Monthly Archive: March 2018

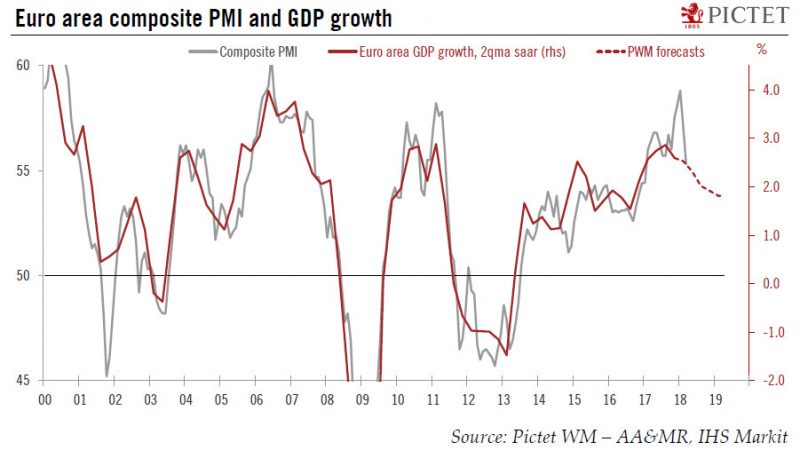

Euro area Flash PMIs: “Growing pains” but no reason to panic

Today’s first batch of euro area March business surveys looks worrying at first sight. The drop in the euro area composite PMI index, from 57.1 to 55.3 in March (consensus: 56.8), was the second one in a row and the largest monthly decline in six years. New orders fell to a 14-month low. The correction in business sentiment was predominantly driven by the manufacturing sector, which could reflect broader concerns of a trade war.

Read More »

Read More »

Freight losses fail to dampen state railway profits

The Swiss Federal Railway’s net profit increased by CHF18 million ($19 million) to CHF399 million ($418 million) last year despite posting a loss in its troubled freight division. The company confirmed a previous decision to cut 800 freight jobs but plans to reduce certain prices for its increasing number of customers, it announced in its annual report on Tuesday.

Read More »

Read More »

Salt set to enter the landline telecoms market

Mobile telephone operator Salt has announced that it will begin offering landline services in Switzerland, in a move set to intensify competition amongst current providers. Salt, which is already an established player in the mobile market, announced on Tuesdayexternal link that it would be proposing “a complete range of telecommunication services in Switzerland, including a ‘triple play’ offer based on high-speed broadband technology”.

Read More »

Read More »

Gold +1.8 percent, Silver +2.5 percent As Fed Increases Rates And Trade War Looms

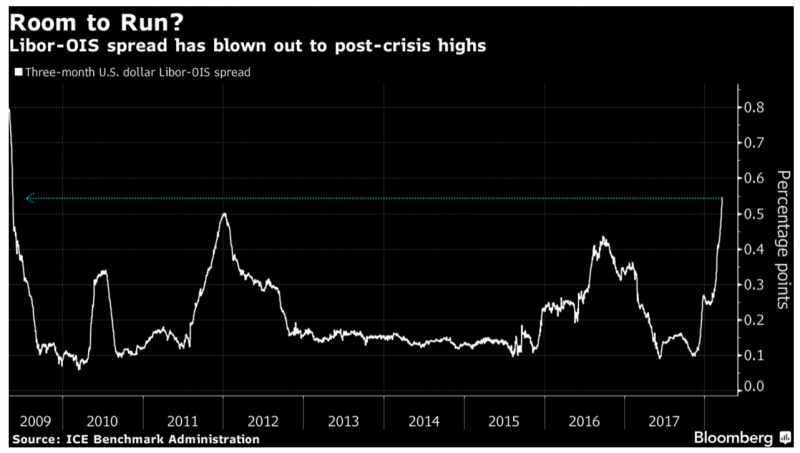

Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday. Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range. Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018. Markets disappointed at lack of hawkish comments from new Fed Chair. Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products including mortgages based off LIBOR.

Read More »

Read More »

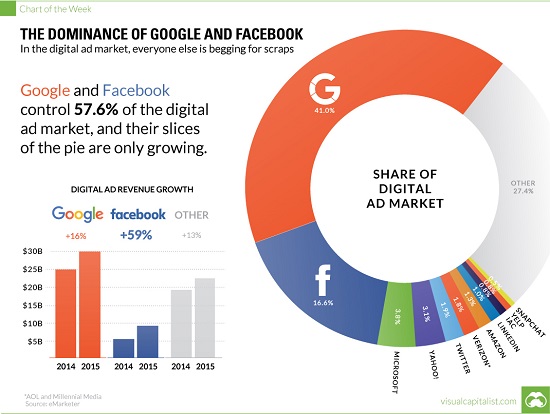

Should Facebook and Google Pay Users When They Sell Data Collected from Users?

