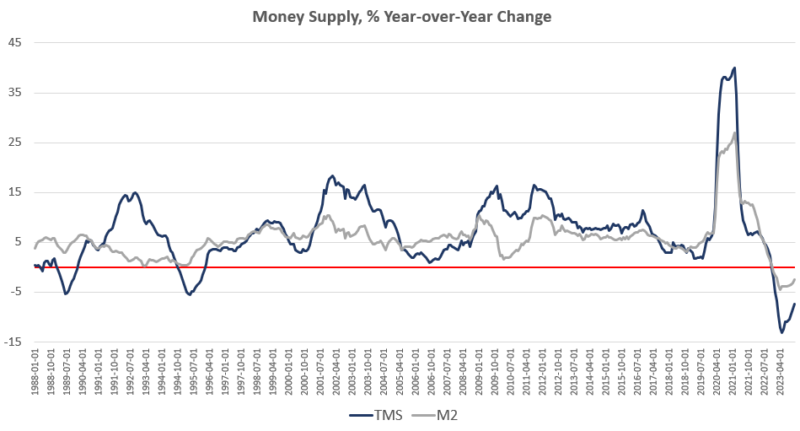

The Money Supply Fell for the Fifteenth Month in a Row as Full-Time Jobs Disappear

Money supply growth fell again in January, remaining deep in negative territory after turning negative in November 2022 for the first time in twenty-eight years. January's drop continues a steep downward trend from the unprecedented highs experienced during much of the past three years.Since April 2021, money supply growth has slowed quickly, and since late 2022, we've been seeing the money supply repeatedly contract, year over year. The last time...

Read More »

Read More »

Bureaucracy: Applying Mises’s Insights to Our Present Day

Human prosperity, contrary to the beliefs of those fanatically obsessed with viewing the government as a savior of humanity, is not guaranteed. For the vast majority of its existence, mankind was impoverished, only recently experiencing unprecedented levels of prosperity and flourishing. This recent state of affairs is not guaranteed to go on forever; its growth could be halted or it could regress the world back to widespread impoverishment if...

Read More »

Read More »

Looking Back at the Crossroads: Liberty or Socialism

Ludwig von Mises begins his book Bureaucracy by declaring that the main issue facing the West in his time was whether man should surrender his liberty to the “gigantic apparatus of compulsion and coercion, the socialist state.” He rephrases: “Should [man] be deprived of his most precious privilege to choose means and ends and to shape his own life?”This question is imminently pressing in the modern day as well, save that we in the West, eight...

Read More »

Read More »

New Video: A Lecture on State Militias and the Second Amendment

Power & Market offers a contrarian take on world events. We favor individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Connect to Power & Market via Twitter and RSS.Power & Market is published CC4, unless denoted otherwise.

Read More »

Read More »

The Economics of the AI Revolution

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Free Markets and the Antidiscrimination Principle

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The Great Depression and Great Depression II: Similarities, Differences

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

The Folly of Rent Control in New York City (Again)

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Be on the Lookout for These Lies in Biden’s State of the Union Address

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Understanding the AI Revolution

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

Separating Information from Disinformation: Threats from the AI Revolution

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

No, There Is Not a Perfect Open Border System between the States

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

A Tale of Two Bureaucracies

Ludwig von Mises is known for his theory of the business cycle and his development of praxeology, but he is best known for discrediting socialism. This critique is found in Economic Calculation in the Socialist Commonwealth (Mises 1990) and Socialism: An Economic and Sociological Analysis (Mises 1951). In a similar vein is a work written near the end of the Second World War: Bureaucracy (Mises 1944). Mises observed shifts away from the market...

Read More »

Read More »

Bureaucracy and Grove City College: How One College Resisted the Bureaucratization of Higher Education

In the last section of his Bureaucracy, Ludwig von Mises laments the loss of the “critical sense” that protected people from authoritarianism (Mises 1944, 108). According to Mises, this was the fault of the bureaucratization of education, which taught students falsehoods, especially in economics (Mises 1944, 82). A prime example was the academic class in the German Empire, which formed an “intellectual bodyguard” (Mises 1944, 82) of the empire’s...

Read More »

Read More »