- US Dollar strengthens during the American session after US data.

- Swiss Franc fails to benefit from the demand for safe-haven assets.

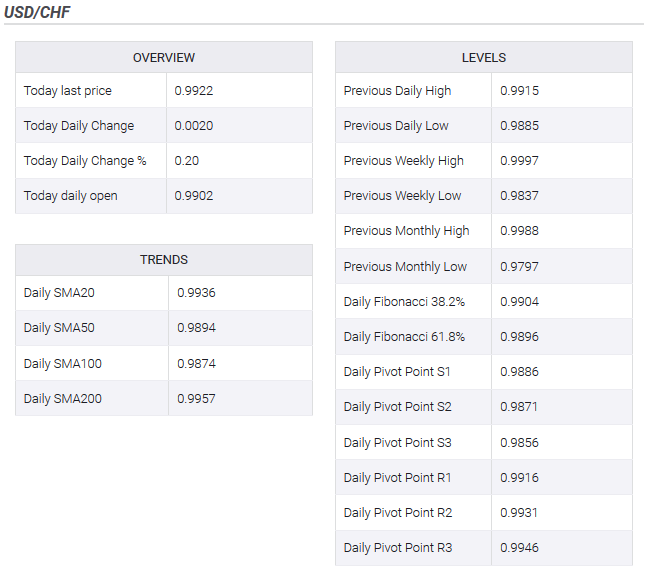

| The USD/CHF pair rebounded at 0.9890 and climbed to 0.9930, the highest level since October 17. As of writing, trades at 0.9920, up almost 20 pips for the day, on its way to the fourth daily gain in-a-row.

The key event today was the European Central Bank meeting but it had a limited impact on currencies. “In a relatively relaxed press conference- Draghi’s last one as ECB President- , he provided a dovish tone, in line with his entire presidency. He did not give any hints about action to be taken in the short term, trying not to tie the hands of his successor, Mrs Lagarde. We expect the ECB to remain on hold”, explained BBVA analysts. Later, the US Manufacturing Purchasing Managers’ Index came in above expectations and offered a boost to the Greenback, sending USD/CHF back above 0.9900. US Vice-president Pence said they hope to complete “phase 1” of the trade deal with China to move to a more structural agreement. Regarding Brexit, UK Prime Minister Johnson is seeking a snap election on December 12. The Parliament needs to back the move. The Pound trimmed losses after the announcement. Levels to watchThe USD/CHF pair today broke another resistance area; it is testing the 0.9930 and above the next target might be seen at 0.9955. The bullish tone will remain intact while above 0.9900, below supports are 0.9890 and 0.9865. |

More levels |

Tags: newsletter