Monthly Archive: December 2016

Smart Programs of Capital Destruction

These days everything must be smart. There are smart cities, smart grids, smart policies, smart TVs, smart cars, smart phones, smart watches, smart shoes, and smart glasses. There’s even something called smart underwear. Before long everything around us will be so smart we’ll no longer have to do one critically important thing. We’ll no longer have to think; smart algorithms will think for us. What’s more, the possibilities for not thinking are...

Read More »

Read More »

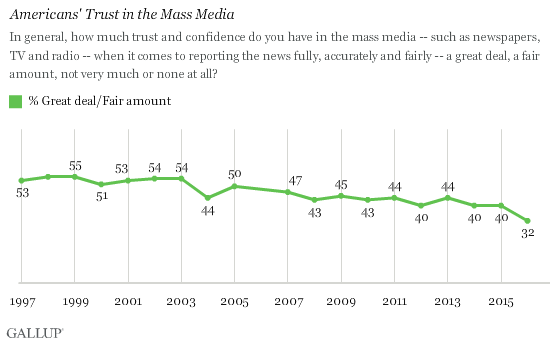

From Captive Audience to Open Democracy: Why the Mainstream Media Is Freaking Out

In its panicky rush to demonize the independent media via baseless accusations of "fake news," the mainstream press has sunk to spewing "fake news" of its own. Here's The Washington Post's criminally false "fake news" article in case you missed it: Russian propaganda effort helped spread ‘fake news’ during election, experts say.

Read More »

Read More »

Weekly Sight Deposits: No SNB Interventions, Short CHF nearing records

Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later.

Read More »

Read More »

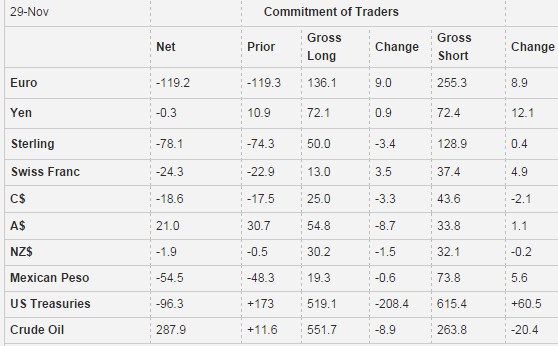

Weekly Speculative Positions: Short CHF Close to Records of 2015

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26.4K contracts. Now we are at 25.4K.

Read More »

Read More »

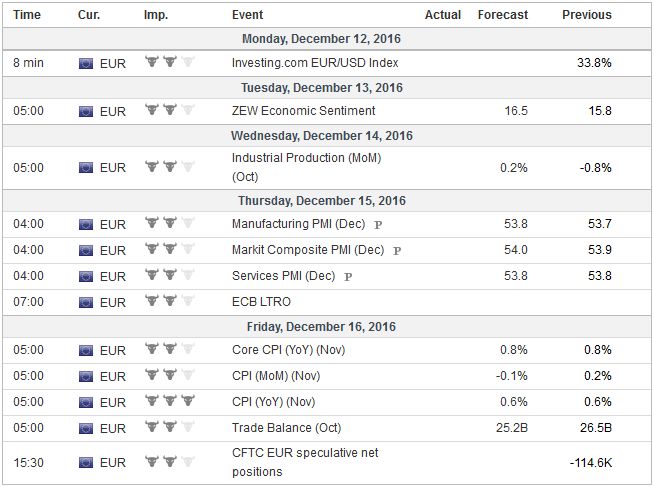

FX Weekly Preview: What the FOMC Says may be More Important than What it Does

FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

After the ECB meeting, we saw curve steepening in the eurozone. This is on top of curve steepening in the US since the elections. While we are nowhere near the magnitude of the 2013 Taper Tantrum, these yield curve dynamics remain negative for EM bonds and EM FX. EM equities are a different matter, supported in part by the continued post-election rally in DM equity markets. Higher commodity should also help insulate some EM countries from the...

Read More »

Read More »

Credit Suisse planning more Swiss job cuts

Credit Suisse Group AG is preparing a new cost-savings program that puts as many as 1,300 jobs in Switzerland on the line, according to Schweiz am Sonntag. The plan will be announced Wednesday, when the lender holds its investor day in London, the newspaper said, without saying where it got the information. Credit Suisse’s Swiss unit may slash an additional 1,000 to 1,300 positions, or about eight to 10 percent of the unit’s workforce, it said.

