Monthly Archive: February 2023

Lifting the Debt Ceiling Is Not a Social Policy

Every time the United States reaches its debt limit, we read that it is important to reach an agreement to lift it. The narrative is that the debt ceiling must be raised, or the US economy will suffer a severe contraction. There is even an episode of a TV series, “Designated Survivor”, where the character played by Kiefer Sutherland places lifting the debt ceiling as the priority to get the U.S. economy on track. The debt ceiling is viewed as an...

Read More »

Read More »

Does Government Create a “Level Playing Field” or Does It Make the Field More Uneven?

Anticapitalist politicians claim intervention can "level the playing field," but when we look closely, we realize that government itself creates the imbalances.

Original Article: "Does Government Create a "Level Playing Field" or Does It Make the Field More Uneven?"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Why You Should Fear “Bipartisan” Agreements in Congress

After the recent midterm election, when it became apparent that Americans would have a divided new Congress, it wasn’t long before the word bipartisan started showing up as an adjective to modify a whole host of legislative proposals and discussions. While in many cases the word has been aspirational rather than descriptive—as in, “the other side should follow our lead in agreeing to this”—it has often also been used as a magic modifier in an...

Read More »

Read More »

How Markets Are Better than Government Regulators at Fighting Corporate Corruption

Can private markets only be regulated by government? Hindenburg Research's successes against corporate corruption suggest otherwise.

Original Article: "How Markets Are Better than Government Regulators at Fighting Corporate Corruption"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Monday: A Short Note while US is on Holiday

The dollar is mostly softer, but

turnover is mostly quiet. The Swedish krona leads the move after

higher-than-expected underlying inflation. It is a mild risk-on day with

equities moving higher too. In the Asia Pacific region, China stood with

the CSI 300 up almost 2.5%. Europe’s Stoxx 600 is up fractionally to

recoup most of the pre-weekend decline. US equity futures are narrowly

mixed. European bond yields are little changed, with a couple...

Read More »

Read More »

Poor People in Developing Countries Find Alternatives to Commercial Banking

Banking is a complicated process for working-class people who fail to comply with anti–money laundering regulations. Know your customer (KYC) requirements mandate prospective clients to provide their source of funding and possible employment history. Such policies make it difficult for working-class entrepreneurs to formalize and access funding. By restricting poorer people to informality, KYC requirements sap the growth potential of small...

Read More »

Read More »

Swiss banks accused of hiding data behind secrecy laws

Swiss banking secrecy used to be the bane of foreign countries trying to catch tax cheats. Now it’s the turn of Swiss journalists and historians to cry foul of laws that can hinder their work.

Read More »

Read More »

Subsidizing Higher Education Is Not Creating Widespread External Benefits

Contrary to the claim that taxpayer subsidies for higher education provide great social benefits, these subsidies actually are a wealth transfer from the less-well-off to wealthy people.

Original Article: "Subsidizing Higher Education Is Not Creating Widespread External Benefits"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Is Capitalism to Blame for the Ohio Train Disaster?

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop address whether the Ohio train disaster is an example of "capitalism gone amuck". They discuss Murray Rothbard's views on pollution, the secondary consequences of the regulatory state, and the decaying qualities of modern financialization.

Read More »

Read More »

The Global Currency Plot

Democratic socialism—the ideology that dominates the world today—aspires to become a world state. The route toward it requires a single world currency to be created. That would undoubtedly create a dystopia. Might this become a reality? And if so, how can it be averted? This book aims to find answers to these questions.

Read More »

Read More »

The Fed’s Portfolio Is Nonexistent: The Fed Does Not Invest. It Destroys Investments

Economists and pundits mistakenly call the Federal Reserve System's security holdings a portfolio. It is anything but.

Original Article: "The Fed’s Portfolio Is Nonexistent: The Fed Does Not Invest. It Destroys Investments"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Why Madison and Hamilton Were Wrong about Republics

The debate between the Federalists and the Anti-Federalists in the late eighteenth century was fundamentally a debate over whether or not Americans wanted or needed a large national state. Thus, in their effort to push ratification of the new constitution, the Federalists employed a wide variety of arguments designed primarily to convince the public that the United States, as it stood in 1787, was not politically centralized enough.

