In the following we present the history of EU reforms, bailouts during the euro crisis and the German perspective on them.

History of bailouts and European institutions | German position, austerity and repercussions on European governments |

|---|---|

| October 4, 2009: Papandreou’s PASOK wins Greek General election. |

|

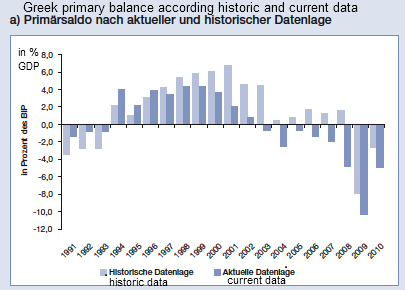

| October 20, 2009: The new Greek government unveils that Greece has 13% of deficit instead of 6% announced by the previous government. The following picture how the Greek debt data was falsified since some years before the euro introduction: |

|

| December 9 & 16, 2009: S&P and Fitch downgrade Greece to BBB+ |

|

| January 8, 2010: Eurostat publishes a report detailing the debt and deficit statistics fraud that took place in Greece | |

| April 23, 2010: 45 bln. € IMF/EU loan to Greece. | |

| May 2, 2010: The money is topped to a 110 bln. IMF/EU loan to Greece, of which Germany’s responsibility is 22.4 bln. Slovakia does not take part. | May 2, 2010: As part of the bailout an economic adjustment (=austerity) program is created. |

| May 9, 2010: The EFSF is agreed by the Council | |

| May 11, 2010: The European Financial Stabilisation Mechanism (EFSM) is enacted. The EFSM is a bailout fund collaterized by the budget of the European Commission. Capacity 60 bln. euros. | |

| June 7,2010: The EFSF is incorporated under Luxembourg law with capital of 440 bln €, i.e. a lending capacity of 248 bln. € (guarantee funds must stay). | |

| September 7, 2010: Creation of the “European Semester”, a framework for financial supervision in the EU. | |

| September 29, 2010: EU Commission proposes the six-pack reforms for an increase of competitiveness | |

| November 28, 2010: Irish bailout: Ireland borrows 23 bln. € from the EFSM and 18 bln. € from the EFSF. | |

| December 16, 2010: The EU governments decide on the modification of the treaty of the Functioning of the European Union which is amended for the ESM, that establishes permanent lending within Europe with the following phrase: “The member states whose currency is the euro may establish a stability mechanism to be activated if indispensable to safeguard the stability of the euro area as a whole. The granting of any required financial assistance under the mechanism will be made subject to strict conditionality. ” This change aims to replace the no-bailout rule of the Maastricht treaty, the so-called “Stability and Growth Pact | |

| January 5, 2011: The EFSM issues its first emission of debt certificates for the Irish bailout. | February 1, 2011: Prime Minister Cowen, of Ireland, resigns. |

| February 11, 2011: Axel Weber, President of the Bundesbank, hands in his resignation, expressing disagreement with the actions of the European Central Bank. He had until then been seen as one of the most likely successors to Jean-Claude Trichet. | |

| March 11, 2011: Agreement on a pact for the Euro (aka Euro Plus Pact) for stronger economic policy cooperation, competitiveness and convergence. | March 23, 2011: The Portuguese Prime Minister, Socrates, resigns |

| April 7, 2011: Portuguese bailout: Portugal borrows 26 bln. from the EFSM, 26 bln. from the EFSF and 26 bln. from the IMF. | April 17, 2011: Finish incumbent Prime Minister, Kiviniemi, loses general election passing governmental leadership from the Centre party to the Jirki Kaitainen centre right National Coalition. Large gains of the Anti-Euro party True Finns. |

| May 17, 2011: Portugal, and the Troika agree on an adjustment programme, under the EFSF. | |

| June 5, 2011: Passos Coelho wins Portuguese general election, replacing the centre left government with a centre-right coalition between the PSD and the PPD. | |

| July 11, 2011: The Euro-group signs the Treaty Establishing a European Stability Mechanism (ESM) | |

| July 21, 2011: Council meeting Conclusion: Proposing the attribution of a second adjustment program to Greece, worth €109 Bn. Supporting Greek, Portuguese and Irish adjustments by lengthening the maturity and lowering the EFSF/ESM borrowing-lending spread. “Supporting” Greek debt Private Sector Involvement (PSI) Allowing EFSF/ESM to purchase sovereign debt in secondary markets. | September 29, 2011: The Bundestag ratifies the capital increase of the EFSF from 440 bln. to 780 bln. (German part 211 bln.), i.e. a lending capacity of 440 bln. €. |

| October 26, 2011: A Eurogroup meeting ”invites” to a 50% Private Sector Involvement (PSI), a haircut on Greek debt in exchange for supporting it with a bailout of €130 Bn. | October 14, 2011: Radicova, the Prime Minister of Slovakia resigns in order to facilitate the ratification of July 21 EFSF modification against the opposition of the second government party Freedom and Solidarity under Ricard Sulik. The reforms are ratified with the help of the opposition. |

| October 23, 2011: The Eurogroup requires an economic adjustment program for Greece. |

|

| November 6, 2011: The Greek Prime Minister resigns over the austerity program after a referendum was rejected by other political parties and the EU. | |

| November 8, 2011: The Italian Prime Minister, Berlusconi, resignsafter Italian government bond yields were for months over 6% and EU was calling for austerity reforms. |

|

| December 9, 2011: A European Council Meeting introduces the “Fiscal Compact”. It also wants to quickly deploy a leverage of the EFSF funds. | November 20, 2011: Spanish Centre Right wins election against incumbent of the centre left |

| February 2, 2012: The EU ambassadors sign the modification of the treaty of the Functioning of the European Union which enables the ESM. | January 13, 2012: S&P downgrades the sovereign debt rating of 10 Euro-Zone countries, including France, Austria, Italy and Spain. |

| February 9, 2012: The ECB refuses to take part in Greek PSI because it is banned from engaging in “monetary financing”. | |

