Category Archive: 6b.) Mises.org

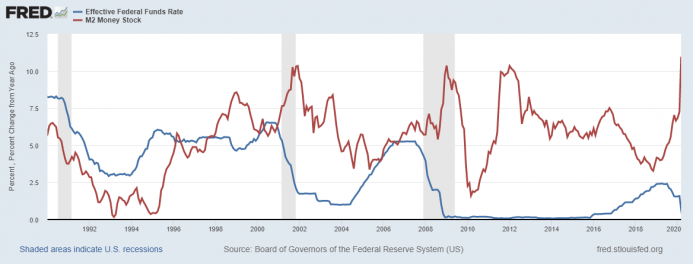

Money Supply Growth in April Ballooned to a New High

Fueled by unprecedented quantitative easing, central bank asset purchases, and various stimulus packages, the money supply growth rate ballooned in April to an all-time high. The growth rate has never been higher, with the 1970s as the only period that comes close. It was expected that money supply growth would surge in recent months. This usually happens in the wake of the early months of a recession or financial crisis.

Read More »

Read More »

How Words Like “Essential” and “Need” Are Abused by Politicians

Over the years, one of the most common trump cards used to justify government treating people differently, rather than equally, has been the word need. And when used to override individuals’ ownership of themselves and what they produce, its usage has created confusion rather than clarity. In public discussion, “need” has increasingly morphed into one of its synonyms—essential, as in “essential jobs.” But it still suffers from many of the same...

Read More »

Read More »

How Central Banks and Lockdowns Are Making the Crisis Worse

What typifies the phenomenon of the boom-bust cycle is that it is recurrent. What is the reason for this? Loose monetary policies set the platform for various activities that would not emerge without the easy monetary stance. What loose monetary policy does here is to engineer the transfer of real savings from wealth generating activities to artificially stimulated activities, which we can label as bubble activities.

Read More »

Read More »

Crisis or Opportunity? To Politicians, It’s the Same Thing

Forget performing William Shakespeare’s Macbeth. The real art form is politicking. They sport taxpayer-funded windbreakers, speak with authority and urgency, and lead a brigade of specialists. When a crisis unfolds, whether it is a hurricane or a virus outbreak, politicians stand before the cameras, appearing to be in control of the situation—but they see an opportunity.

Read More »

Read More »

How Bad Is It?

How bad is it? That is the question on everyone's mind as we come to grips with the economic carnage caused by global economic shutdowns, supply chain disruptions, and ongoing quarantines of million of people. Do we face another Great Depression, or simply a deep recession more like 2008? And equally important, are soft Americans prepared for either? Have we started to process all of this psychologically?

Read More »

Read More »

Ludwig von Mises & “Circulation Credit” Theory of the Trade Cycle

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] Starting with Carl Menger’s undisputed role in the “marginal revolution,” which ushered in subjective value theory, the Austrian school has made important contributions that have been absorbed into standard economic theory.

Read More »

Read More »

More Protectionism and Regulation Won’t Fix the Economy

In the wake of the COVID-19 pandemic and its attendant economic strains, some protectionists and anti-immigration ideologues are trying to take advantage of this opportunity to advance their nationalist agenda. They argue that if the United States had restricted international trade and immigration more thoroughly in the past, as President Trump had fought to achieve, the public health crisis could have been curtailed.

Read More »

Read More »

Three Reasons Why the Eurozone Recovery Will Be Poor

The eurozone economy is expected to collapse in 2020. In countries such as Spain and Italy, the decline, more than 9 percent, will likely be much larger than in emerging market economies. However, the key is to understand how and when the eurozone economies will recover.

Read More »

Read More »

How the Corona Crisis Differs from the 2008–2009 Financial Crisis

There are several important differences between the global financial crisis of 2007–08 (GFC) and the coronavirus crisis (CC). Origin and Nature of the Crisis. The GFC resulted from financial imbalances, primarily the housing bubble, while the CC was triggered by the external negative shock (the pandemic and the following economic shutdown) that dramatically reduced the labor supply.

Read More »

Read More »

When Governments Switched Their Story from “Flatten the Curve” to “Lockdown until Vaccine”

In the early days of the COVID-19 panic—back in mid-March—articles began to appear pushing the idea of "flattening the curve" (the Washington Post ran an article called "Flatten the Curve" on March 14). This idea was premised on spreading out the total number of COVID-19 infections over time, so as to not overburden the healthcare infrastructure.

Read More »

Read More »

