|

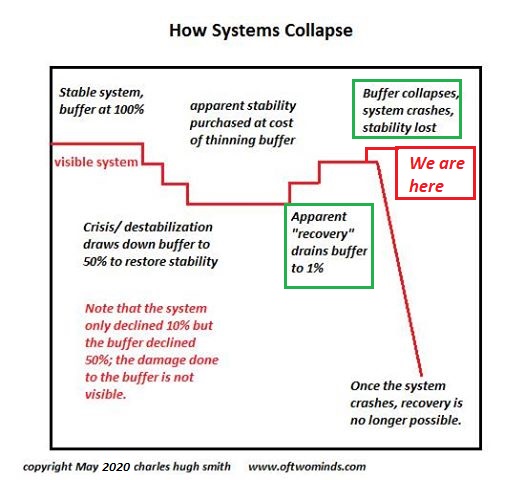

Flooding the financial system with “free money” only restores the illusion of stability I updated my How Systems Collapse graphic from 2018 with a “we are here” line to indicate our current precarious position just before the waterfall: For those who would argue we’re nowhere near collapse, consider that over 20% of the Federal Reserve’s $2 trillion spew of free money went directly into the pockets of America’s billionaires: $434 billion by the latest estimates, while most of the rest went into the pockets of the top 10% who own all the assets that the Fed is goosing higher while millions of households are worried about feeding themselves: (American billionaires got $434 billion richer during the pandemic). In America’s system, the solution to soaring, destabilizing inequality is… to goose inequality to new heights. No wonder there’s no middle ground left politically, socially or financially, and social disorder is so easily ignited. There are few feedback loops left in our fragile system; the rich get richer, and rather than restore some balance, our political system further empowers the parasitic and predatory financial elites. The rich and politically powerful are one group, sharing control of public and private institutions. One way to understand “middle ground” is that the middle ground acts as a buffer between systemic extremes. The key concepts here are stability and buffers. Though complex systems are never static, but they can be stable: that is, they ebb and flow within relatively stable states supported by buffers. |

How Systems Collapse |

America’s social, political and economic buffers have been thinned by extremes and excesses, but nobody noticed or cared: America’s reigning credo is: anything goes, winners take all.

In systems, this ebb and flow of low-level volatility generates stability and adaptation. In natural systems, feedback loops between the weather, environment and plant/animal species keep the ecosystem in a state of dynamic equilibrium. Ideal weather conditions may spark a rise in an insect population, for example, which then enables an increase in insect-predator populations (fish, birds, frogs, etc.) which then increases the consumption of the insects and reduces the impact of the higher insect population.

If the river runs low, the human populace relies on wells for reserves of water. In good harvests, grain is set aside for lean harvests; the wells and grain stores are buffers which can be drawn down to restore stability to a stressed system.

Buffers are largely invisible and of little common interest in times of abundance. When water and grain are well-supplied, who cares if the stores have spoiled and the well water tastes bad?

A system with thin buffers and few feedback loops looks robust on the surface but is highly vulnerable to collapse. In our example, the first lean harvest and low water flow completely drain the reserves, and the second year of drought triggers a collapse of the system.

In our complex socio-economic system, the buffers are largely invisible. As a general rule, “money” (currency created by central banks and private banks when a loan is issued) is our all-purpose buffer: if something becomes scarce and threatens the system, we print/ borrow into existence more “money” which is distributed to buy whatever is needed.

But “money” is an illusory buffer. If the well has run dry, no amount of money will restore ground water. If the fisheries have collapsed due to overfishing, no amount of currency issued by the Federal Reserve will restore the fisheries. In other words, the natural world provides hard limits that money can only fix if buffers are available for purchase.

“Money” is itself a system, a system with financial buffers, buffers that have been consumed by the speculative excesses of the private sector and the financial repression of central banks. These buffers are largely invisible; few know what’s going on in global liquidity markets, for example. Yet when liquidity dries up, for whatever reason, markets go bidless and asset prices go into freefall.

Flooding the financial system with “free money” only restores the illusion of stability. As noted in my diagram, restoring and maintaining an apparent stability thins buffers to the point of dangerous fragility.

When buffers are paper-thin, a crisis that would have been overcome with ease in the past triggers the collapse of the entire system. Everyone who based their faith in the system on its surface stability is stunned by the rapidity of the collapse, for how could such a vast, apparently robust system implode with so little warning?

The financial system’s buffers have been thinning for 20 long years, but nobody seems to care. The quality of risk, debt, borrowers and speculative gambles have all declined, but faith in the “Fed put”–that the Federal Reserve can fix anything and everything by printing endless trillions– is quasi-religious: few doubt the limitless power of the Fed’s currency-printing machinery to quickly overcome any crisis.

This is how systems collapse: misplaced faith in the visible surface of abundance generates fatal complacency and confidence, and the fragility of the buffers goes unnoticed.

Just before the collapse, central bank currency is super-abundant, but systemic stability is near-zero and all the buffers are paper-thin: the Fed’s trillions create an illusion of safety, as if all we need to do to restore the lost middle ground and buffers is to hand America’s most parasitic and predatory clique another $434 billion in stock market wealth.

Doing more of what has destabilized the system in the belief that new extremes will somehow restore equilibrium is simply rowing faster as we speed toward the waterfall of systemic collapse.

Full story here Are you the author? Previous post See more for Next postTags: newsletter