We often find...

Read More »

Read More »

How Fast Should the Money Supply Grow?

As Murray Rothbard wrote, inflation is not an increase in prices. It is, instead, an increase in the supply of money in circulation. The distinction is important.

Original Article: "How Fast Should the Money Supply Grow?"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The Fed’s 2% Inflation Target

Mark Thornton explains the target as another smokescreen that was originally intended to stabilize monetary policy, currencies, and exchange rates, but has become a justification for inflation and central bank manipulation.

Be sure to follow Minor Issues at Mises.org/MinorIssues.

Read More »

Read More »

Week Ahead: Market Seeks Proper Balance after Exaggerating in Both Directions

The pendulum of market sentiment swung from

fear of a synchronized recession in the US and Europe to optimism that a

recession can be avoid. The perceived reduction of downside risks had driven

the upside performance of equities and bonds. Just as the data seems to confirm

it, the rally in in stocks and bonds faltered. The MSCI Emerging Markets equity

index gained 7.8% last month but is off almost 3.8% this month, and has fallen for three...

Read More »

Read More »

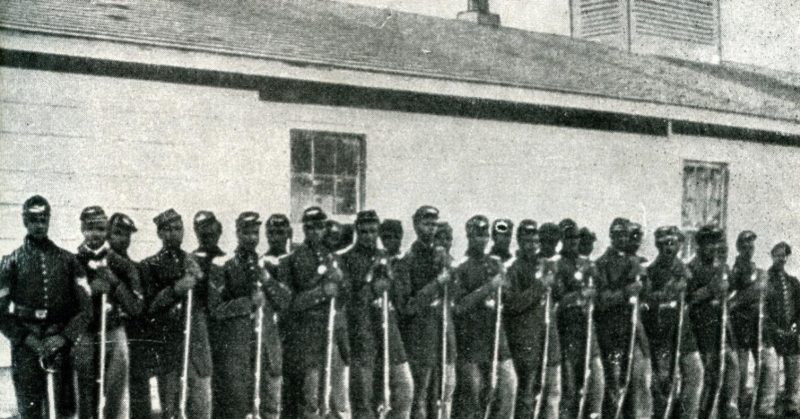

The Forgotten Lessons of Government-Enforced Race Relations

On April 23, 2003, in South Side Chicago, Reverend Jeremiah Wright cursed America for treating blacks as less than human.

Such harsh rhetoric should not seem surprising given the US government’s history of involvement in race relations. Judge Andrew P. Napolitano takes us through that history in his book Dred Scott's Revenge: A Legal History of Race and Freedom in America.

Most readers have heard about black lynchings that gripped the South for...

Read More »

Read More »

How Government Spending Hurts the Economy

[In this chapter from Man, Economy, and State, Murray Rothbard explains how government employees consume productive resources, while both taxes and government spending distort the economy.]

For years, writers on public finance have been searching for the “neutral tax,” i.e., for that system of taxes which would keep the free market intact. The object of this search is altogether chimerical. For example, economists have often sought uniformity of...

Read More »

Read More »

Switzerland sees surge in numbers of foreign workers

The number of new foreign workers moving to Switzerland on long-term contracts increased by a quarter last year compared to 2021, according to official statistics.

Read More »

Read More »

Will AI Learn to Become a Better Entrepreneur than You?

Contemporary businesses use artificial intelligence (AI) tools to assist with operations and compete in the marketplace. AI enables firms and entrepreneurs to make data-driven decisions and to quicken the data-gathering process. When creating strategy, buying, selling, and increasing marketplace discovery, firms need to ask: What is better, artificial or human intelligence?

Read More »

Read More »

Why Ron Paul Is Right

The great Dr. Ron Paul has been right about all the major issues that confront the world today. He is right about the Fed, the Ukraine war, the FBI, and so much else. How has he managed to do that? What has given him wisdom unique on the political scene today? The answer is simple.

Read More »

Read More »