Banks have been lobbying intensively against Brexit. Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU... and now we know why (hint - it's not concern for the common man).

As The Wall Street Journal reports, about a decade ago, Goldman launched project “Armada,” a plan for a hulking European headquarters on the site of an old telephone exchange in London.

Unbundling this kind of structure will be expensive and time-consuming, lawyers and bankers say. Goldman is mapping out which jobs might be hit by a loss of this passport, or the right to sell services across the EU, while scoping out European countries where it has existing banking licenses and infrastructure that could quickly be scaled up, according to a person familiar with the matter. Goldman also has a banking license in Germany, for instance.

In the event that this passport was lost, derivative and currency trading with EU counterparts would likely be hit hard. A large portion of euro currency and securities trading takes place through London, outside the eurozone. In the event of Brexit, EU authorities may well press for the trading of euro securities to be cleared within the trading bloc, bankers say.

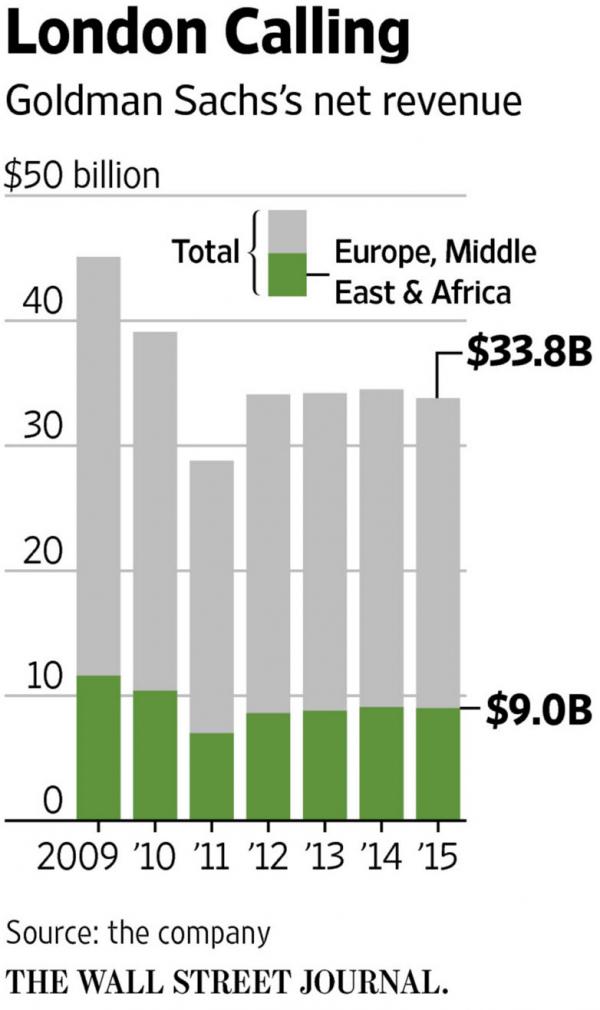

Today, Goldman services Middle Eastern and African customers in London too. Some 90% of its 6,000 staff based in Europe are in London. Europe, the Middle East and Africa accounted for 27% of Goldman’s $33.8 billion of net revenue in 2015.

But faced with the prospect of spending billions of dollars to rejig their operations, banks have been lobbying intensively against Brexit.

Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU.

The bank has donated around $700,000 to a group which is lobbying against Brexit, according to a person familiar with the matter. Its executives have signed warning letters to major British newspapers. An EU flag currently flutters above its London headquarters. Last fall the bank organized events on the sidelines of opposition Labour and governing Conservative party conferences to debate the role of the U.K. in Europe.

During the annual meeting of the World Economic Forum in January in Switzerland, Gary Cohn, president of Goldman Sachs, reiterated a well-rehearsed warning. “It is imperative for the U.K. to keep the financial-services industry in the U.K.,” he said, adding, “I don’t know what would replace that industry.”

The advocacy by U.S. banks has antagonized those, often at smaller brokers or hedge funds, who say the U.K. financial sector would be less heavily regulated outside the EU and thrive.

“Why would the Americans be interested in what is good for the U.K.?” said Howard Shore, executive chairman of Shore Capital Group PLC, an investment group.

“They are interested in what is good for their bank.”

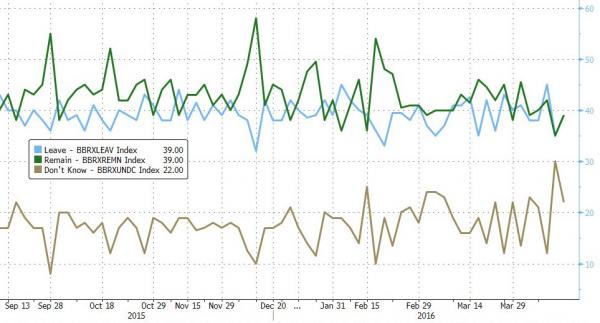

Shocking!! So next time you read a research piece proclaiming the catastrophe Brexit would be, consider the above... because fo rnmow it's all about the "undecided"

Full story here Are you the author? Previous post See more for Next postTags: Eurozone,Goldman Sachs,Middle East,Switzerland,Wall Street Journal