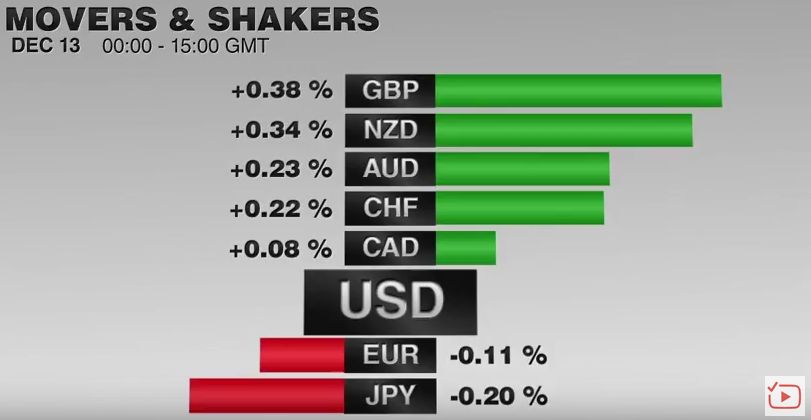

The euro is paring the recovery that began in the middle of the ECB's press conference yesterday. The markets had reacted as one intuitively would expected to broad easing of interest rates and credit conditions.

The market reversed, and violently so, only after Draghi seemed to rule out further interest rate cuts. Many investors took this to mean the ECB had gone all in and that monetary policy had reach the end. We do not expect this interpretation to be sustained.

Even though we suspect that Draghi could have simply said that with the new initiatives, the ECB was reasonably confident that deflation forces will be arrested and the tightening of financial conditions will be reversed. He could have continued to explain that the ECB does not pre-commit and that it is prepared to take fresh actions should they be judged necessary.

However, we recognize Draghi's constraints. He indicated that a tiered deposit rate was rejected because the exemptions would imply the complete removal of a lower bound of interest rates. The ECB does not accept that. Even if there were some doves that believe that minus 40 bp is some kind of floor, when other central banks, like the Swiss National Bank, has more negative rates, there likely had to be a compromise with those who are uncomfortable with the negative rate regime.

There are three things that much of the post-mortem commentary has missed. First, Draghi directed the focus of additional measures on credit easing, that is QE, rather than rates. Draghi had previously indicated that interest rate policy had reached the end of tether, only to backtrack. Second, most of the criticism has been levied against monetary policy rather than communication. It was essentially one comment by Draghi that reversed the markets' initial constructive response. Third, the success or failure of the ECB's new initiative cannot be judged by the reaction to largely one class of investors (speculators) in the first 24-hours.

The ECB did easy policy and ease aggressively. It not only cut all key interest rates and accelerated the asset purchases by a third, but the ECB also included investment grade corporate bonds in the eligible assets, while also increased the amount of international bonds that can be included, and a new TLTRO scheme that could result in the ECB paying banks to participate.

The details of the corporate bond purchases have not been announced, but the effect on corporate bond spreads was immediate. Moreover, as investment grade bonds rallied compared with government bonds, the high yield sector also performed better. The ECB chose not to buy bank banks though as the single supervisor for systemically important banks it would seem to have done its due diligence.

However, the rally in corporate bonds may help bolster European bank balance sheets. The financials are outperforming today in Europe. While the Dow Jones Stoxx 600 is up 1.75% near midday in London, the financials are up 3%. That does not speak to the ineffectiveness of monetary policy or the loss of ECB credibility.

