Category Archive: 6b.) Claudio Grass

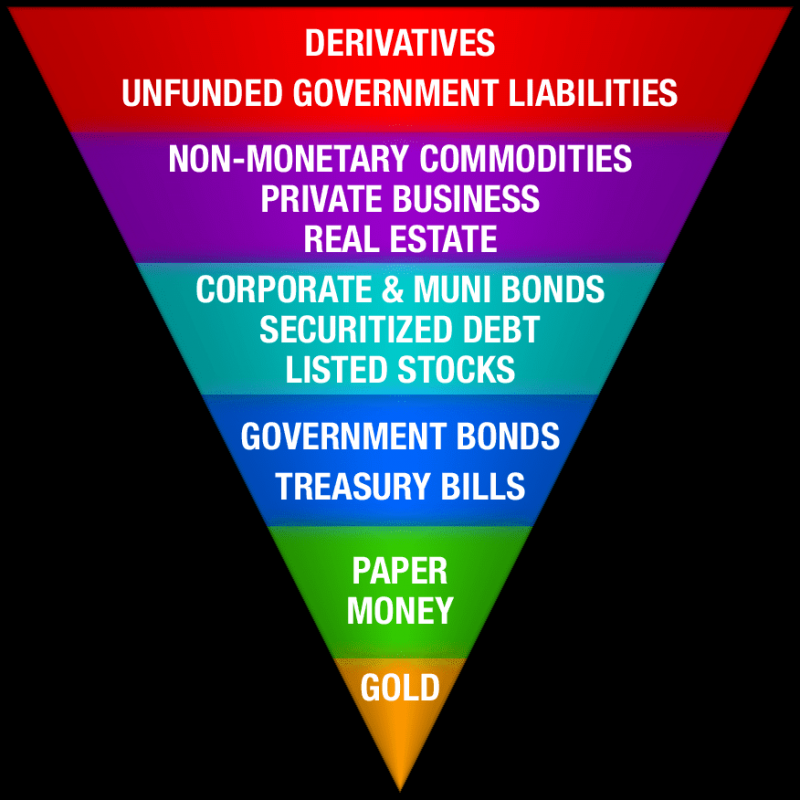

Gold is the secret knowledge of the financial universe

Every seasoned gold investor and every student of monetary history has likely stumbled upon various theories about institutional manipulation of the gold market. While it is true that rarely is there smoke without fire, it is still important to approach this matter rationally and form opinions based on sound evidence and solid research.

Read More »

Read More »

THE PENALTY FOR SAVING

In previous articles, we have outlined in great detail the many faults of the current monetary policy direction of major central banks and the large-scale economic impact of keeping interest rates artificially low. Among the worst offenders is the ECB, that is unapologetically persistent on continuing this exercise in absurdity that are negative interest rates.

Read More »

Read More »

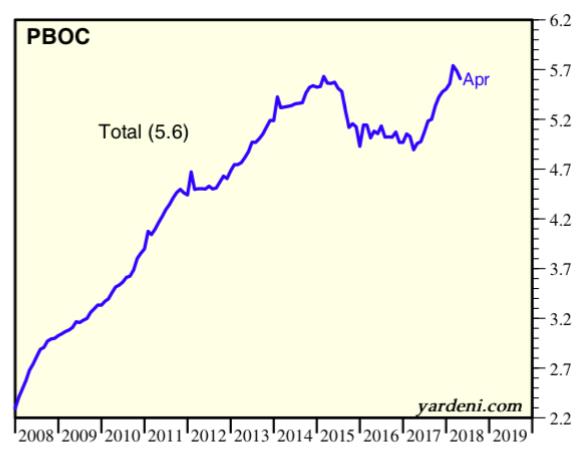

THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck. Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert in the development of...