Read More »

Read More »

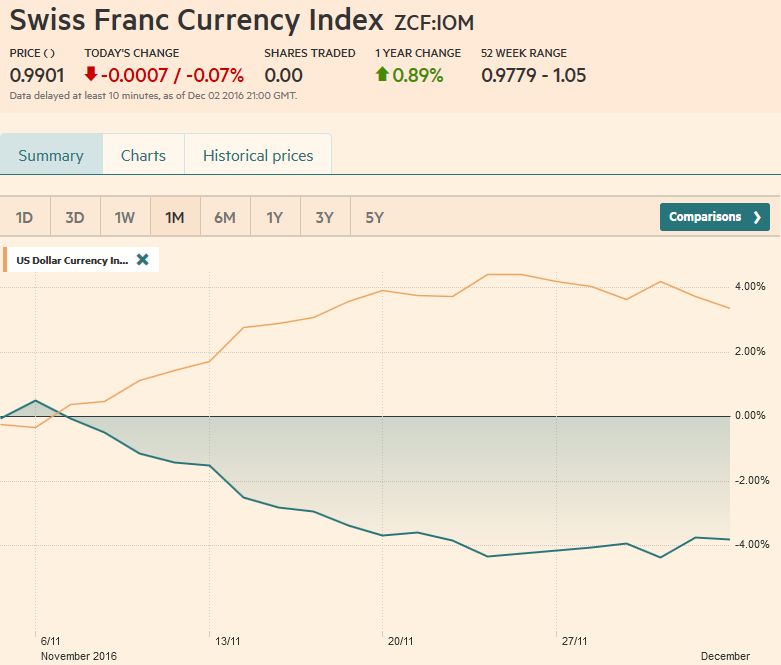

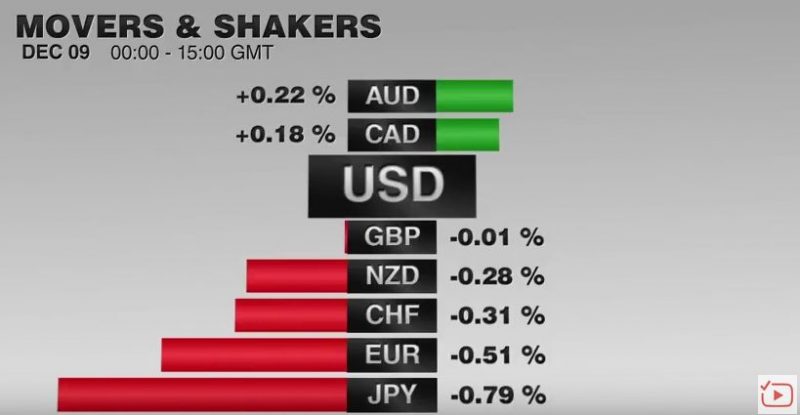

FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. USD/CHF The US dollar is finishing the year on a firm note. It rose … Continue reading »

Read More »

Read More »

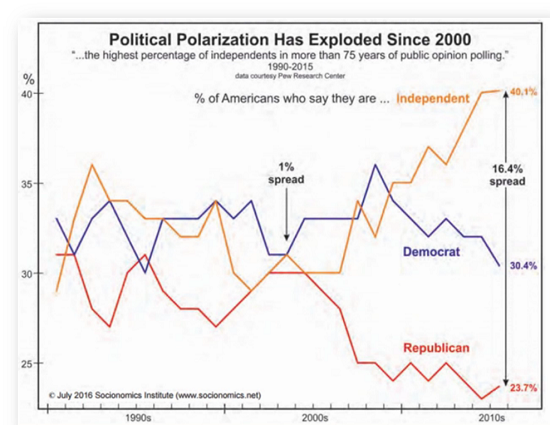

A Disintegrative Winter: The Debt and Anti-Status Quo Super-Cycle Has Turned

With this list of manifestations in hand, we can practically write the headlines for 2017-2025 in advance. How would you describe the social mood of the nation and world? Would anti-Establishment, anti-status quo, and anti-globalization be a good start? How about choking on fast-rising debt? Would stagnant growth, stagnant wages be a fair description? Or how about rising wealth/income inequality? Wouldn't rising disunity and political polarization...

