Protectionism has cross-party support in the U.S., and nationalist parties continue to gain traction in Europe. Where there is inequality, there is a surge in protectionism; a risk that could trigger the next global economic crisis sometime around 2020.

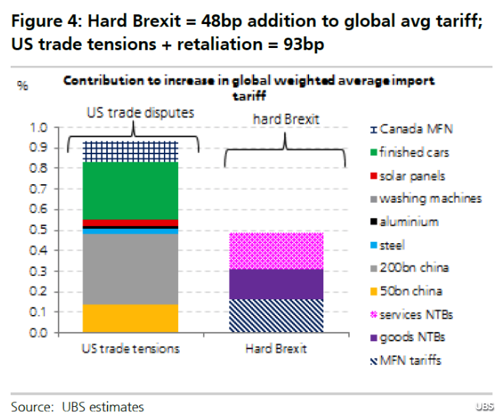

The Trump administration’s trade war and a hard Brexit could send tariffs to levels not seen in 15 years, according to UBS economist, as per Market Watch.

The Swiss bank views the U.S. tariffs, along with retaliatory measures (tit-for-tat with China), as the most significant factors boosting the metric. Second, are fears of a hard Brexit, which refers to the potential split between the U.K. and the European Union.

The first chart shows how the U.S. significantly outpaces the U.K. in the bank’s report of “which tariff wall if bigger.” In other words, the next global economic crisis could be triggered by President Trump’s trade war. |

UBS Hard Brexit |

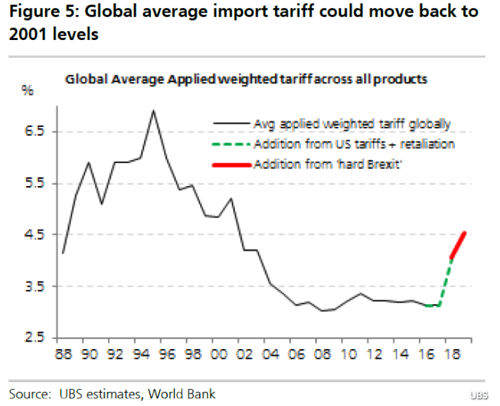

| The next chart reveals how the average global tariff could skyrocket to levels not seen since the early days of George W. Bush’s first presidential term.

Kapteyn then warns that trade wars and a hard Brexit could be the perfect cocktail to stymie global growth. “We wanted to give some sense of the jump in trade disruptions.” |

Global Average Import Tariff, 1988 - 2018 |

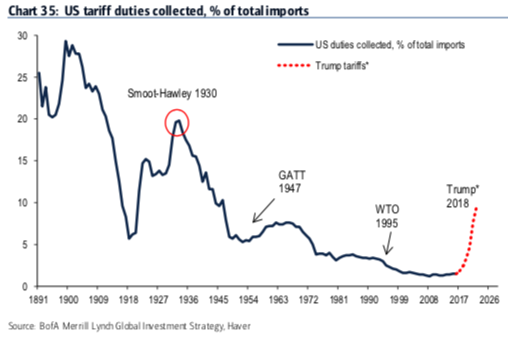

| BofA’s Michael Hartnett sings a similar tune of the coming turmoil. He warns U.S. fiscal easing and protectionism late in the economic cycle could cause trouble.

In the chart below, controls on trade, capital, and labor are likely to soar to levels not seen since the 1940s, effectively wiping out more than a half-century of progress under globalism.

|

US Tariff Duties Collected, 1891 - 2018 |

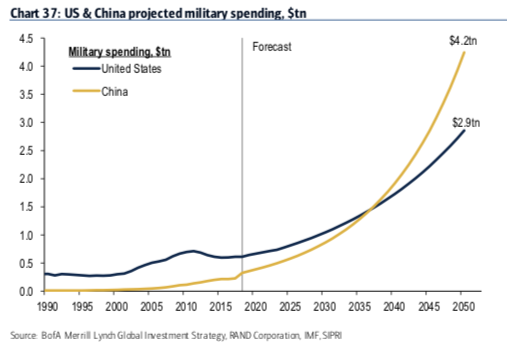

| Hartnett sees the trade war between the U.S. and China morphing into the next cold war, which the first stage has already begun: militaries in both countries are racing to acquire quantum computing, artificial technology, stealth warplanes, hypersonic weapons, lasers, robotics, and low Earth orbit weapons. By 2035, China is projected to outspend the U.S. on military spending.

He said tax cuts and trade wars late in the economic cycle had boosted U.S. EPS, but they have also stymied global GDP in 2018. |

US and China Projected Military Spending |

Late-cycle fiscal easing and trade disputes could be what ushers in the next global recession:

|

US Federal Budget Deficit vs Unemployment Rate |

Both Kapyeyn and Hartnett are on similar pages that global economic turmoil is around the corner. Now is the time to prepare.

Full story here Are you the author? Previous post See more for Next postTags: newsletter