Read More »

Read More »

SOUND MONEY: A BIBLICAL PERSPECTIVE – PART II

The value of silver and gold is given by their own nature. Neither gold nor silver has value expressed in other units of account. Their value is expressed directly in their own weights. Everything else that is valuable (other assets, commodities, goods, services, or performed labor) is measured against a certain weight of these metals. In other words, the value of gold and silver is assigned by their own nature, while the value of a transaction is...

Read More »

Read More »

Sound money: A Biblical perspective – Part I

In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of Enlightenment roughly 200 years ago. In the words of Immanuel Kant:

Read More »

Read More »

Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for $10 billion.

Read More »

Read More »

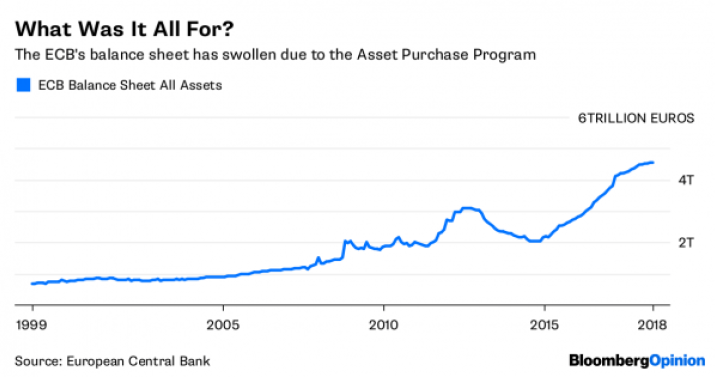

ECB: running out of runway – Part II

Overall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms.

Read More »

Read More »

ECB: running out of runway – Part I

At the end of January, only a month after the official end of the QE program of the European Central Bank (ECB), its President Mario Draghi told the European Parliament’s committee that the central bank could resume its bond purchasing, in a questionable effort to assuage concerns over the impact of the policy change.

Read More »

Read More »

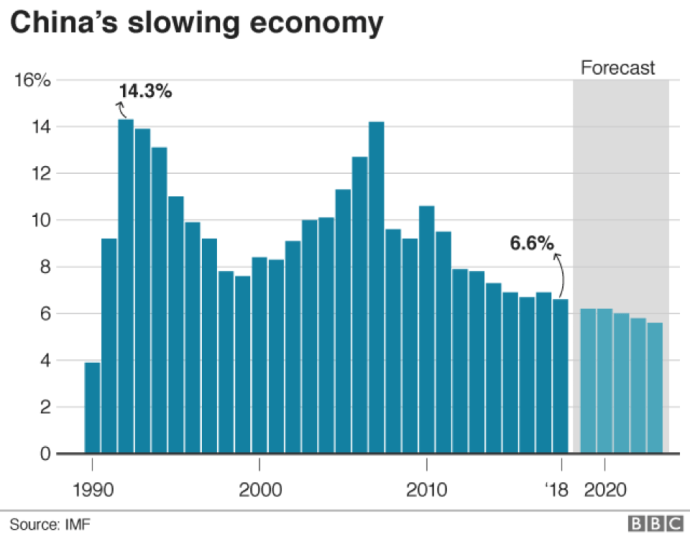

China: Harbinger of Global Economic Decline

The latest numbers released by China’s statistics bureau fueled widespread concerns about the outlook of the global economy, as the Asian superpower reported its slowest growth rate since 1990. The figures showed a 6.6% growth for 2018, confirming the view that the growth engine of the world economy is running out of steam.

Read More »

Read More »

Claudio Grass: Blockchain und Internetreformation (ef-Zukunftskonferenz 2019, Teil 8)

Claudio Grass: Zukunft der persönlichen Freiheit – Blockchain und Internetreformation ef-Konferenz 2019 – Postsozialismus Dieses Video wird für Sie bereitgestellt vom Portal eigentümlich frei. Bitte unterstützen Sie unsere alternative Medienarbeit durch ein Abonnement von eigentümlich frei über ef-magazin.de. Helfen Sie uns, die frohe Botschaft auch mit vielen weiteren Videos zu verbreiten: Politik ist nicht die …