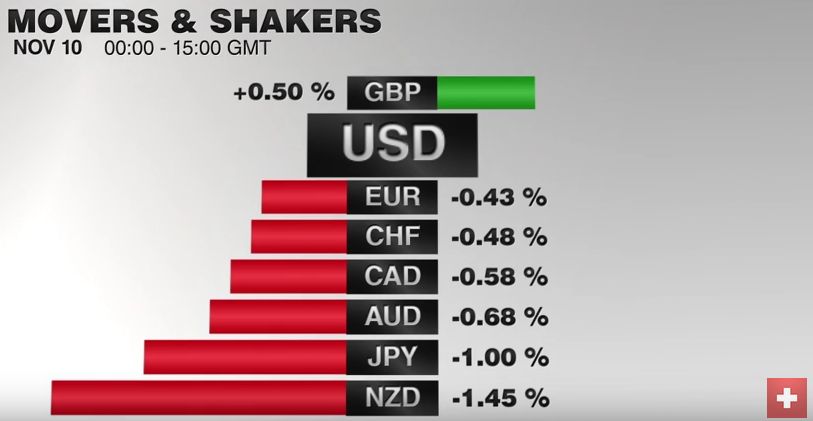

The dramatic reversal in the capital markets yesterday was particularly difficult for short-term participants, leaving many to prefer the sidelines ahead of the weekend, awaiting clear indications of market direction. Today’s economic news is light. It has been largely limited to UK trade and construction figures and Italian industrial production figures.

UK’s trade balance improved in January but only because the December figures were revised to a larger shortfall. The goods deficit was GBP10.29 bln after a revised GBP10.45 bln in December. The non-EU deficit slipped to GBP2.2 bln from GBP3.0 bln. The overall trade deficit narrowed to GBP3.459 bln from GBP3.699 bln. Separately, the UK reported a 0.2% decline in January construction spending. The consensus had expected an increase of the same magnitude. The disappointment was blunted by the sharp upward revision to the December series to 2.1% from 1.5%.

With the initial Brexit risk adjustment made, sterling seems to be at the mercy of the overall dollar tone and the euro. Sterling is poised to recover further. Initial resistance is seen near yesterday’s high (~$1.4320). A break of it could signal a move toward $1.4400.

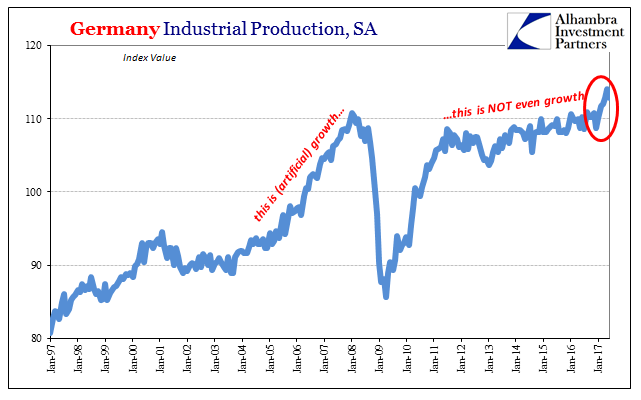

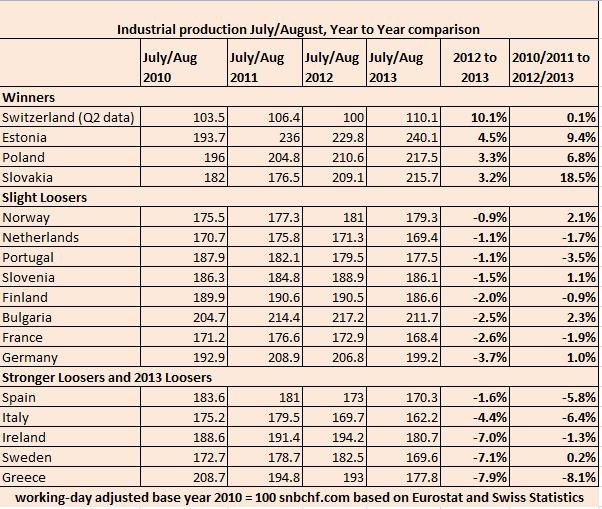

Italy completed the trifecta. Recall that in December Germany, France, and Italy reported declines industrial output. Earlier it was indicated that Germany and French production bounced back more than expected in January. Italy matched suit. Italian industrial output rose 1.9% compared with consensus forecast for a 0.7% increase.

