Category Archive: 6b.) Mises.org

New Jersey Eliminates Sales Taxes on Gold and Silver

Sound money advocates are today (September 12, 2024) hailing their hard-fought victory today as New Jersey’s Senate Bill 721 was signed into law—thereby removing sales taxes on purchases of gold, silver, and other precious metals above $1,000 effective January 1, 2025.The long-anticipated bill signing by Gov. Phil Murphy positions New Jersey, alongside 44 other states, that recognize the importance of exempting constitutional sound money from...

Read More »

Read More »

Enough Already: Stop Provoking Russia

Like many people, I eagerly await Scott Horton’s upcoming book, Provoked, which will explain in detail the US provocations that led to Russia’s invasion of Ukraine. But will it come too late?Since the Russia-Ukraine war began, the Biden administration, in collaboration with the Ukrainian government and much of Europe, has continued incessantly provoking Putin toward a wider conflict with the West. One can recognize the dangerous path we tread...

Read More »

Read More »

Economically-Illiterate Policy Proposals Are Popular, And Economists Are to Blame

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Against the Hamiltonian Statecraft

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

What Does ChatGPT Know about Money?

Given the contentious topic of money and its influence on the world, I decided to see what ChatGPT “knows” about it. I was surprised by the breadth of its responses, as well as its information on free market positions, especially those of the Austrian school.Though my prompts (queries) were exactly as I present them here, ChatGPT was so expansive I had to edit its results due to article length restrictions. For emphasis and to mark subject headings...

Read More »

Read More »

Why the Family Is Not the Model for the State

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Understanding the Real Costs of Slavery: It’s Not Cheap labor

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

New “Engels” on Marx

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Do Financial Markets Immediately Provide All Relevant Information?

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Vampire Fiat Money System: How It Works and What It Means for Your Wealth

Who doesn’t know them: the blood-sucking vampires, the eerie undead, immortalized in countless films, and inspired primarily by Bram Stoker’s novel Dracula (1897). Just think of iconic movies like the silent film Nosferatu – A Symphony of Horror (1922), Dracula (1958) with Christopher Lee, Roman Polanski’s parody The Fearless Vampire Killers (1967), or Nosferatu – Phantom of the Night (1979), starring Klaus Kinski as Count Dracula. Vampires are...

Read More »

Read More »

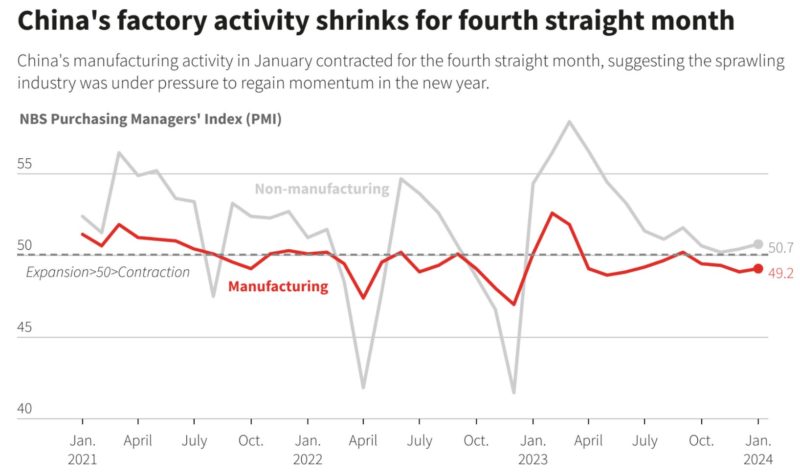

China on the Edge of Recession

China is on the edge of recession — excluding Covid, for the first time since 2008 — as new data showed all-important manufacturing contracted for the fourth month in a row with particular weakness in new orders.In other words, what they’ve got is a backlog, then it’s a cliff.Manufacturing makes up a third of China’s economy — much more than the US. The collapse of China’s property — another third of China’s economy — is adding further fuel to the...