Read More »

Read More »

Which Of These Would You Rather Have In Your Safe?

Let’s say you have two equal size safety deposit boxes. One box you completely fill up with stacks of $100 bills. The other box you fill up with gold. Which of the two is “worth” more? It’s easy to calculate. A stack of 100x $100 bills is 6.14 inches long, 2.61 inches wide, and 0.43 inches tall. That’s a volume of 6.89 cubic inches (112.92 cubic centimeters… and we’ll use the metric system from here on out because it really does make more...

Read More »

Read More »

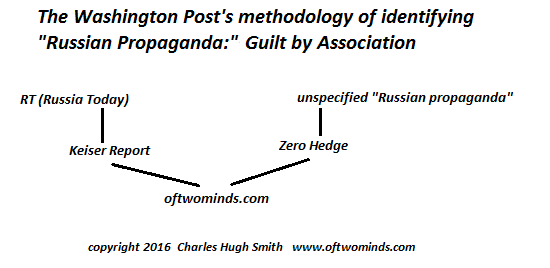

Charles Hugh Smith a Russian Propaganda Site?

We highly appreciate the site of Charles Hugh Smith because it integrates good economic graph with critical political comments.

A couple of days ago, it appeared on a list of "Russian Propaganda Sites" that got cited by mainstream media.

Read More »

Read More »

Pension payments could become compulsory for self-employed in Switzerland

Switzerland’s Federal Council is looking at a proposal to make pension payments compulsory for self-employed workers in the same way that they are for salaried workers.

Read More »

Read More »

Adoption Of The Euro Has Been ‘Unequivocally Bad’ For Southern European Economies

Some say that the common currency prevents less productive economies from cheating by weakening their national currencies and forces them to become more efficient and competitive. Industrial production data shows that it is not the case. Italy, France, Greece and Portugal have not only stopped producing more; they are producing now less than in 1990! The decay started immediately after the introduction of the euro in 2002!

Read More »

Read More »

Emerging Markets: What has Changed

Hong Kong Chief Executive Leung Chun-ying said he won’t seek a second term. Korea’s parliament voted 234-56 to impeach President Park. Czech National Bank raised the possibility of negative rates to help manage the currency. A Brazilian Supreme Court justice removed Senate chief Renan Calheiros from his post, but was later overturned by the full court. Brazil central bank signaled a possibly quicker easing cycle.

Read More »

Read More »

Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change.

Read More »

Read More »

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

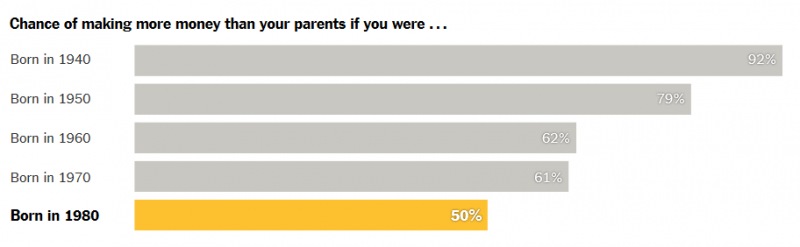

Great Graphic: Another Look at the Reproduction Problem

In order for a society to be sustained social relations have to be reproduced. Yet now neither the middle class nor capital are able to reproduce themselves. This may be the single greatest challenge our society faces.

Read More »

Read More »

Uncertainty prevails everywhere, says Draghi, but apparently investors don’t mind

According to European Central Bank President Mario Draghi “uncertainty prevails everywhere” but apparently investors don’t mind. Market participants shrugged off last weekends “no” to constitutional reform in Italy and the subsequent resignation of Prime Minister Matteo Renzi to push European indices to 12 month highs this week.

Read More »

Read More »

Swiss EU immigration – unfortunately there is no plan B, says president in interview

Switzerland’s plan to solve an immigration dilemma with the European Union could avoid being held up by another referendum if it gets strong support in parliament next week, according to Swiss President Johann Schneider-Ammann. A clear result in a final vote on Dec. 16 with the Swiss People’s Party, or SVP, in the minority could make it “delicate” for the group to push for another plebiscite, he said in an interview with Bloomberg Television’s Guy...

Read More »

Read More »

How Trump Can Bring Outside-the-Box Thinking to Bear on the Fed

President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous. On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically motivated. Trump also called for the Federal Reserve to be audited.

Read More »

Read More »