Let's imagine a model in which the marketers of data distribute some of their immense profits to the users who created and thus "own" the data being sold for a premium. It's not exactly news that Facebook, Google and other "free" services reap billions of dollars in profits by selling data mined/collected from their millions of users. As we know, If you're not paying for it, you're not the customer; you're the product being sold, also phrased as if...

Read More »

Read More »

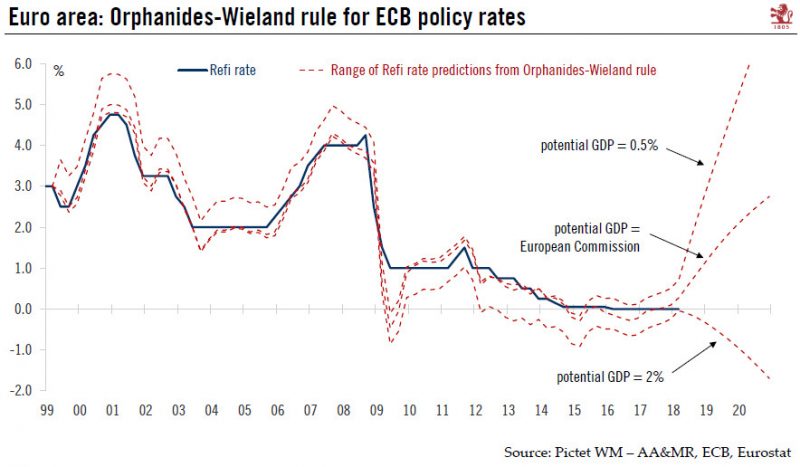

Europe chart of the week – monetary policy

Much of recent ECB dovish rhetoric has been building around the (not-sonew) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good reasons.

Read More »

Read More »

Cool Video: Let’s Not Declare Trade War Yet

Trade tensions have risen. No doubt about it, but to consider this a trade war is premature. We should not pretend that this is the first time that the US adopted protectionist measures that ensnarled are military allies. We have been to this dance before.

Read More »

Read More »

US trade disputes indirectly threaten Swiss economy

Ongoing global trade disputes involving the United States are casting a potential shadow over Swiss economic growth, along with other international events, such as the Italian elections and Brexit. However, the Swiss economy is forecast to expand 2.4% this year and 2% in 2019.

Read More »

Read More »

Raising Switzerland’s retirement age – like death and taxes

Last week, State Councillor Peter Hegglin (PDC/CVP) withdrew his motion demanding Switzerland’s retirement age automatically rise with life expectancy. He argues that Switzerland urgently needs to find a way to ensure the financial health of its pension system and raising the retirement age is the main way to do this.

Read More »

Read More »

Credit Concerns In U.S. Growing As LIBOR OIS Surges to 2009 High

Key Metric LIBOR OIS Signals Major Credit Concerns. Widening of the spread between LIBOR OIS (overnight index swap) rate raises concerns. Spread jumped to 9 year widest spread, rising to 54.6bps, most since May 2009. Libor recently moved to over 2% for first time since 2008. Wider spread usually associated with heightened credit concerns.

Read More »

Read More »

Incrementum’s New Cryptocurrency Research Report

As we noted on occasion of the release of the first Incrementum Crypto Research Report, the report would become a regular feature. Our friends at Incrementum have just recently released the second edition, which you can download further below (if you missed the first report, see Cryptonite 2; scroll to the end of the article for the download link).

Read More »

Read More »

Swiss central bank records huge profits after franc slide

The Swiss National Bank (SNB) was less active on the foreign exchange markets last year, acquiring CHF48.2 billion ($50.8 billion) in foreign currency to weaken the franc. On Thursday, the central bank nonetheless confirmed massive profits on currency holdings in 2017. In 2017, the SNB purchased CHF48.2 billion in foreign currency to stop the Swiss franc appreciating – down from CHF67.1 billion in 2016.

Read More »

Read More »

FX Daily, March 22: Dollar Trades Off

The US dollar has not recovered from the judgment that yesterday's that Fed was not as hawkish as many had anticipated. There was no indication that officials thought they were behind the curve or prepared to accelerate the pace of hikes. Powell is comfortable with the broad policy framework that has been established but seemed to have little time for the summing up of the individual forecasts (dot plot).

Read More »

Read More »

Geneva’s mega apartment project now underway – 1,000 apartments and 2,500 jobs

Last week, work started on a project to construct 1,000 apartments in Geneva. The project known as the Quartier de l’Etang will unfold over an 11 hectare site in Vernier, not far from Geneva airport. The video above shows the commencement ceremony and a computer animation of the completed project.

