Category Archive: 6b.) Mises.org

Caitlin Clark, Bullying and the Business of Basketball

Why do people watch sports? My mother believes it’s because “people want to be uplifted.” This may explain why many are upset about how basketball phenom Caitlin Clark, who broke the National Collegiate Athletic Association (NCAA) women’s and men’s scoring records, is being treated—or mistreated—in the Women’s National Basketball Association (WNBA).

Read More »

Read More »

Who Needs the Fed?

This article appears as a full-page ad in the Wall Street Journal today, June 24, 2024, and was made possible by one of our generous donors:Perhaps nothing in financial news receives more attention than an announcement from the Federal Reserve. About eight times per year, the Federal Reserve’s Federal Open Market Committee meets to formally decide and announce its plans for monetary policy. Every announcement has the potential to cause a rally, or...

Read More »

Read More »

The American Empire

[The following is a condensation of Garet Garrett’s pamphlet The Rise of Empire, published in 1952, and included in his collection The People’s Pottage (Caldwell, ID: Caxton Printers, 1953).]We have crossed the boundary that lies between Republic and Empire. If you ask when, the answer is that you cannot make a single stroke between day and night; the precise moment does not matter. There was no painted sign to say: “You now are entering Imperium.”...

Read More »

Read More »

Why Consumer Sentiment Fell To A Seven-Month Low

The University of Michigan Consumer Sentiment Survey plummeted to its lowest level in seven months. The index reading for June came in at 65.6, down from 69.1 in May and under the consensus expectation of 72. In the current conditions and expectations categories, the survey fell below economists’ expectations.Year-ahead inflation expectations were unchanged this month at 3.3%, but above the 2.3–3.0% range seen in the two years prior to the...

Read More »

Read More »

Harry Frankfurt, Humbug, and the Battle against Wokery

Although Harry Frankfurt was not a libertarian, his critique of egalitarianism reflects the principles of liberty. Frankfurt argued that “economic equality is not, as such, of particular moral importance” and that “if everyone had enough, it would be of no moral consequence whether some had more than others.” This has been described by David Gordon asan argument that most people who read Mises Institute articles will know already. In brief, the...

Read More »

Read More »

Democracy Is Not the Same Thing as Freedom

In our modern world, most states are democracies or at least call themselves “democratic.” The adoption of democracy is hailed as one of humanity’s greatest achievements. Once upon a time, humanity broke out of the shackles of monarchies and has never looked back since. Nowadays, all citizens in democratic countries are free and safe from despots. Except, that is far from the truth.Democratic systems have been around for a long time. Ancient Greece...

Read More »

Read More »

The Oklahoma City Curse, Skyscraper Edition

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Private Property Comes from Scarcity, Not Law

Property is a key economic principle for markets to operate and their participants to live in harmony with one another. But as with so many things in the modern age, the scene (and accompanying meme) from the 1987 movie The Princess Bride applies: “You keep using that word; I do not think it means what you think it means.”To the Marxian, property means unjust hoarding of resources. Most Americans think of their houses. To Murray Rothbard and many...

Read More »

Read More »

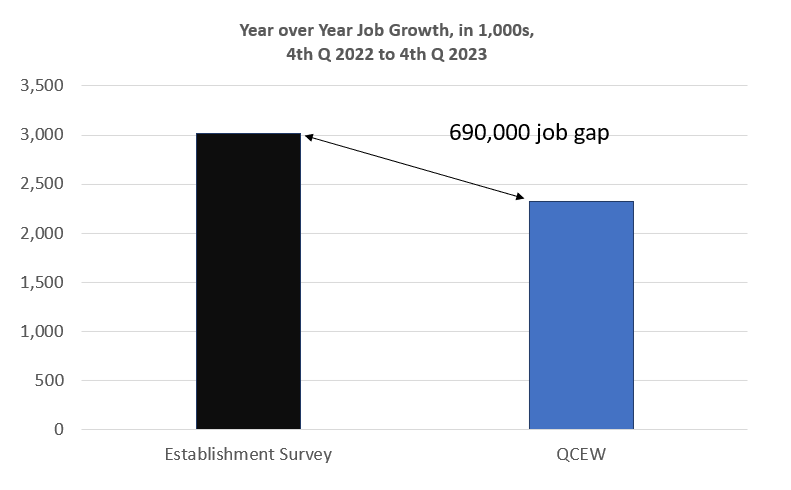

The Establishment Survey Overestimated Job Creation by nearly 700,000 in 2023

Yesterday, we looked at how the Business Employment Dynamics (BED) report showed job losses last year while the much-reported and much-touted monthly Establishment survey report showed “blowout” job gains throughout most of the year. Indeed, over the past year, the Establishment survey has repeatedly showed considerably more job growth than both the BED report and the Household survey. Another source we can now consider is the Quarterly Census of...

Read More »

Read More »

What Price Charity?

Ludwig von Mises tries in Human Action to reconcile two arguments about charity that pull in opposite directions. The first of these is that some people cannot survive without receiving help: unless they are guaranteed such help by law, they are dependent on charitable donations from the better-off.Within the frame of capitalism the notion of poverty refers only to those people who are unable to take care of themselves. Even if we disregard the...

Read More »

Read More »

What Price Charity?

Ludwig von Mises tries in Human Action to reconcile two arguments about charity that pull in opposite directions. The first of these is that some people cannot survive without receiving help: unless they are guaranteed such help by law, they are dependent on charitable donations from the better-off.Within the frame of capitalism the notion of poverty refers only to those people who are unable to take care of themselves. Even if we disregard the...

Read More »

Read More »

How People Can Better Fight Inflation

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Lesson of the Trump Conviction

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Unsustainable AI-Driven Lending Boom

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Biden Administration Uses Fudged Numbers to Justify Imposing Punitive Regulations

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

From Profits to Pandering: How Government Turned Universities and Businesses into DEI Bureaucracies

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Do You Know Who’s Hitting You?

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Socialist Road to Destruction amid So-Called Good Intentions

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Menace of Political Show Trials

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Why the Scottish “Free Banking” Episode Doesn’t Justify Fractional Reserves

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »