|

Swiss voters largely accepted on Sunday a reform of the corporate tax system that will scrap preferential treatment for multinational firms. The result also means a financial boost for the country’s ailing pension system. Two years after voters rejected a similar idea to overhaul corporate tax rules, the issue – this time linked controversially to pensions – received a clear thumbs-up. Final figures showed 64.4% of Swiss voters approved the government-backed plan, while none of the 26 cantons voted against. Canton Vaud, with 80%, was the keenest. The legislation will bring Switzerland into line with international tax rules by cutting out preferential rates offered to multinationals, while lowering baseline rates in an effort to prevent them fleeing to more attractive destinations. And to dispel left-wing fears that these lower overall rates will mean more strain on public services and citizens, the government has promised to pump an annual CHF2 billion ($1.98 billion) into the state pension scheme as compensation. |

|

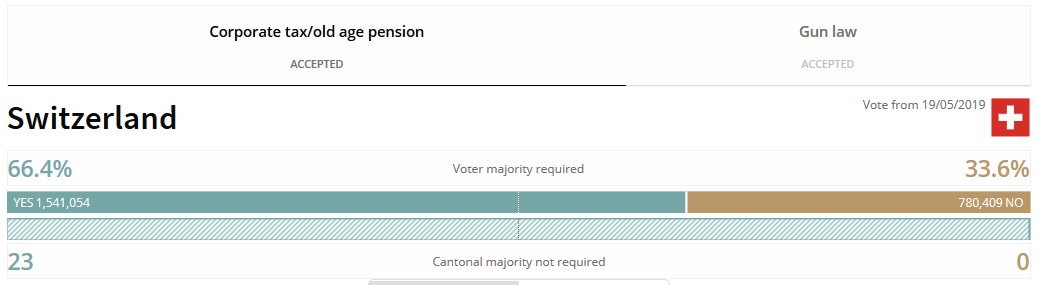

External ContentResults vote March 19, 2019 |

International pressure

Acceptance comes as a relief to authorities, who have been under pressure to fall into line with standards agreed by the Organisation for Economic Co-operation and Development (OECD) and the European Union (EU) on fair tax practices.

Speaking at a press conference on Sunday afternoon, finance minister and current Swiss president Ueli Maurer welcomed the “robust” result that he hoped would cement Swiss competitiveness and bring the country back into the EU’s good books.

Indeed, throughout the lead up to the vote, the government had warned that rejecting the package would compromise Switzerland’s attractiveness for business and spark an exodus of firms to low-tax competitors like Ireland, Singapore, or the Netherlands.

The new system will thus provide stability and certainty for the some 24,000 foreign companies based in Switzerland, which generate a quarter of Switzerland’s jobs and a third of its economic output.

Under the new system, such firms will lose the “special status” allowing them pay less tax than normal Swiss companies, but will still be able to cut bills by claiming deductions on income from patents or spending on research and development.

And though the new system is expected to produce an initial annual shortfall of some CHF2 billion in lost tax revenues, in the long-term, supporters say, failure to reform would have worked out even more costly.

Divisions remain

While the country’s main business federation welcomed the outcome, opponents of the plan – some left-wing groups and NGOs who see it as unfairly generous to companies – said the result on Sunday was bad news for public services, which will suffer from lower tax receipts.

Céline Vara, vice-president of the Swiss Green Party, which opposed the plan, told public radio that the CHF2 billion in lost tax revenues would come at the expense of normal taxpayers. “Public services, creches, or public transport will have to be cut [to fund the loss],” she said.

Others, both before and following the vote result, criticised the artificial linkage of corporate tax and pensions in one single package as being undemocratic. Minister Maurer rejected this on Sunday, saying that citizens recognised the “balance” between both issues.

Cantonal versions

Meanwhile, alongside the national ballot, the cantons of Geneva and Solothurn also voted on Sunday on laws to implement the reforms at a regional level, where tax rates in Switzerland are in practice set.

In Geneva, where there is a high concentration of multinational companies, voters accepted a plan to set the baseline corporate tax rate for all companies at 13.99%. Previously, it had been 11.6% for “special status” firms, and 24.2% for others.

The loss of tax revenues for the canton that this implies is estimated at some CHF186 million in 2020; authorities said that job security and attractiveness as a business destination compensates for the financial losses.

Solothurn, which was the region that gave the weakest “yes” to the national plan, narrowly rejected the cantonal implementation plan put to them; authorities there will have to come up with an alternative.

Results Vote May 19, 2019

Gun law in line with EU: 63.7% yes 36.3% no

Corporate tax reform: 66.4% yes 33.6% no

Turnout: 43.9%

Tags: newsletter,Politics