Read More »

Read More »

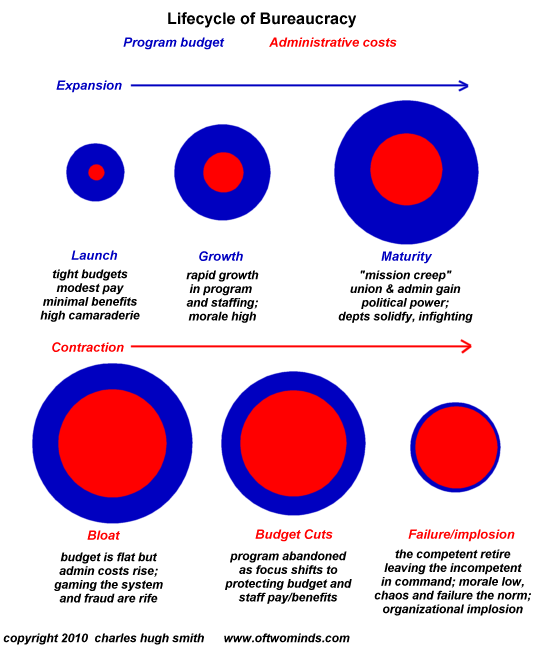

Solutions Only Arise Outside the Status Quo

Solutions are only possible outside these ossified, self-serving centralized hierarchies. Correspondent Dan F. asked me to reprint some posts on solutions to the systemic problems I've outlined for years, most recently in How Much Longer Can We Get Away With It? and Checking In on the Four Intersecting Cycles. I appreciate the request, because it's all too easy to dwell on what's broken rather than on the difficult task of fixing what's broken.

Read More »

Read More »

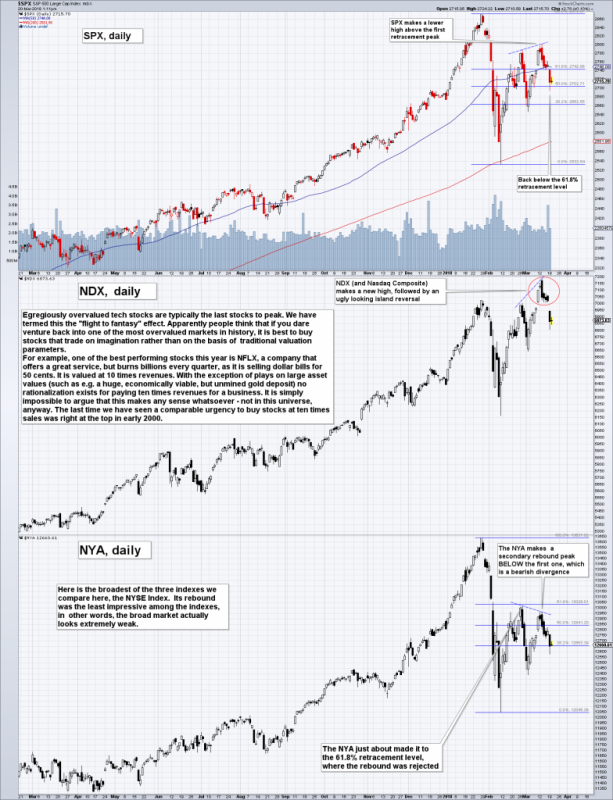

US Stock Market – The Flight to Fantasy

The chart formation built in the course of the early February sell-off and subsequent rebound continues to look ominous, so we are closely watching the proceedings. There are now numerous new divergences in place that clearly represent a major warning signal for the stock market. For example, here is a chart comparing the SPX to the NDX (Nasdaq 100 Index) and the broad-based NYA (NYSE Composite Index).

Read More »

Read More »

„Vollgeld“ ist rotester Kommunismus – lanciert vom Ausland

Schuldfrei“ – so soll unser Geld zukünftig in Umlauf kommen. Das Wort „schuldfrei“ ist positiv besetzt. Wer möchte nicht schuldfrei sein? Jedermann. „Schuldfrei“ ist das zentrale Wort im Initiativtext der kommenden Vollgeld-Initiative, über die das Schweizervolk am 10. Juni 2018 abstimmen wird. Die Initiative kommt daher wie der Wolf im Schafspelz. Absatz 3 des Initiativtextes besagt.

Read More »

Read More »

Switzerland’s parliament rejects plan to cut health insurance discounts

Switzerland has a system of compulsory health insurance. Residents must choose an insurer and pay. Those who don’t are automatically signed up and sent a bill. Other than shopping around, choosing a policy with an excess, a sum that must be covered out of your own pocket before the insurance kicks in, is one of the few ways to reduce your premium.

Read More »

Read More »

Swiss accounts blocked over suspected Nigerian oil bribery case

The Office of the Attorney General of Switzerland (OAG) has blocked various bank accounts in Switzerland regarding an alleged oil bribery scheme linked to Nigeria. Executives from oil giants Shell and Eni are due to stand trial in Milan, Italy, in May.

Read More »

Read More »