Monthly Archive: May 2023

Markets Catch Breath as Politics Trumps Economics

Overview: The dollar is mostly consolidating last

week's gains. The big news has been on the political front. Thailand's

opposition parties dealt the military-led government a powerful blow. But in

Turkey, Erdogan staved off a serious challenge and a run-off later this month

looks likely, while his party maintained its parliamentary majority. Tensions

over arms shipments to Russia have eased between the US and South Africa,

giving the rand a boost....

Read More »

Read More »

Neither Red nor Blue, but Free

The real issue we face is not whether we should be in the red tribe or the blue tribe, but rather what will be the constituency for freedom.

Original Article: "Neither Red nor Blue, but Free"

Read More »

Read More »

Rothbard Was Right: Wars Don’t Enhance Freedom. They Destroy Liberty.

We hear ad nauseum from political and media elites that the war in Ukraine is about preserving "our freedoms." Murray Rothbard had something to say about this sophistry.

Original Article: "Rothbard Was Right: Wars Don't Enhance Freedom. They Destroy Liberty."

Read More »

Read More »

Week Ahead: Does the Dollar have Legs?

There are different ways to

measure it, but the dollar just put in its best week of the year. The greenback

rose against all the G10 currencies, and the Dollar Index rose by the most

since last September. It also appreciated against most emerging market

currencies, with the notable exceptions of a handful of Latam currencies. It

seems to be an overdue technical correction. Few genuinely believe that the US

will default given the ominous...

Read More »

Read More »

Expecting Rate Cuts

After a long series of rate hikes, Fed officials and asset markets are expecting a long series of interest rate cuts. This is based on the tried and hue Phillips Curve analysis. In color theory, "hue" is the technical appearance of color that can be described mechanically as a number. Let's hope interest rate expectations are not being distorted by other factors of reality, and that current Phillips Curve model perceptions of hue are also...

Read More »

Read More »

The US Followed a Policy of Foreign Intervention Long before World War II

In history classes (in public or private schools, colleges, and others), state propaganda, and mainstream history, a historical fiction has been spun that allegedly debunks any notion of noninterventionism. This is the myth of American isolationism.

The assertion usually goes that America was extremely isolationist prior to World War I and had no interest in involving itself in unnecessary warfare. After the Zimmermann telegram was sent, America...

Read More »

Read More »

The Brutality of Slavery

[This article is excerpted from Conceived in Liberty, volume 1, chapter 6, "The Social Structure of Virginia: Bondservants and Slaves". An MP3 audio file of this article, narrated by Floy Lilley, is available for download.]

Until the 1670s, the bulk of forced labor in Virginia was indentured service (largely white, but some Negro); Negro slavery was negligible. In 1683 there were 12,000 indentured servants in Virginia and only 3,000...

Read More »

Read More »

Proposal for budget Swiss health insurance

Last weekend, the PLR/FDP unveiled a plan to create a budget low cost health insurance option in Switzerland, reported RTS.

Read More »

Read More »

Switzerland needs to be able to recharge 2.8 million vehicles

This week, the Swiss Federal Office of Energy (SFOE) published its predictions and ambitions for electric transport infrastructure.

Read More »

Read More »

In the Event of an Official US Bankruptcy

The current known federal debt is $31.7 trillion according to the web site, US Debt Clock, which is about $94,726 for every man, woman, and child who are citizens as of April 24, 2023. Can you write a check right now made payable to the United States Treasury for the known share of the federal debt of each member of your family after liquidating the assets you own?

A report released by the St. Louis Federal Reserve Branch on March 6, 2023, stated a...

Read More »

Read More »

ESG: Another Fraudulent Hustle That Progressive Elites Have Foisted on the Economy

In their attempts to remake the economy, progressive elites are pushing ESG. What they forget is that the economy runs on real things, not ideology.

Original Article: "ESG: Another Fraudulent Hustle That Progressive Elites Have Foisted on the Economy"

Read More »

Read More »

Practice Makes Parfit

Parfit: A Philosopher and His Mission to Save Moralityby David EdmondsPrinceton, 2023; xx + 380 pp.

The British philosopher Derek Parfit ranks as one of the most influential moral philosophers of the past century. But as David Edmonds says in his outstanding biography of him, Parfit was a “philosopher’s philosopher” who did not write for the general public. Edmonds, who has a gift for explaining difficult ideas simply, has made Parfit’s ideas...

Read More »

Read More »

Does the Inverted Yield Curve Signal a Coming Recession?

Dr. Paul Cwik joins Bob to discuss the inverted yield curve's "signal" of an impending recession.

Dr. Cwik's dissertation on inverted yield curves and economic downturns: Mises.org/HAP395a

Bob on the link between inverted yield curves and recessions: Mises.org/HAP395b

Bob's Understanding Money Mechanics: Mises.org/Mechanics

[embedded content]

Read More »

Read More »

Prices, Food, Employment: AI and Robotics Are for Regular Folks, Not Just the Elite

While politicians, media mavens, and the academic elite spread fear about artificial intelligence, AI is helping make life better for ordinary consumers.

