In the history of financial cycles, we explained that the years 1999 and 2000 were driven by austerity in Asia after the 1998 Asia crisis, the euro introduction austerity measures and Germany, the sick man of Europe. With weak commodity prices, Americans went into period of overspending that culminated in the dot com bubble. The following extract from FT Alphaville, Julian Callow at Barclays Capital has a brief historical overview:

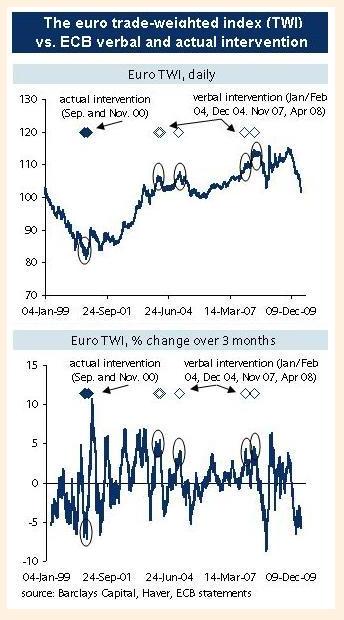

The ECB has intervened on only three occasions, all of them in support of the euro. These interventions were conducted during September and November 2000. The first was on 14 September, 2000, when the ECB announced that it had sold EUR2.5bn of accumulated interest income on FX reserves (the previous day the euro’s Trade-weighted Effective Exchange Rate Index (TWI) was at 83.85, while the euro was at $0.8654. Then on 22 September, the ECB put out another statement saying that there had been joint intervention in the FX markets with the Fed and BoJ (TWI the previous day: 82.7, euro at $0.8524). The ECB put out a further statement on 3 November, 2000, informing that it had undertaken FX intervention (TWI the prior day: 83.56, euro at $0.8646).

Overall, we can conclude from this that the ECB tends to intervene only rarely, and so far only to strengthen the euro when it was at or close to record lows. The intervention has tended to be relatively short-lived, intended as a signal designed to focus market attention on the possibility of a move the other way in a currency, and has been sterilised within the ECB’s monetary operations.

Read more:

History of Financial Cycles: 1998-2002: The Dotcom Bubble and Bust and the Euro Creation Austerity as its Enabler

See more for