Read More »

Read More »

MUST WATCH – BANKERS FREAKING OVER BITCOIN – Claudio Grass

Bitcoinkurs für Anfänger: https://goo.gl/x51gy4 #MUST #WATCH #- #BANKERS #FREAKING #OVER #BITCOIN #- #Claudio #Grass

Read More »

Read More »

Claudio Grass – Sound Money & Human Liberty Are Inextricably Linked

SBTV speaks with Claudio Grass, an independent precious metals adviser based in Switzerland. A proponent of sound money and the Austrian School of Economics, Claudio shares his convictions on why human liberty and sound money are inextricably linked. Claudio’s website: http://claudiograss.ch Discussed in this interview: 02:39 Relationship between liberty and sound money 06:51 Keynesian view …

Read More »

Read More »

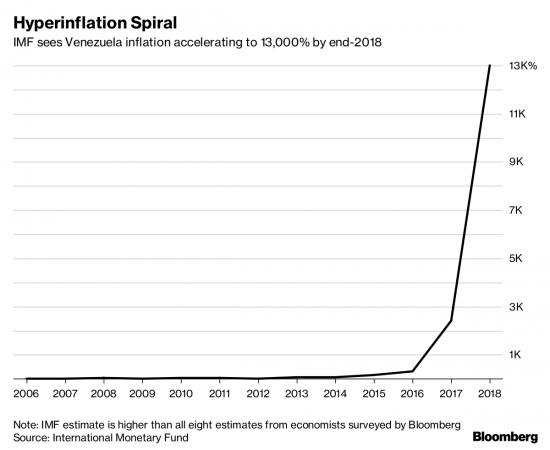

Venezuela: when fiat money reaches its intrinsic value

Over the last years, Venezuela has become a modern poster child for the failure of socialism and with good reason. It offers an abundance of lessons and stern warnings for many western nations, but it also provides a very insightful and relevant reminder for individual investors too.

Read More »

Read More »

Global Censorship Agenda – Can Humanity Retain Its Free Speech? Claudio Grass Interview

Subscribe to our Free Financial Newsletter: Crush The Street TOPICS IN THIS INTERVIEW: 01:00 Widespread internet censorship and the agenda 05:00 Can humanity be silenced by giant tech corporations? 08:30 Trump’s economy in 2018 and beyond 15:30 Gold preserving the wealth of the Middle Class 20:15 What is Bitcoin pathing the way for? 24:35 Where …

Read More »

Read More »

Wealth Moving East, Dollar Reset Imminent w/ Claudio Grass Part 2

Source: https://www.spreaker.com/user/transformationtalkradio/wealth-moving-east-dollar-reset-imminent Part 2: This is a two part show with Claudio Grass, an Ambassador for the Mises Institute, and long time citizen of Switzerland. He joins the program to first discuss how Switzerland is unique as the world’s closest state to having a direct democracy. Part 2 we switch topics into global economics and …

Read More »

Read More »

Switzerland: Model of Freedom & How the NWO Uses Them w/ Claudio Grass – Part 1

Source: https://www.spreaker.com/user/transformationtalkradio/switzerland-model-of-freedom-how-the-nwo Part 1: This is a two part show with Claudio Grass, an Ambassador for the Mises Institute, and long time citizen of Switzerland. He joins the program to first discuss how Switzerland is unique as the world’s closest state to having a direct democracy. Part 2 we switch topics into global economics and …

Read More »

Read More »

A Fake Brexit and the “Noble Dream” – Claudio Grass Speaks With Godfrey Bloom

Introductory Remarks: The “Anti-Politician” Godfrey Bloom, by PT

Most of our readers will probably remember former UKIP chief whip and European Parliament representative Godfrey Bloom. As far as we know, he is the only politician who ever raised the issue of the workings of the fractionally reserved central bank-directed monetary system in the EU parliament. This system is of course central to the phenomenon of the recurring boom-bust sequences...

Read More »

Read More »