Monthly Archive: February 2023

Legislators Seek Repeal of Wisconsin’s Controversial Sales Tax on Gold and Silver

Madison, Wisconsin - (February 4th, 2023) – A large bipartisan contingent of Wisconsin legislators seek to end Wisconsin’s controversial practice of levying sales tax on purchases of gold and silver. Senate Bill 33, primarily sponsored by Sen. Duey Strobel (R - Saukville) and Sen. Rachael Cabral-Guevara (R - Appleton), and cosponsored by Rep. Shae Sortwell, enjoys wide support – and would align Wisconsin with the policies of 42 other U.S. states....

Read More »

Read More »

2023 Libertarian Scholars Conference

Join the Mises Institute at the 2023 Libertarian Scholars Conference on Saturday, September 23.

We'll meet at the Grand Hyatt in Nashville, Tennessee.

The first Libertarian Scholars Conference was held in New York City in 1972 under the aegis of the Center for Libertarian Studies.

Read More »

Read More »

It’s Never Too Late to Begin Protesting against the Proposed Central Bank Digital Currency

Whether you like it or not, central bank digital currencies (CBDCs) are coming. That’s the message in a recent tech column in the Wall Street Journal. A similar tone can be found coming from organizations like the World Economic Forum, the International Monetary Fund, and the Atlantic Council.

Read More »

Read More »

Seven Points on Investing in Treacherous Waters

What's truly valuable has no price and cannot be bought. If all investments are being cast into Treacherous Waters, our investment strategy must adapt accordingly. Once we set aside denial and magical thinking as strategies and accept that we're in treacherous waters, a prudent starting point is to discern the most consequential contexts of all decisions about where and how we invest our time, energy and capital.

Read More »

Read More »

More Recession Signs: Money Supply Growth Went Negative Again in December

Money supply growth fell again in December, falling even further into negative territory after turning negative in November for the first time in twenty-eight years. December's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. During the thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent year over year, well above...

Read More »

Read More »

The Dollar Pares Yesterday’s Gains but Near-term Change in Sentiment may be at Hand

Overview: The dollar remained firm yesterday, even

after the ECB's hawkish stance, reaffirming its intention to hike rates by

another 50 bp next month. We had expected the greenback to have been sold in

North America yesterday. That this did not materialize warns that despite its

pullback in Asia and especially Europe today, that near-term sentiment may be

changing with the Fed and ECB meetings over and die cast for next month, where

the Fed is...

Read More »

Read More »

Study: solar panels only pay off in half of Swiss cities

Solar panel installations are only profitable in half of Swiss cities according to a new study. This could create hurdles for the expansion of solar energy in the country.

Read More »

Read More »

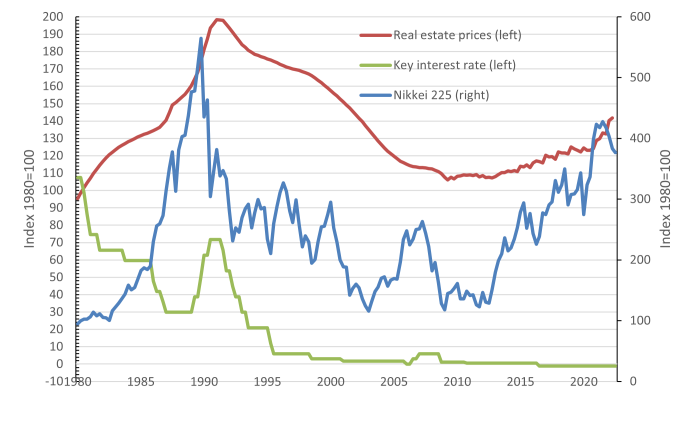

Is the Japanese Low Inflation–Low Interest Rate Model at an End?

The macroeconomic situation in Japan seems to be coming to a head. When the Bank of Japan, under its President Haruhiko Kuroda, announced on December 20, 2022, that it would raise its interest rate ceiling on ten-year Japanese government bonds from 0.25 percent to 0.50 percent, share prices in Tokyo plummeted and the Japanese yen appreciated sharply.

Read More »

Read More »

North America likely will Sell USD Bounce Seen in Europe

Overview: The failure of the Federal Reserve to push harder against the market's dovish views and the easing of financial conditions encouraged a risk-on trade that saw the dollar and yields slump and equities rally. There has been limited follow-through dollar selling today, and a small recovery ahead of the Bank of England and European Central Bank meetings.

