Monthly Archive: May 2023

Divide and Control: Central Bankers Blame the Victims

The Central bankers of the world, apparently losing confidence that they can fix the inflation they created, are turning to Plan B: blame the people. So we fight each other.

Last week the chief economist of the Bank of England, Huw Pill, said the quiet part out loud, that “British households and businesses need to accept they are poorer and stop seeking pay increases and pushing prices higher.”

Note inflation in the UK is currently running...

Read More »

Read More »

Does GDP Present an Accurate Picture of the Economy? Not Likely

To understand the economy, most financial experts and commentators rely upon gross domestic product (GDP). The GDP framework looks at the value of final goods and services produced during a particular time interval, usually a quarter or a year.

This statistic is constructed with the view that consumption, not wealth production, drives an economy. Since consumer outlays are the largest part of the overall demand, it is assumed that consumer demand...

Read More »

Read More »

Fed Day

Overview: A sharper than expected decline in US job

openings and weaker factory orders coupled with intensifying bank stress sent

ripples through the capital markets. The large US bank index fell 4.5%

yesterday, the most in six weeks, while the regional bank index fell nearly

5.5%, its biggest loss since March 13. Both indices took out the March lows. The

US 10-year yield unwound Monday's increase and the two-year note yield fell

back below 4.0%...

Read More »

Read More »

Endangering Washington’s Divine Right to Deceive

Official Washington and its Court Media are up in arms that someone has told the truth via leaking government documents. They won't rest until he is punished severely.

Original Article: "Endangering Washington's Divine Right to Deceive"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

How to Teach Austrian Economics to the Neighbor Kids

A mom in the neighborhood recently made trouble. Macroeconomic trouble. Here is a way to spot such trouble, and how to help nurture the goodness in our economic way of life.

A few months back her boy went door to door, confidently introducing himself, explaining his purpose, and handing us a detailed flier: “Twelve-year-old boy willing to work.” He was trying to earn money to go to sailing school. I was impressed. My wife was impressed. We told our...

Read More »

Read More »

Congress Ignores Real Debt Ceiling Drama

Last week the House passed legislation increasing the debt ceiling. The bill was supported by all but four Republicans. For some Republicans, this was the first time they had ever voted for a debt ceiling increase. Perhaps the reason they did so this time was because the legislation also promised to reduce federal spending by $4.5 trillion over the next decade. Most of those spending reductions are achieved by rolling back Fiscal Year spending to...

Read More »

Read More »

Why Do Most Countries Have Their Own Currency? Governments Wanted It That Way.

Even when currency is backed by gold, governments have many political reasons to pursue national, territorial currencies. Now there are hundreds of national currencies. It didn't have to be this way.

Original Article: "Why Do Most Countries Have Their Own Currency? Governments Wanted It That Way."

Read More »

Read More »

Paying the Piper: Time to Clean Up the Latest Malinvestments

The Austrian business cycle theory teaches us that low interest rates manipulated by the central bank lead to malinvestments, which are cleared when the central bank lets rates rise, reflecting a truer cost of capital. A real-time example is happening in the United States commercial office real estate market. Combine that with the government’s covid lockdowns, which forced employees to work from home. Now, employees never want to change out of...

Read More »

Read More »

France on strike

The roots of the injustice that brought over a million to the streets

It is the core of a long running joke that the French love to strike more than they like to work – and for good reason. Demonstrations, strikes and even riots, have been a common occurrence for decades. However, this latest round seems to be interestingly persistent, despite the fact that it’s receiving increasingly sparse media coverage.

The last time that the French...

Read More »

Read More »

RBA Surprises with a Quarter-Point Hike

Overview: A combination of a surprisingly strong

prices paid component to the US manufacturing PMI, corporate supply, and US

debt woes spurred an almost 15 bp spike in the US 10-year yield and 13 bp jump

in the two-year yield. The rise in US rates appeared to lend the dollar support.

The greenback's gains have been extended today, but a surprise hike by the

Reserve Bank of Australia is seeing the Australian dollar (and New Zealand

dollar) traded...

Read More »

Read More »

How the Woke Left Is Destroying Education

Adherents of leftist dogma increasingly push the notion that teachers should be permitted to distract, confuse, or influence their students by discussing their personal beliefs, ideas, and private activities and choices in the classroom.

Original Article: "How the Woke Left Is Destroying Education"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

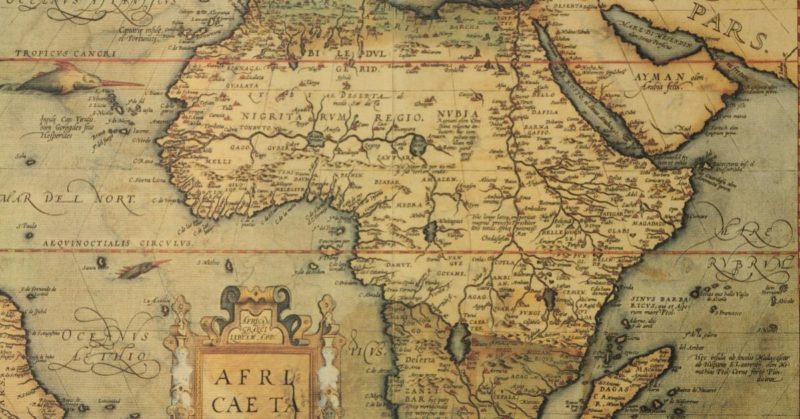

Historical Effects of the Transatlantic Slave Trade

Economists are becoming more appreciative of how historical episodes shape future events. The resurgence of history as an explanatory tool has led economists to publish a series of papers collectively known as the “Deep Roots” literature. These papers cover a wide range of topics, but Africa has been a strong focus due to its unique history of underdevelopment. Some trace Africa’s fortunes and misfortunes to the character of precolonial...

Read More »

Read More »

Presidents Are Legally Immune for Their Most Dangerous Crimes

Donald Trump legally pays hush money and prosecutors try to fashion a crime from it. However, if a president lies and thousands of people die, it is called foreign policy.

Original Article: "Presidents Are Legally Immune for Their Most Dangerous Crimes"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Charles Schwab and Other Big Banks May Be Secretly Insolvent

The taming of monetary policy necessary to slow price inflation has triggered a corrective trend in the valuation of financial instruments. Many big banks in the United States have substantially increased their use of an accounting technique that allows them to avoid marking certain assets at their current market value, instead using the face value in their balance sheet calculations. This accounting technique consists of announcing that they...

Read More »

Read More »

Property, Civilization, and Culture: Mises in Reno

"The foundation of any and every civilization, including our own, is private ownership of the means of production. Whoever wishes to criticize modern civilization, therefore, begins with private property." — Ludwig von Mises

Every day, more and more Americans are awakening to the reality that the institutions in control of this nation are failing them. From violence in the streets, inflation in our stores, increasing tyranny and...

Read More »

Read More »

Dollar Comes Back Bid, as First Republic Taken Over (Mostly) by JP Morgan

Overview: Most markets are closed for the May Day

holiday. News that JP Morgan will acquire most of First Republic assets will be

a relief for the markets. US equity futures are slightly firmer, and the

10-year Treasury yield is around three basis points higher, slightly above

3.45%. Recall that before the weekend, it has fallen from almost 3.55% to 3.42%.

The market has more than a 90% chance of a quarter-point hike discounted for

Wednesday. The...

Read More »

Read More »