Here a translation of the interview with the president of the Swiss National Bank, Thomas Jordan, in the finance magazine ECO of the Swiss television SF1. Here the original German video.

Question: Given that the SNB has reserves of over 200 bln. Euros, are you still able to sleep ?

Jordan: We are in a very difficult situation, Europe has a big debt problem, the world economy is not advancing very well. In this very difficult situation we are trying to achieve the best for Switzerland and to fulfill our mandate. Sometimes we have tensions, but despite these tensions I am able to sleep well.

[StartAdTest] Question: Tensions means that you must buy euros in order to defend the minimum rate. There are many people of our audience who think that the SNB is taking incredible risks. What do you say to these people ?

Jordan: I can understand that many are concerned about the risks. It is important to state that the minimum rate introduction was absolutely necessary. Otherwise we would have had a destabilization of the Swiss economy, also the big risk that we could fall into a deflation. Under these circumstances the floor had a very positive effect and helped the Swiss economy to stabilize.

Question: At the same time, defending the floor is getting more and more difficult, you got to spend more and more money. This summer there were certain months when you had to spend more than 50 billions, are you able to hold this out forever?

Jordan: Currently it is out of question that we deviate from our policy. It is absolutely necessary to maintain the minimum rate. We would obtain a very difficult situation for the Swiss economy and could have the risk of falling into deflation. Therefore there is no reason to deviate from this policy.

Question: Do you have an exit scenario ?

Jordan: The minimum rate is an extreme measure for an extreme situation. The minimum rate is not for the eternity. But today an exit is out of question. It is the correct monetary policy for our current challenges.

Question: How big is the probability that the minimum rate still exists in one year ?

Jordan: We cannot evaluate this probability. Currently an exit is out of question. We will enforce the minimum rate with all consequences.

Question: Aren’t you a prisoner of your own policy. You even cannot remove the floor, because you would directly have huge losses on your euro positions. If the euro goes down by 20% then you would have losses of 50 billion ?

Answer: The question of losses is an important question. But the question if there will be losses or not, is not important for monetary policy. Our mission is create monetary conditions that are correct for the Swiss economy and to maintain price stability.

Question: Still, wasn’t the situation last autumn not a little bit different ? When you introduced the minimum rate, people thought that the situation will calm down quickly and the euro will rise subsequently again. But this autumn the things look a lot more gloomy ?

Jordan: We are in very difficult situation as for Europe. There are always doubts if it possible to organize the crisis management in short term. There is a lot of volatility in the markets. But it does not make sense to change monetary policy in a phase in which these tensions have become bigger.

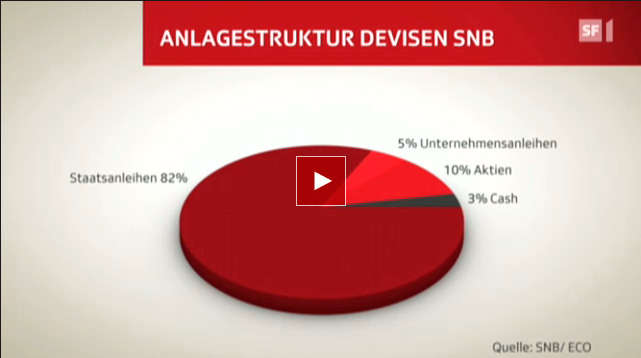

Question: You do not simply store these euros at the National Bank, but you invest them. We have prepared a graph:

3% are invested in cash. 82% in government bonds, 5% in corporate bonds and 10% in stocks. A big part in government bonds, but these are not that secure these days, does this make sense ?

Jordan: The investment policy is an important for the SNB. Since a long time we have a very progressive investment policy, we are one of a few central banks who invest in stocks. One has to see that these government bonds of which you spoke, are AA or even AAA. For us it is very important not to run credit risks.

Question: Somebody wrote that the SNB is the biggest single holder of German bonds? We Swiss finance Germany ?

Jordan: I do not comment on this. We diversity our investment in order to avoid concentration risks. But certainly, a big part is invested in euros.

Question: There was an idea of these politicians to create a sovereign wealth fund with all these euros?

Jordan: We are very skeptical to this idea. We think that it does not help as for the execution of the minimum rate. The minimum rate purely depends on the SNB if she is willing to defend it. Having a sovereign wealth fund or not. But the main risk, the exchange rate risk, is exactly identical, if the euros are directly in our balance sheet or externally in a sovereign wealth fund. Also from this perspective, a sovereign wealth fund does not help.

Question: You will meet this week some politicians in a commission in Berne. Currently the support for your minimum rate is very big. Do you think that this will continue to be so, if you continue to buy billions of euros ?

Jordan: I think that it is important to be able to explain that this policy is in the interest of Switzerland. The enforcement of the minimum rate is to prevent a destabilization. I am of the opinion that this support will continue.

In a different interview with Thomas Jordan ECO asked if the Swiss confederation and cantons are able to receive a part of the SNB profits. “It does not look bad this year.”

Here are my comments on the interview and the questions that ECO was too shy to ask. Still I must admit that against my first impression the questions were not that weak, but still I maintain my view that this interview was far too artificial.

Are you the author? Previous post See more for Next postTags: floor,Jordan,Monetary Policy,Swiss National Bank,Switzerland