Read More »

Read More »

No, Russia is Not Losing the War in Ukraine: A Reply to Paul Schwennesen

On September 5th, Reason Magazine published a very strange assessment of the war in Ukraine, written by Paul Schwennesen, titled “The War in Ukraine Is Already Over—Russia Just Doesn’t Know it Yet.” In short, Schwennesen argues that, based on his experience recently traveling to the front in Kursk Oblast, Ukrainian will and high morale mean that the war is as good as over and that Ukrainian triumph is “inevitable.”Schwennesen’s analysis that Russia...

Read More »

Read More »

The Comic Absurdity of a US Sovereign Wealth Fund

In recent weeks, both candidate Donald Trump and President Biden—via his staff—have expressed support for the idea of a US sovereign wealth fund (“SWF”). An SWF is simply an investment fund run by a national government. Ostensibly, the goals of such a venture are twofold—to increase the wealth of America and its citizens, and to spur innovation in “critical” areas like infrastructure, technology, and medicine.An American SWF is bound to fail on at...

Read More »

Read More »

Economically-Illiterate Policy Proposals Are Popular, And Economists Are to Blame

According to a recent poll from the Wall Street Journal, many of the policies proposed by Kamala Harris and Donald Trump that economists hate most are very popular with the American public. For example, the plan endorsed by both candidates to eliminate taxes on tips for service workers is favored by nearly 80 percent of the ordinary public. However, only 10 percent of economists support the measure.A similar difference can be found with Harris’s...

Read More »

Read More »

The Fed Cut the Interest Rate to Bail Out the Treasury

The Federal Reserve decided to cut rates by 50 basis points despite what Chairman Powell considers “no risk of a recession or downturn,” a “solid economy,” and a “strong job market.”After ignoring the impact of monetary aggregates and the warning signs of inflation, the Federal Reserve has breached its price stability mandate for three consecutive years, preferring to prioritize liquidity injections, i.e., printing money, to the recovery of the...

Read More »

Read More »

Thanks to Our Fall Campaign Donors

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Covid Tyrants Partied While Demanding Lockdowns for Everyone Else

Remember when government officials sanctioned orgies but insisted it was too risky to permit children to attend classes to learn how to read?During the pandemic, New York City Covid Czar Jay Varma championed endless government restrictions and lockdowns to keep people safe. But, at the same time, he attended sex parties and a dance party, indulgences that made a mockery of everything he preached to New Yorkers. His hypocrisy was exposed this week...

Read More »

Read More »

Covid Czar Scandal Is Reminder of Boundless Idiocy and Hypocrisy of the Covid Regime

Remember when government officials sanctioned orgies but insisted it was too risky to permit children to attend classes to learn how to read?During the pandemic, New York City Covid Czar Jay Varma championed endless government restrictions and lockdowns to keep people safe. But, at the same time, he attended sex parties and a dance party, indulgences that made a mockery of everything he preached to New Yorkers. His hypocrisy was exposed this week...

Read More »

Read More »

Washington’s Ukraine Obsession is Going to Get Us All Killed!

Last week the world narrowly escaped likely nuclear destruction, as the Biden Administration considered Ukraine’s request to allow US missiles to strike deeply into Russian territory. Russian president Vladimir Putin warned, as the request was being considered, that because these missiles could not be launched without the active participation of the US military and NATO, Russia would consider itself in a state of war with both NATO and the US...

Read More »

Read More »

Does Technical Knowledge by Itself Drive Economic Growth?

Some have argued that new technological ideas, unlike material inputs and labor, are not in themselves scarce. Consequently, it is further argued that new ideas for more efficient processes and new products can make continuous economic growth possible. So-called experts, however, are of the view that in a fully competitive environment, firms are likely to be concerned that competitors are going to copy any innovations they introduce. Therefore, it...

Read More »

Read More »