Read More »

Read More »

Switzerland looks to safeguard gas supplies for winter 2023-2024

With an eye on possible shortages next winter, the government plans to repeat this year’s mitigation strategy of buying reserve stocks. The decision is a repeat of what the government already outlined in May 2022: to head off possible winter gas shortages, authorities want to ensure that the country has six terawatt hours’ worth of gas in reserve stocks in neighbouring countries.

Read More »

Read More »

Outrage on Refugees and Silence on Sanctions

I have seen immigration-control advocates exclaim against illegal immigration my entire life. They say that U.S. officials just need to “crack down” in the war on illegal immigration in order to bring an end to America’s decades-long, never-ending, ongoing, perpetual immigration crisis and immigration chaos along the border.

Read More »

Read More »

Will What the Fed Says be More Important than What it Does?

Overview: The focus is squarely on the Federal Reserve today. There is nearly universal agreement that it will lift the target by 25 bp. The market is inclined to see the shift as a sign that the Fed is nearing the end of its tightening cycle, and sees, at most, one more quarter-point hike. Despite the Fed's warnings, including in the December FOMC minutes, about the premature easing of financial conditions, the market has done precisely that.

Read More »

Read More »

UBS profits rise after Credit Suisse client defections

UBS enjoyed a 23% rise in pre-tax profits in the final quarter as it benefited from clients switching from rival Credit Suisse. The Swiss bank on Tuesday reported $1.7 billion (CHF1.58 billion) of net profit in the final three months of 2022, comfortably ahead of analyst estimates of $1.3 billion, bringing the group’s profit for the year to $7.6 billion.

Read More »

Read More »

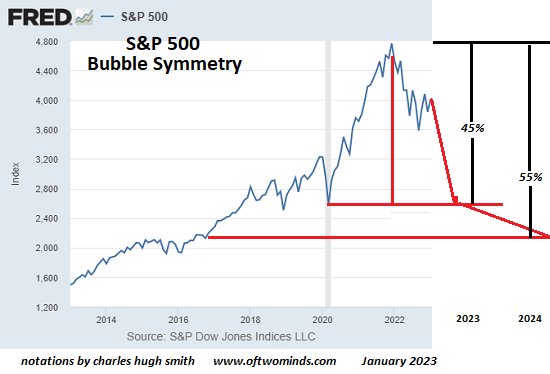

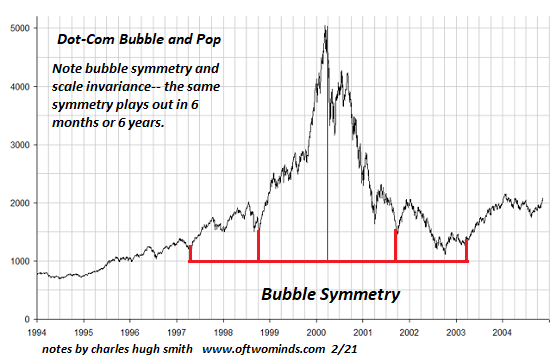

What Goes Up Also Comes Down: The Heavy Hand of Bubble Symmetry

Should bubble symmetry play out in the S&P 500, we can anticipate a steep 45% drop to pre-bubble levels, followed by another leg down as the speculative frenzy is slowly extinguished. Bubble symmetry is, well, interesting. The dot-com stock market bubble circa 1995-2003 offers a classic example of bubble symmetry, though there are many others as well.

Read More »

Read More »

Fighting Inflation Really Means Fighting the Federal Reserve

There are surely other worlds than this—other thoughts than the thoughts of the multitude—other speculations than the speculations of the sophist.

—Edgar Allan Poe, “The Assignation”

Nothing brings out misleading or false narratives like the subject of money. Prices over the last twenty-five months have shot up, and this development is roundly called inflation. Why? Because prices have shot up. The criminals running the government even passed an...

Read More »

Read More »

Colossal tax dodging: the odd case of billionaire Pierre Castel

The bill comes to CHF410 million. The amount demanded by the Geneva revenue administration from French billionaire Pierre Castel has drawn the attention of the international press and made waves locally.

Read More »

Read More »