In a recent article entitled “Where Are All the Austrian Scholars’ Yachts?” John Tamny has criticized Austrian economists, and Mark Thornton in particular, for their skepticism regarding the relatively “ebullient stock market” in the midst of the pandemic. Mark Thornton responded to Tamny’s main argument in an earlier post. In this post, I will address two serious errors that underlie Tamny’s argument.

The first error involves a common misinterpretation of Austrian business cycle theory (henceforth ABCT). Tamny represents Austrian cycle theorists as claiming that stock market booms and bubbles are caused by the central bank arbitrarily reducing interest rates. But this is a misunderstanding. According to ABCT, it is not the arbitrary lowering of interest rates per se that causes an inflationary boom, asset bubbles, and a subsequent recession. Rather, it is the issue of “fiduciary media,” or bank deposits unbacked by reserves, that are created via new business loans that actuate the boom-bust cycle. The decline of interest rates on loans is merely one of the results of this expansion of money and credit and is not essential to the process. On the one hand, banks could arbitrarily lower the interest rate on loans and this would not initiate an inflationary boom; on the other hand, banks could leave the interest rate unchanged but lend out newly-created bank reserves by lowering credit standards, which would ignite a boom and asset price inflation. Mises emphasized this point in 1949 (Human Action, p. 789n5):

If a bank does not expand circulation credit by issuing additional fiduciary media…it cannot generate a boom even if it lowers the amount of interest charged below the rate of the unhampered market….The inference to be drawn from the [Austrian] monetary cycle theory by those who want to prevent the recurrence of booms and of the subsequent depressions is not that the banks should not lower the rate of interest, but that they should abstain from credit expansion.

Tamny completely misses this point when he writes:

As Thornton sees it, the main driver of modern stock-market health has been the Fed. Supposedly the Fed’s artificially low rates boosted equity prices. In Thornton’s estimation, Fed rate cuts equal artificial equity rallies. To then presume that the Fed, merely by decreeing “cheap credit,” can make it cheap is not something one would expect Thornton to take seriously. . . . Furthermore, if zero or low rates were the path to soaring stock markets as Thornton et al assume, Japan’s stock market would have outperformed all other global equity markets by many miles when it’s remembered that the BOJ [Bank of Japan] has kept the rate it targets near zero since the 1990s. Except that the Nikkei is still well off of highs last experienced in 1989.

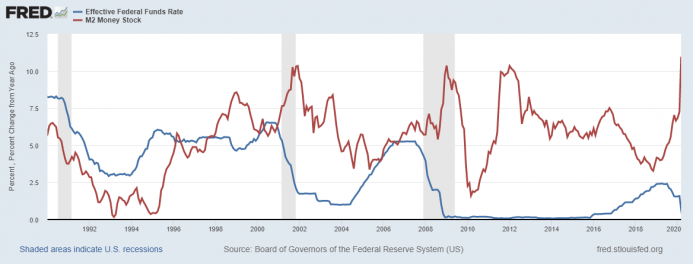

| In this passage, Tamny’s misrepresentation of ABCT is on full display. First, neither Thornton nor any other Austrian economist, past or present, has ever proposed that the Fed lowers interest rates “merely by decreeing ‘cheap credit.’” The fact that Tamny maintains this indicates that he is innocent of any knowledge of the crucial role of money and credit expansion in ABCT. As pointed out above in the quotation from Mises, what engenders the boom and perpetuates it is the injection of fiduciary media into credit markets regardless of the movements of interest rates, especially short rates. As I have argued elsewhere, a higher (lower) growth rate of the money supply is perfectly consistent with increases (decreases) in the fed funds rate. This is illustrated in the graph, which over the period 1990-2020 displays no systematic relationship between the monetary growth rate and the fed funds rate. |

Effective Federal Funds Rate/M2 Money Stock |

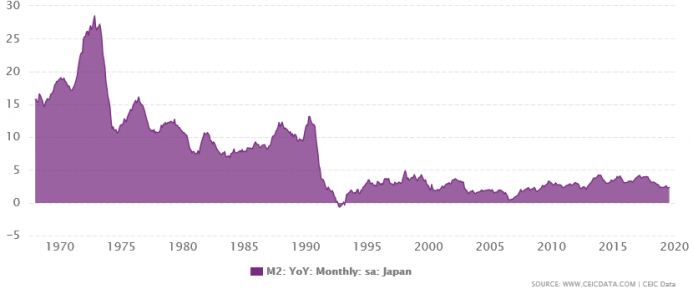

| Tamny’s failure to grasp the essence of ABCT is starkly revealed by his contention that the Nikkei Index is still below its 1989 peak despite the fact that the BOJ has maintained its targeted interest rate near zero since the 1990s. As the graph below shows, the average year-over-year growth rate of the Japanese monetary aggregate M2 in the 1980s was more than twice as high as it was from 1990 to 2020. For Austrians it is the money supply and not manipulations of a short-term interest rate that affects asset prices. |