Original Article: "Prices, Food, Employment: AI and Robotics Are for Regular Folks, Not Just the Elite"

Read More »

Read More »

Taxing Capital Leads to Capital Consumption

The Misesian tradition provides essential insights into the nature of capital. From Frédéric Bastiat to Murray N. Rothbard, Austrian capital theory excels.

Bastiat illustrated gains from capital by giving us the anecdote of the neighbor who wanted to borrow a timber planer. Rothbard gave us the examples of royalties in the extractive industry to illustrate capital consumption. The list goes on. Often, capital’s exceptional output is because it...

Read More »

Read More »

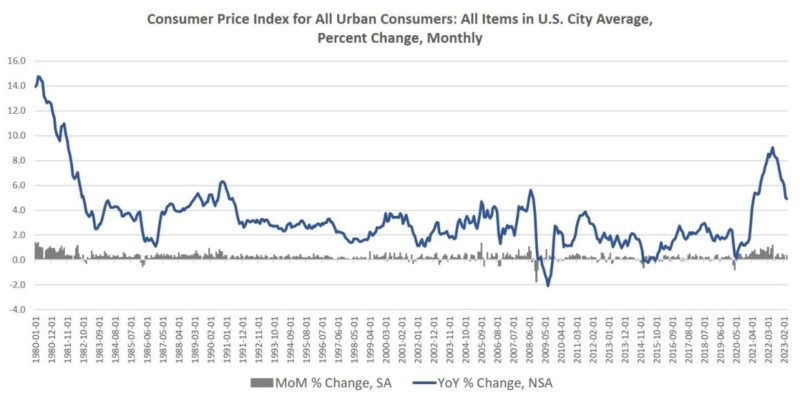

Price Inflation Growth Slowed Slightly in April. Now Wall Street Will Demand More Easy Money.

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data Wednesday, and according to the report, price inflation during April decelerated slightly, coming in at the lowest year-over-year increase in twenty-four months. According to the BLS, Consumer Price Index (CPI) inflation rose 4.9 percent year over year in April before seasonal adjustment. That’s down from March’s year-over-year increase of 5.0 percent, and...

Read More »

Read More »

Limited Follow-Through Dollar Buying After Yesterday’s Gains

Overview: The dollar sprang

higher yesterday but follow-through buying today has been limited. The

little more than 0.5% gain in the Dollar Index was among the largest since

mid-March. And yet, the debt ceiling anxiety and weak US bank shares persist. Today's

talks at the White House have been postponed until early next week. Both sides

are incentivized to bring it to the brink to demonstrate to their

constituencies that they got the best deal...

Read More »

Read More »

Should Local Municipalities Default on Their Debts? Seems Like a Good Idea

While most free market advocates are fixated on the national debt, they also should be looking at municipal debt over which taxpayers have no say. Maybe default is the answer.

Original Article: "Should Local Municipalities Default on Their Debts? Seems Like a Good Idea"

Read More »

Read More »

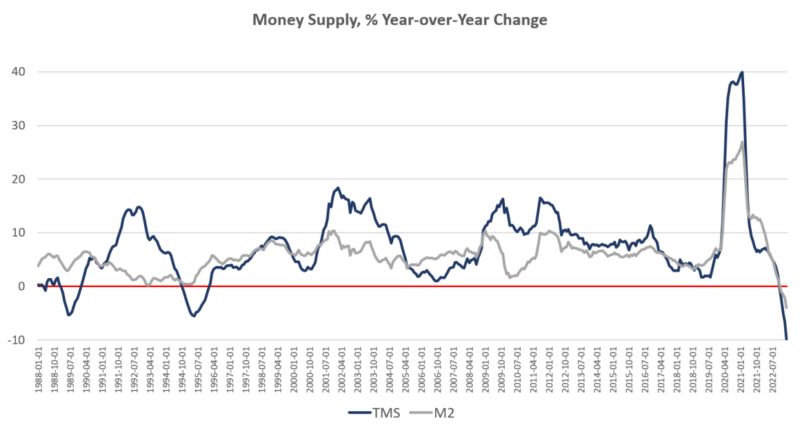

The Money Supply Has Plummeted in the Biggest Drop Since the Great Depression

Money supply growth fell again in March, plummeting further into negative territory after turning negative in November 2022 for the first time in twenty-eight years. March's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years.

Since April 2021, money supply growth has slowed quickly, and since November, we've been seeing the money supply repeatedly contract for five months in a row. The...

Read More »

Read More »

Finance Discovers Sting: “How Fragile We Are”

An ongoing debate concerns the plunge in the four-week Treasury note yield in relation to the three-month Treasury yield. At least one tweeter claims it’s all about the coming debt ceiling showdown with the difference in rates (3.145 percent versus 5.070 percent) reflecting the risk of having liquidity tied up within three months as the debt ceiling exercise is run through DC sausage making.

On the other side is Eurodollar University’s Jeffrey...

Read More »

Read More »