February 28, 2012: The final agreement between Greece and the bank association “Institute of International Finance” IIF describes PSI as reducing the total debt burden to Greece by €107 Bn, through a 53.5% haircut on the value of the principal accompanied. 31.5% of debt may be exchanged into longer maturities. | |

| March 1, 2012: The ISDA rules that the Greek PSI did not amount to a CDS triggering “credit event” | March 14, 2012: The German government proposes the ESM Ratification Law, the ESM Financing Law and the Modification of the Debt Law of the German Confederation |

| March 2, 2012: The Council of the EU Meeting: 25 EU Member states sign the Fiscal Compact treaty, akaTreaty on Stability, Coordination and Governance in the Economic and Monetary Union (TSCG) | May 9, 2012: The Spanish government takes over Bankia by converting a 4.5 billion euro state loan into equity. |

| May 24, 2012: The SPD and the Greens change their position and are against Eurobonds, but want a “debt repayment fund”. For more details see here |

|

| June 9, 2012: The Spanish government seeks a bailout from the EFSF. The finance ministers say that up to 100 bln. euros are available for Spain (enough money to employ 5 million workers at 20000 euro per year). | |

| June 20, 2012: A new Greek government among the two former dominating parties Nea Demokratia and PASOK and the DIMAR party is created. |

|

| June 29, 2012: The European summit brings some results which could have been expected, but puts them into a nice agreement form. The following details of the summit also give an overview about the EFSF and ESM | July 5. 2012: A group of 172 important German economists led by Hans-Werner Sinn, president of the IFO institute, write an open letter against the attempts to make Germany pay for the huge debt of the PIIGS and their banks, a smaller group of economists is in favor of the ESM. |

| July 8, 2012: The German constitutional court start its discussion on whether the ESM law must suspended provisionally, i.e. not signed by the German president, until the court has finished its main decision in favor or against the ESM, a decision which could take months. |

|

| July 20, 2012: The Eurogroup formally agrees to, up to EUR100bn in assistance for Spain so that it can help its banks. | July 16, 2012: The German Constitutional Court announces it will rule on the legality of the ESM treaty by September 12 |

| July 26, 2012: Draghi’s London speech: He hints at ECB’s interventions in Euro-Zone Bond markets following a week that saw Spanish Bond Yields rise above 7.5%. | |

| July 27, 2012: Merkel and Holland bolster Draghi’s move with the pledge to “do everything to protect” the euro. | |

| August 2nd, 2012 At ECB press conference, Draghi clarifies new fiscal-monetary strategy: | |

| September 6, 2012: ECB holds rates and announces OMTs. SMP comes to an end. | September 12, 2012 German Constitutional Court rules against an injunction of the ESM treaty. Until its final decision it approves the ESM under the following conditions: |

| September 12, 2012Dutch elections yield gains for centrist pro-EU(ro) parties | |

A more complete history on the Euro crisis can be found on the blog “Place du Luxembourg”.

The Bailouts and the German Opinion

Many economists in Germany, like the president of the IFO institute Hans Werner Sinn, the former ECB chief economist Jürgen Stark and the ECB member Asmussen, are against the demands of the English-speaking financial press, to provide more and more cheap money to European banks and push investments into the PIIGS based on borrowed German money. German economists are rather worried about the increasing (wage) inflation in Germany. The German government and the ECB want supply-side measures contained in the Stability and Growth Pact.

As opposed to the initial position of the social-democratic opposition, Merkel’s CDU does not want any Eurobonds, for them commonly issued bonds would mean that the PIIGS would imply that they not need implement austerity as Merkel demanded in the Fiscal Compact.

The Fiscal Compact wants the strong reduction of government debt and a balanced budget rule, which implies that the European states have to cut spending and implement austerity. To ratify the Fiscal Compact, including the balance budget rule, is the precondition for countries to access the permanent European Stability Mechanism (ESM), with a lending capacity of 500 bln Euros.

The predecessor of the ESM was the EFSF, with a lending capacity 240 bln Euros, originally planned for a limited time only, from which Ireland, Portugal, Greece and Spain in June 2012 had to borrow. Both the ESM and EFSF allow the Euro countries to borrow money at better interest rates than they would get in the free market. As opposed to the EFSF, the ESM has a seniority status, i.e. a creditor country must first pay the ESM before it pays its other debt (similar to IMF rules). European governments decided to combine the ESM and the remaining funds from the EFSF so that bigger Euro countries like Spain could also use these emergency funds. There are rumors that Italy and Spain together are not allowed to borrow from the joint fund. Spain is currently experiencing significant problems because of high unemployment and the bailout of some of its banks.

The following table gives the outcome of the June 29th 2012 summit and clarifies certain issues.

See more for