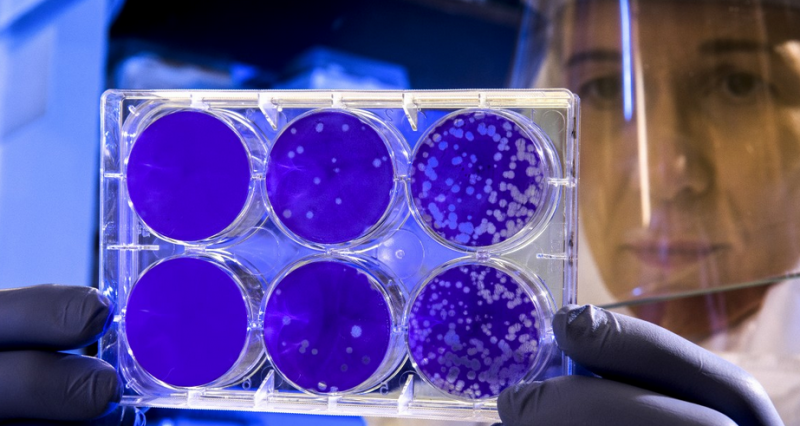

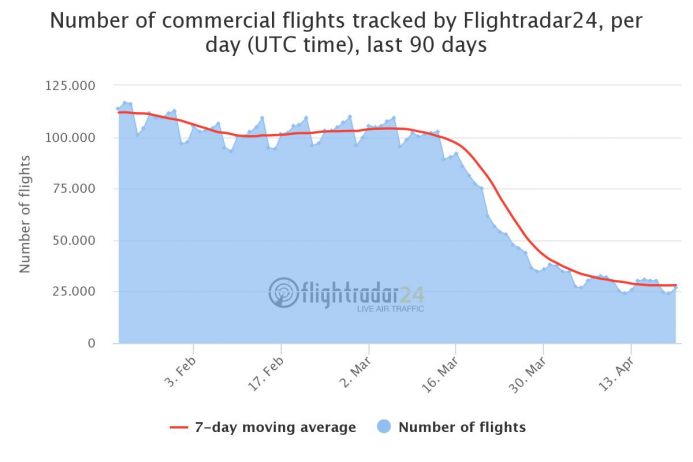

The Global Airline Industry Is in Even Worse Shape Than You Think

The economic impact of the COVID-19 pandemic has reached all productive sectors. The massive spread of the virus and social distancing measures have led to a dramatic decrease in economic activity. The aviation industry, vital for tourism and business, has been hit hard. Investors and analysts state that this crisis could be worse than the one that followed the SARS outbreak in 2003 and the one after 9/11.

Read More »

Read More »

Police Are Complicit in Politicians’ Disregard for the Rule of Law

People of a certain age might remember the old John Birch Society slogan "Support your local police!" The idea here is that your local policeman is a liberty-loving buddy of yours who would only ever support just laws and constitutional mandates. Only those bad guys in the FBI or BATF would ever consider violating your rights.

Read More »

Read More »

Some Insightful Entrepreneurs Planned for a Pandemic

Listen to the Audio Mises Wire version of this article. Does a pandemic trump entrepreneurial foresight? Many in business will say yes, “nobody saw this coming.” Lack of customer demand and government lockdowns are “no fault of their own.”

But Penny Chutima, co-owner of the Lotus of Siam restaurant, did see it coming. Chutima and her mother, Saipin, have operated the off-Strip Las Vegas staple for years.

Read More »

Read More »

Be Thankful for Those Who “Only Do It for the Money”

At least since I first read George Orwell’s Politics and the English Language, I have been a student of the use of weasel words. I have joined what he called the “struggle against the abuse of language,” because “Political language…is designed to make lies sound truthful…and to give an appearance of solidity to pure wind.”

Read More »

Read More »

Money Creation – Not Low Interest Rates – Is Behind the Boom-Bust Cycle

In a recent article entitled “Where Are All the Austrian Scholars' Yachts?” John Tamny has criticized Austrian economists, and Mark Thornton in particular, for their skepticism regarding the relatively “ebullient stock market” in the midst of the pandemic. Mark Thornton responded to Tamny’s main argument in an earlier post. In this post, I will address two serious errors that underlie Tamny’s argument.

Read More »

Read More »

Politicians Have Destroyed Markets and Ignored Human Rights with Alarming Enthusiasm

An economic cataclysm has been unleashed upon the world by Western politicians and bureaucrats. Unbelievably, economic activity in the West has slowed to a creep, as entire populations have been confined to their homes for weeks, if not months. As a result, millions have had their lives turned upside down. Most entrepreneurs and self-employed persons have had their livelihoods jeopardized.

Read More »

Read More »

Decades of Productivity Gains Have Made Our Debt Bomb Manageable (For Now)

Listen to the Audio Mises Wire version of this article. Listening to the news, you might have the impression that its Christmas and the government is Santa Claus. Under legislation recently introduced in Congress, Americans over the age of sixteen would receive $2,000 per month for at least six months. This follows the government’s $1200 giveaway in progress.

Read More »

Read More »

Why the Current Unemployment Is Worse Than the Great Depression

Government restrictions on production are driving prices up as unemployment drives them down. It's impossible to say now whether price inflation or price deflation will be the predominant factor in the crisis's next phase.

Read More »

Read More »

Government Regulation against “Monopolies” Only Lowers Our Standard of Living

According to a popular way of thinking, monopolies undermine the efficient functioning of the market economy by being able to influence the prices and the quantity of products. Consequently, this undermines the well-being of individuals in the economy. By this way of thinking, the inefficiency emerges because of the deviation from the ideal state of the market as depicted by the “perfect competition” framework.

Read More »

Read More »

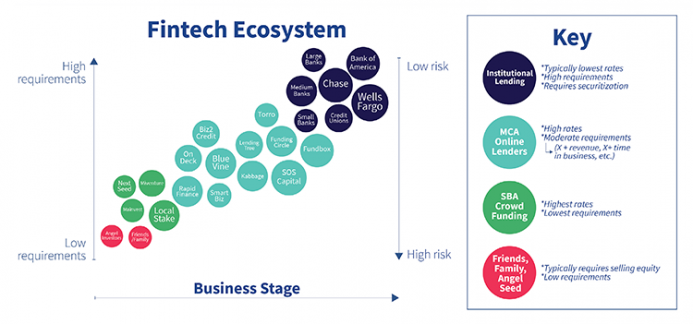

Dusty Wunderlich on FinTech Financing: Entrepreneurs Helping Entrepreneurs

Key Takeaways and Actionable Insights. Consider these findings from a 2017 report from the G20 Global Partnership For Financial Inclusion, titled Alternative Data: Transforming SME Finance.

Read More »

Read More »