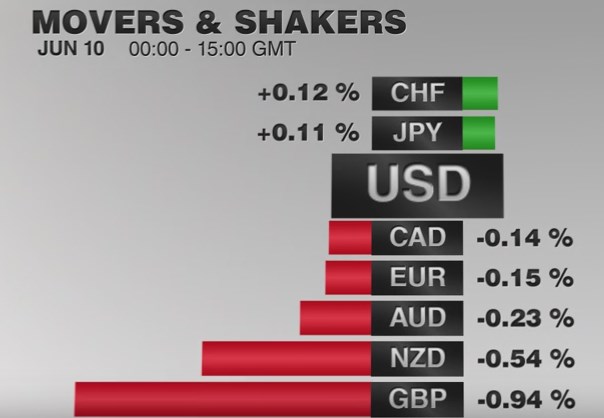

After reaching almost $1.1220 yesterday, the euro was sold in the European morning to nearly $1.1090. The intraday technicals suggest limited scope for additional losses today. We see initial support near $1.1060 and then $1.1025. Our larger bearish call for the euro was predicated on divergence, and that remains intact. With the FOMC meeting next week, the focus shifts from the ECB-driver to the Federal Reserve.

Firm US bond yields and rising equities helps the dollar retake the JPY113.00 level and look again at the JPY114.00 area. The greenback needs to push through the JPY114.40-60 area to lift the tone. Otherwise, the range affair continues. The BOJ meets next week and is unlikely to take fresh steps yet. However, unlike the ECB, the next easing by the BOJ is expected to be on rates note on credit easing (QQE).

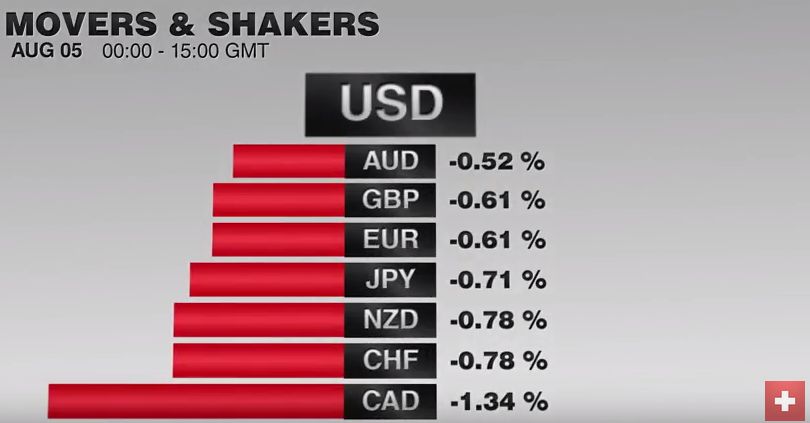

Rising commodity and equity prices, and the general appetite for risk are underpinning the dollar-bloc currencies. The Australian and Canadian dollars are up nearly 0.75%, with the New Zealand dollar up half as much. Canada reports February employment figures today. The unemployment rate is expected to be flat at 7.2%. Canada is expected to have grown 10k jobs after losing 5.7k jobs in January. While the market often responds to the headline, note that in January, full-time positions increased by 5.6k, with the job losses exclusively in part-time work. The rise in oil prices seems to be more critical for the Canadian dollar at the moment, but the two-year interest rate differential continues to work against it.

The IEA reports that OPEC output slipped 90k barrels a day in February. The market seemed to like the news, but it looks no more than a rounding error. Iraq, UAE, and Nigeria had declines in output, which were offset nearly in full by the 220k barrel a day increase by Iran. Iran output reached a four-year high of 3.22 mln barrels a day. Particularly noteworthy is the fact that Saudi output edged higher to 10.23 mln barrels a day from 10.21 mln. The output freeze that captured the imaginations of many was required Iran to participate. It is not, and cannot until its output has reached pre-sanction levels. This may take a several more months, according to reports.

Tags: Italy Industrial Production