Monetary policy is and remains tight in Emerging Markets, in particular since many of their currencies collapsed in summer 2013. This created inflation and led to lower spending. We want to find out which stock indices in the developed world have which exposure to Emerging Markets.

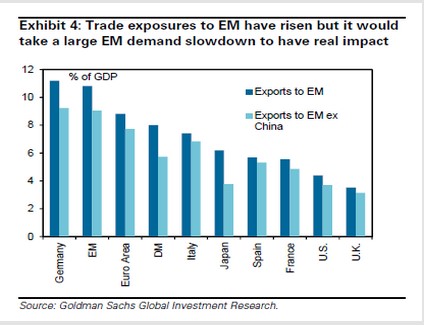

The following graph gives an overview for major developed countries and their exposure the Emerging Markets (EM).

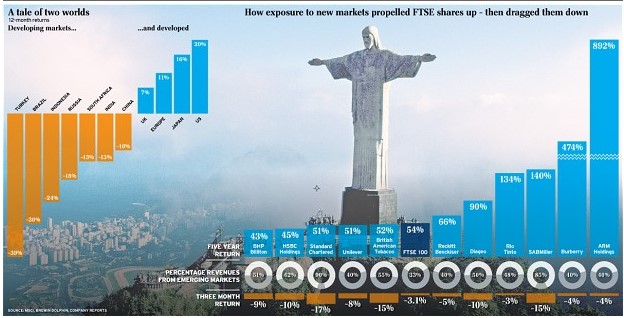

The best data for the FTSE comes from the Telegraph.

source Telegraph

While the British FTSE has a EM revenues share of 33%, the paper states that companies of the S&P 500 only sell 5% to EM.

Via ETF Strategy and Stephen Cohen, Head of EMEA Investment Strategy and Insights Team, iShares. (source)

He says: “The benefits of EM through developed markets are plenty: Some of the highest quality and most stable developed market companies have made great inroads into emerging economies. There will also be less political and foreign ownership risk, and better governance as developed market equities may be subject to higher regulatory standards. In short, investing in emerging markets through developed markets provides a compromise between the two investment worlds, with potential for enhanced risk return.”

Cohen notes that large-cap corporates, such as those of the UK and Germany, as represented by the FTSE 100 and DAX indices respectively, tend to offer higher exposure to emerging markets compared to mid- and small-caps, due to the minimum thresholds needed to set up international trade partnerships and economies of scale.

UK large-caps derive more than 90% of their underlying sales revenue from overseas; 29% of revenue comes from emerging markets, significantly higher than corresponding exposures for the mid-cap and small-caps segments. Companies such as HSBC, Standard Chartered, British American Tobacco, Unilever, and BHP Billiton are among the FTSE 100′s major emerging markets earners.

Similarly, the German DAX has 31% sales revenue exposure to emerging markets. This is comparable to the MSCI Australia Index, which is often seen as an emerging market proxy within the developed world (Australia is a major exporter of commodities to emerging market countries, particularly in Asia). DAX constituents earning a significant proportion of revenue from emerging markets include Bayer, Siemens, BASF, Daimler and BMW.

When compared to the broader German market, such as the MSCI Germany Index, which has 19% sales revenue exposure, the DAX is significantly more emerging market exposed. In fact, historically, the DAX has tracked well a basket of 10 currencies most associated with China in terms of trading partnerships, reflecting the impact of currency on corporate profits as a result of the exposure of German companies to emerging markets.

This theme – accessing emerging markets growth via developed market companies – has been recognised by index providers, who have launched a range of innovative indices tracking such investments. MSCI, Russell and Stoxx all offer interesting plays on the concept. Examples include the MSCI World with EM Exposure Index, the Russell Developed Large Cap EM GeoExposure Index and the Stoxx Global 1800 EM Exposed Index. The MSCI World with EM Exposure Index has outperformed the MSCI Emerging Markets Index by 4.22% YTD, though has lagged the MSCI World.

While the aforementioned index providers are thought to have marketed these indices to ETF providers, as yet no such product has been launched. Investors do, however, have a range of options when it comes to accessing the FTSE 100 and DAX. Among the most popular FTSE 100 ETFs are the iShares FTSE 100 ETF (ISF) with £3.8 billion in assets, the HSBC FTSE 100 ETF (HUKX) with £365 million, and the Vanguard FTSE 100 ETF (VUKE), which is the cheapest, charging just 0.10% per annum. For DAX exposure, among the most popular funds are the iShares DAX ETF (DE) (EXS1) with with £11.4 billion in assets, the db X-trackers DAX UCITS ETF (XDAX) with £5.9 billion, and the Lyxor ETF DAX (LYXDAX) with £541 million.

