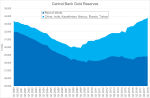

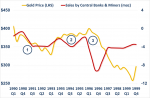

– There has been a recent change for the better in central bank attitudes to gold. – There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification”. – Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics. – Little in the current global economic and political environment to support any reason to change in this conservative position.

Read More »2018-09-28