We reckon that a sustained US recovery will make it possible that the eurozone splits up. Today’s Italian elections are maybe the start of an upcoming Italian euro exit.

UPDATE 2014:

Stormy #Grexit would not pose systemic risk for € as in 2011-12. Rather, would help fend off populists. So says @FT http://t.co/6vaCtbHaOm

— Alessandro Leipold (@ALeipold) December 14, 2014

(Post originally written in early 2013, arguments still valid today)

One of the most famous financial blogs, Mish’s Global Economic Trend, argues that an Italian euro exit might be best for the country: Greece should have taken this path four years and Spain two years ago.

The polls show that Berlusconi and the anti-euro party of Beppe Grillo are on the rise. The Italian’s hate against the financial oligarchy and their friends, the European leaders and German exporters and politicians, is getting bigger and bigger each time some of these leaders tell them what they should vote.

The left-wing form of anti-europeans, la Rivoluzione Civile, has emerged and might take 3 to 5%.

Latest Poll By Elecionista (min-max across polls):

- centre-left (Bersani, pro-euro) 33-36%

- centre-right (Berlusconi, potentially anti-euro) 28-30%

- M5S/Movimento 5 Stelle (Beppe Grillo, right anti-euro) 17-21% (see its position on the euro)

- Monti/centre (pro-euro) 11-13%

- Rivoluzione Civile (left anti-euro) 3-5%

If this poll becomes reality then it could mean a hung parliament, the centre-left wins the “camera” thanks a premium of delegates assigned to the party with highest number of votes on national level (Majoritarian system). But Berlusconi and Grillo would have the majority in the senate because the same premium is applied only at regional level. While in one region the premium is attributed to Berlusconi, in the other one it can be Bersani. At the end, the majoritarian system for the senate becomes close to the proportional system.

For once, the Swiss public completely agrees with the European leaders and wants to fight against the common enemy, the “enfant terrible” Silvio Berlusconi, a personality completely incompatible with Swiss values, but highly compatible with the Italian mentality.

We and most of our Italian readers, however, recognise that the result of Monti’s Reign of the German-Italian Spread was a sharp reduction in GDP and some halfway reforms. We maintain our position that an Italian euro exit is thinkable (see why) and that the Northern Euro creation would be the best way to avoid excessive austerity and slow growth over a decade (see the upcoming Spanish Lost Decade).

Similarly as Mish, we reckon that the euro zone will split up one day, even if the financial oligarchy tries to convince us that simple economic principles like Robert Mundell’s optimum currency area are not not valid any more and this just for the sake of avoiding losses on banks’ and central banks’ balance sheets.

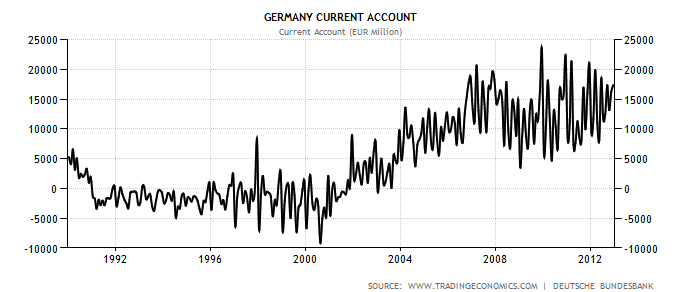

Though we think that the breakup story is nothing which happens very soon. In particular it was not possible during the period of falling US house prices and high risk aversion between 2008 and 2012. But at the latest, it will be feasible when the continuing German yearly pay rises of 3% and more help to lift inflation to 3 – 4 %, while austerity and weak competitiveness will continue to depress salaries and inflation in Southern Europe. Last but least, the euro zone contradicts not only economic principles but also political logics:

“there will come a time when a populist office-seeker will stand before the voters, hold up a copy of the EU treaty and (correctly) declare all the “bail out” debt foisted on their country to be null and void. That person will be elected.” (source Mish)

But never the less, isn’t the situation becoming similar to:

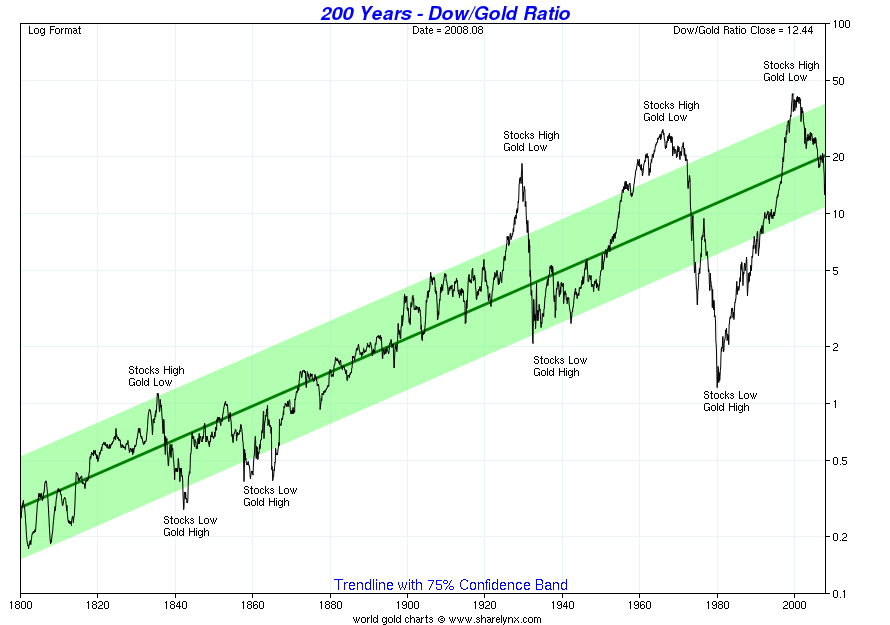

- 1981-1987, when Volcker raised interest rates, killed global growth and the gold price (see below). The Latin American (financial !) debt crisis led to an oil glut, a strong dollar and strong markets.

- or to 1998 to 2000, when US markets completely shrugged of the Asia (financial !) crisis and the fear during the euro creation thanks to relatively cheap oil, strong spending and a stock market bubble. The risk indicator gold was on record lows. Most economists warned against the euro creation just seven years after the breakdown of the European Exchange Rate Mechanism (ERM), In the year 1999, however, Germany was far weaker than today and as weak as the Southern members, because it had enormous costs with the integration of Eastern Germany. The whole euro zone was perceived as a conglomerate of weak countries and the euro fell to levels of 86 US cents, but stock markets did not care at all.

We reckon that a sustained US recovery will make it possible that the eurozone splits up. Today's Italian elections are maybe the start of an upcoming Italian euro exit. - Click to enlarge

The recent rise of home prices and growing US risk appetite, might be soon good enough so that the US economy is able to shrug off another localised financial crisis like an Italian euro exit (and even a potential chain reaction included). As opposed to the Asian and Latin American crises it will not even involve a whole continent, just some countries of low global importance in the Southern part of an ageing continent, Europe.

The combination of the new US oil boom and lower European and global growth could lead to cheaper gas prices. And while US consumers will be simply happy about lower gas and rising home prices, they will not give attention to Italy, Spain or Greece. And if US consumers do not care then financial markets do not care neither.

See more for