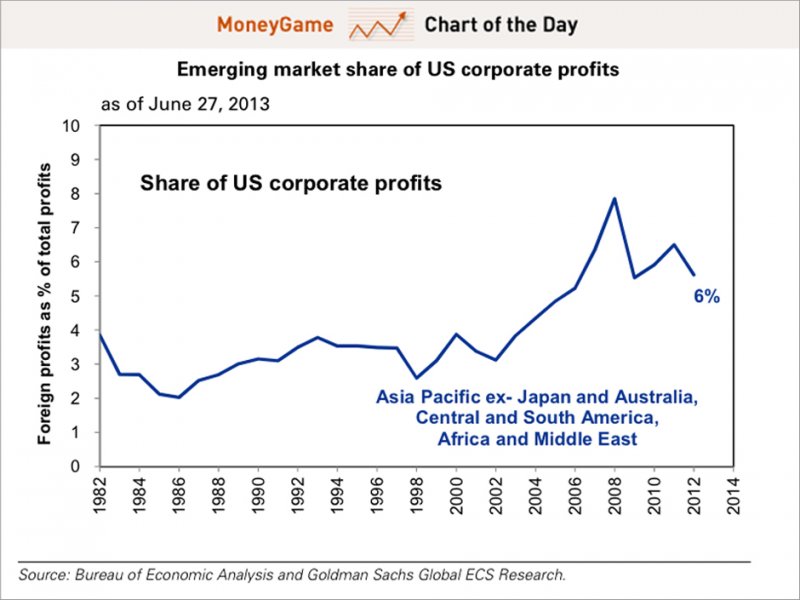

From Business Insider

The S&P 500 is a great index for U.S. investors because its constituents offer some great international exposure.

But in recent weeks, there has been some concerns arising in the emerging markets. With interest rates on the rise, investors have been yanking out their funds from the EMs at a breakneck pace.

Earlier today, we got more evidence that China was slowing as interest rates rise in the region.

So where does that leave investors exposed to the S&P 500?

Goldman Sachs’ David Kostin doesn’t think you need to be too worried.

“We believe weaker EM growth poses little risk to S&P 500 earnings,” he wrote in a new note to clients. “We estimate roughly 5% of S&P 500 revenues are derived from EM, and BEA data suggest a similar EM share of total US corporate profits. Two-thirds of S&P 500 sales are domestic, making our forecast for stronger US GDP the biggest driver of our EPS growth forecasts of 11% and 8% in 2013 and 2014.”

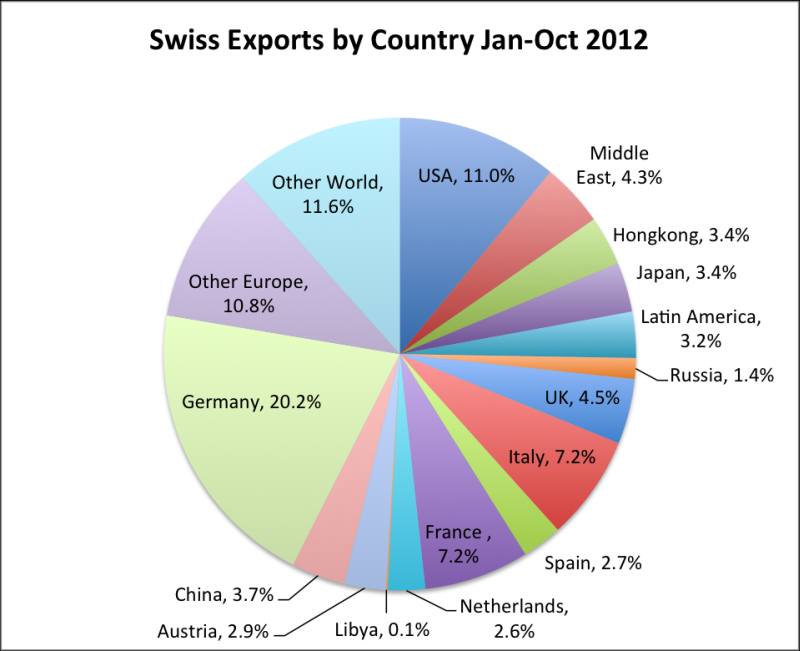

Switzerland has another country that sells to Emerging Markets. According to an article in the Finanz und Wirtschaft, Swiss blue-chips contained in the SMI make less than 20% of their sales in Switzerland, but 25% are in the United States. Exports to the U.S. of the total exporters is smaller, for the smaller companies, Germany and other European countries are more important, they make up 45%. The Middle East, Russia, Hongkong and China make up 16% of exports, the rest of the world, a considerable part of it also EM, are 12%.

From STOXX

See more forSTOXX INTRODUCES EMERGING MARKETS EXPOSED INDEX FOR EUROPEZURICH (December 10, 2013)–

STOXX Limited, a leading provider of innovative, tradable and global index concepts, today introduced the STOXX Europe600 EM Exposed Index.The new index represents those companies within the STOXX Europe 600 Index that derive a substantial part of their revenues from Emerging Markets countries, thus providing exposure to these growing markets through liquid securities. The STOXX Europe600EM Exposed Index is designed to act both as a proper benchmark for actively managed funds, and as an underlying to exchge-traded funds and other investable products.