Japan M2: YoY: Monthly |

That a fine economic journalist such as Tamny should err on a technical point of business cycle theory is understandable. Many prominent economists have failed to comprehend the causal significance of fiduciary media in ABCT. This includes Gottfried Haberler, a former follower of Mises and an expert on business cycle theory. Unfortunately, Tamny cannot be so easily excused for the second error in his article, which appears to be based on ignorance of the nature and function of money. Thus Tamny opines,

Thornton and other Austrians will say the Fed can create dollars, but that’s not the same as creating credit. If so, every central bank in the world would aggressively print money as a way of summoning real resources. Except that there would be no takers; unless Thornton thinks market actors are so dense as to readily exchange real market goods for paper, and without regard to what the paper will subsequently command in the marketplace. Not very likely.

Now it appears to me that Tamny is here claiming that, even when “aggressively” creating new money, the Fed is unable to commandeer for itself or the immediate recipients of its largesse control over “real resources.” The reason, Tamny asserts, is that market participants are smart enough not to accept the depreciating dollars for their labor services and other real stuff they have to sell. Examined closely, this claim is breath-taking in its theoretical and historical obtuseness. For it implies that no one will ever accept a depreciating currency in exchange, even though it has a positive purchasing power. But this is a logical contradiction. The fact that a fiat currency does have a purchasing power—a power to command real goods in exchange—means that it is already being traded for goods and services in the market place.

Let us examine this point in a little more depth. At any given moment the dollar has a given purchasing power, which is reflected in the array of dollar prices for the various goods currently being exchanged in the economy. When the Fed creates new dollars for banks to lend, these dollars have exactly the same purchasing power as those already in circulation and being readily accepted in exchange for real goods. The first recipients of the new dollars—be they business borrowers or the US Treasury—are able to trade them at approximately their current purchasing power thereby “summoning real resources,” because prices have not yet begun to rise in response to the expanded money supply. However, as these dollars are spent and re-spent in subsequent periods on a widening array of goods, prices begin to increase throughout the economy and the dollar begins to depreciate or lose purchasing power. At this point, those who have not yet received the new dollars are thus forced to cede command over some of the real goods that their nominal incomes had previously exchanged for. Nonetheless, contrary to Tamny, once all prices have risen, sellers continue to trade “real market goods” for these depreciated dollars not because they are “dense,” but because the higher prices they are receiving offset the loss of purchasing power of the individual dollar. And, of course, the sellers require these greater quantities of depreciated dollars in order to pay the higher prices of the goods that they demand. As episodes of aggressive and persistent inflation, e.g., the Great Inflation of the 1970s in the US, have amply demonstrated, this process of rational people continuing to trade real goods for an ever depreciating currency can go on for many years with the economy thus absorbing greater and greater quantities of depreciating monetary units printed by the central bank.

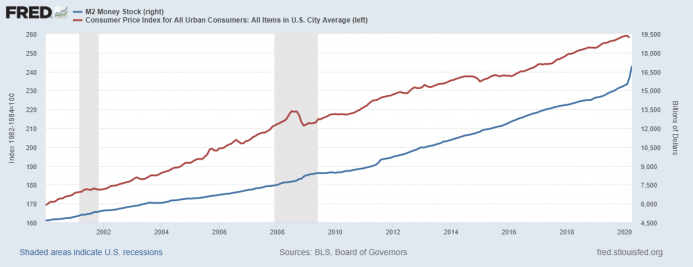

| In fact, this is precisely what has been occurring in the US economy over the past three decades. As the graph below shows, from 1990 to 2020, the Fed appeared to “aggressively print money,” increasing the M2 aggregate from $4.653 trillion to $16.871 trillion or by 270 percent. This near quadrupling of the money supply resulted in a continually depreciating dollar, as the price level as measured by the headline CPI index more than doubled and the dollar in 2020 retained only $.49 of purchasing power compared to the 1990 dollar. And yet, contrary to Tamny’s assertion, there continue to be “takers” for the depreciating US dollar, as the advance estimate of last quarter’s (annualized) GDP of $21.51 trillion—albeit forcibly shrunken by government restrictions of economic activity—can readily attest. |

M2 Money Stock / Consumer Price Index |

Full story here Are you the author? Previous post See more for Next post

Tags: newsletter