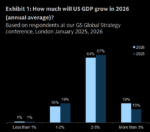

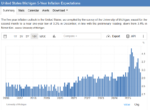

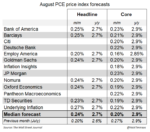

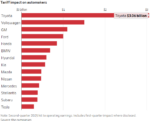

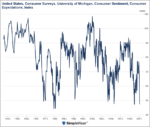

In a recent white paper, The Risk Of Higher US Inflation In 2026, Adam Posen and Peter Orszag argue that inflation could exceed 4 percent by year’s end. To wit, they lead the article as follows: In our view, however, this optimism is premature. We think it is more likely that inflation will surprise to …

Read More »2026-02-20