Category Archive: 6b.) Claudio Grass

“Gold is Money, Everything Else Is Credit” – J.P. Morgan

By now it is probably obvious, even to the most naive of mainstream narrative followers, that we are well past the point of no return on many fronts. Politics, on a national and global level, are never getting back to “normal”, the economy is already knee-deep in a severe recession, while social frictions and public discontent with governments, institutions and all kinds of rulers and central planners is on a sharp and dangerous trajectory.

Read More »

Read More »

Unless the US stops printing money, the dollar will collapse

Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about?

Read More »

Read More »

BFI Special Report “On the Brink of a New Era – Are You Prepared?”

A “Swiss Conversation” with Frank R Suess, Founding Partner and Chairman of BFI Capital Group in Switzerland and Claudio Grass

Read More »

Read More »

“Unless the US stops printing money, the dollar will collapse.”

We’re less than two weeks away from the US election, and yet this sense of utter confusion, bitter political conflict, and economic uncertainty that has been ominously hovering over the nation, as well as the rest of the world, doesn’t seem to have subsided.

Read More »

Read More »

US election: Red flags for investors

Outlook and wider impact. As showcased during the debates and in the entire campaign rhetoric, politicians in the US but also in Europe, are solely focused on promoting solutions that only serve to paper over the problems and address the symptoms of the disease.

Read More »

Read More »

Tyrants Are Waging War Against Their Own Citizens

As [D] Mayor de Blasio shuts down schools and restaurants in NYC yet AGAIN, and as cops in Australia arrest women on beaches for traveling outside of 5 KM from their homes, it’s clear that tyrants around the world are openly waging war against their own people. Claudio Grass joins me to discuss.

Read More »

Read More »

TYRANTS ARE WAGING WAR AGAINST THEIR OWN CITIZENS Claudio Grass

If you are afraid of being called a conspiracy theorist, then those words are having their intended effect. I will not censor myself to appeal to the Normie McNormiesons of the world. Yes, sometimes I theorize about conspiracies. And guess what? So do you! Now let's discuss some evidence, shall we?

Read More »

Read More »

We don’t have to kill the king, if we just can ignore the king

“The right of self-determination in regard to the question of membership in a state thus means: whenever the inhabitants of a particular territory, whether it be a single village, a whole district, or a series of adjacent districts, make it known, by a freely conducted plebiscite, that they no longer wish to remain united to the state to which they belong at the time, but wish either to form an independent state or to attach themselves to some...

Read More »

Read More »

People Are Waking Up To [DS] Events, The [DS] World Control Agenda Is Failing

?People Are Waking Up To [DS] Events, The [DS] World Control Agenda Is Failing | Claudio Grass?

Read More »

Read More »

“The U.S. economy felt like a balloon in search of a needle” – Part II

In this surreal policy environment, how has the role and the investment process of the value investor evolved, especially over the last decade? How can one still identify value in a world of subsidized binge borrowing, extreme indebtedness, and stock buybacks?

Read More »

Read More »

People Are Waking Up To [DS] Events, The [DS] World Control Agenda Is Failing

Claudio discusses the virus event. That the people are not buying it anymore, the hospitalization rate is close to zero, the death rate is close to zero and this less harmful than the flu. The [DS] is now pushing their agenda for total control, but the people are waking up and the people are banning together. Claudio also discusses on how the [CB] are using the crisis to cover up the global economy implosion. Gold will continue to move up, but the...

Read More »

Read More »

“The U.S. economy felt like a balloon in search of a needle” – Part I

As we move deeper and deeper into this covid crisis, more and more people understand that there’s a lot more to fear besides the disease itself. As the economic impact and the full scale of the damage caused by the lockdowns and the shutdowns become undeniable, there are too many questions lacking any sort of convincing answer and the future for so many employees, business owners, investors and ordinary savers seems bleak and uncertain.

Read More »

Read More »

You cannot print your way to prosperity – Part II

Looking at the damage inflicted upon supply chains, production facilities and global trade in particular, how quickly could these operations snap back even if all COVID-related restrictions were lifted tomorrow? Do you think we’ll eventually get back to business as usual, or have we now experienced a permanent shift to a “new normal”?

Read More »

Read More »

Gold Doing What It Does Best (Part II): Claudio Grass

Https://rebrand.ly/rawealthpartners1

Sign up Now

Gold Doing What It Does Best (Part II): Claudio Grass , Keyword

Beyond economics While the economic forces that drive this rush to precious metals are clearly understandable, there are other, deeper and less obvious factors that must also be taken into account. This “fear of uncertainty”, which pushes demand for gold higher as it has done so many times in the past, is different this time. It goes...

Read More »

Read More »

Gold doing what it does best – Part II

While the economic forces that drive this rush to precious metals are clearly understandable, there are other, deeper and less obvious factors that must also be taken into account. This “fear of uncertainty”, which pushes demand for gold higher as it has done so many times in the past, is different this time.

Read More »

Read More »

A blueprint for a European superstate

After intense negotiations, long days and nights of clashes and a distinctly sour note underlying the entire summit, European Union leaders finally agreed on an unprecedented 1.82 trillion-euro ($2.1 trillion) budget and COVID recovery package.

Read More »

Read More »

Is the West repeating India’s mistakes?

Following the publication of our last conversation with Jayant Bhandari, I received a lot of interesting feedback and remarks. The common denominator of all those comments was the astonishment of many Western readers at the real conditions and dynamics on the ground in India.

Read More »

Read More »

War on poverty, or just war on the poor?

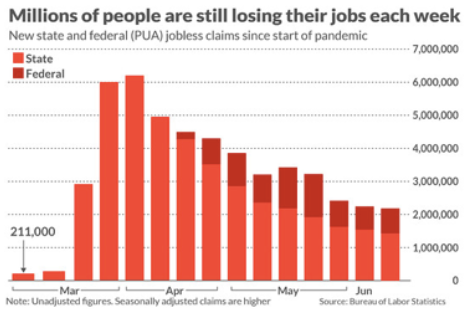

As the dust is now begging to settle, both from the heights of the COVID panic and from the riots that shook the western world, we are starting to get an idea about where we stand after this unprecedented and tumultuous time.

Read More »

Read More »

Claudio Grass – The Great Economic Collapse Waiting For The World

We are all affected in some way by the crisis we are experiencing. There is an unfinished crisis process waiting for the world. Will we be affected more by both the pandemic and the entire economic crisis?

SUBSCRIBE For The Latest Issues About ;

#useconomy2020

#economynews

#useconomy

#coronaviruseconomy

#marketeconomy

#worldeconomy

#reopeneconomy

#openeconomy

#economynews

#reopeningeconomy

#globaleconomy

#silverprice

#stockmarket

#recession...

Read More »

Read More »