It goes without question, among economists of the central planning mindset, that if a central bank can just set the right quantity of dollars, then the price level, GDP, unemployment, and everything else will be right at the Goldilocks Optimum. One such approach that has become popular in recent years is nominal GDP targeting.

Read More »

Category Archive: 6b.) Paper Money

Should the Gold Price Keep Up with Inflation?

The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true?

Read More »

Read More »

Who Lends to the Fed?

This leads to our present question. To speak of borrowing and a ready market in which the Fed can borrow, means there is a lender. Who is the lender to the Fed?

Read More »

Read More »

What Is Money Printing?

There is a populist idea of money printing. The idea is that banks can just print what they want, enriching themselves in a massive fraud. But, does it really work this way?

Read More »

Read More »

Janet Yellen Fights the Tide of Falling Interest

The Fed is going to have to take back this interest rate hike (Dec 16). The process that sets the interest rate is complex. I have written many words on its terminal decline. However, there are two simple reasons why the trend remains downward.

Read More »

Read More »

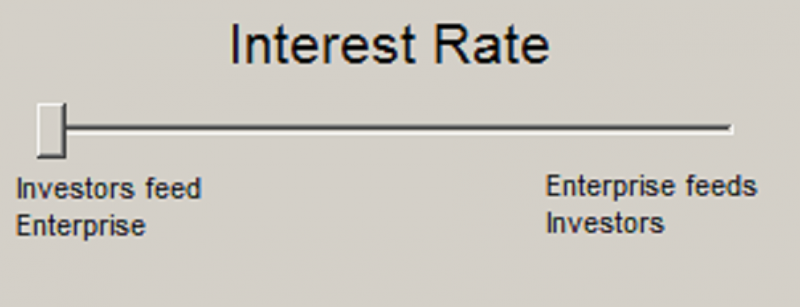

A Free Market in Interest Rates

Unless you’re living under a rock, you know that we have an administered interest rate. This means that the bureaucrats at the Federal Reserve decide what’s good for the little people. Then they impose it on us.

In trying to return to freedom, many people wonder why couldn’t we let the market set the interest rate. After all, we don’t have a Corn Control Agency or a Lumber Board (pun intended). So why do we have a Federal Open Market Committee?...

Read More »

Read More »

Will a GDP Futures Market Be Liquid?

At the Cato Monetary Conference, Scott Sumner said he had a “modest” proposal, that there should be a highly liquid futures market in Nominal Gross Domestic Product (NGDP). Sumner is known for his view that the Fed should target NGDP as the basis for monetary policy. So a GDP futures market that predicts it would be convenient. Let’s look at his idea more closely.

Read More »

Read More »

What’s Different about Monetary Policy?

Keith Weiner argues that the money that many money managers make does not come from producing anything of value. It’s other people’s life savings that they are driving and eating.

Read More »

Read More »

The Dog That Did not Bark

In the famous Sherlock Holmes Story, the detective identified the perpetrator from the fact that a dog didn’t bark. The dog didn’t bark because it dog knew the perp. This story makes a good analogy to what happened on Thursday, Sep 17. Perhaps I should say what did not happen.

The Fed did not raise the interest rate.

Read More »

Read More »

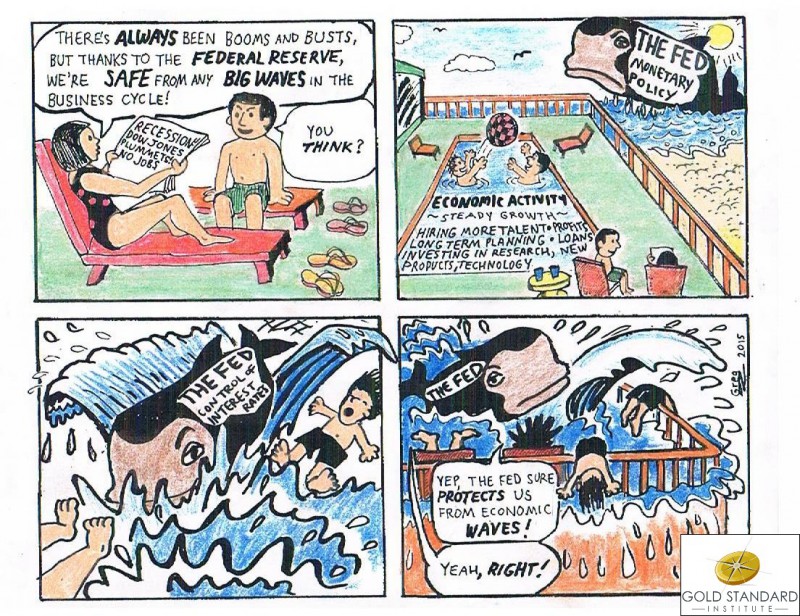

How Could the Fed Protect Us from Economic Waves?

Mainstream economists tell us that the Federal Reserve protects us from economic waves, indeed from the business cycle itself. In their view, people naturally tend to go overboard and cause wild swings in both directions. Thus, we need an economic central planner to alternatively stimulate us and then take away the punch bowl.

The very idea of centrally planning money and credit boggles the mind.

Read More »

Read More »

Who Is Worth More: Some Hedge Funds or All our Kindergartens?

"The top 25 hedge fund managers made more than all the kindergarten teachers in the country," declared President Obama in a discussion of poverty at Georgetown University. Calling them “society’s lottery winners,” he proposed to hike their taxes. Predictably, battle lines have been formed between two polarized sides. One side is unhappy with the pay disparity. The other is quick to defend the status quo. Rather than arguing about whether hedge fund...

Read More »

Read More »

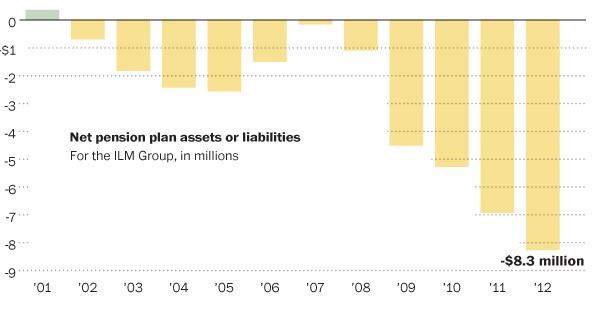

Did Ben Bernanke Call for Euthanasia of the Rentier or of the Pensioner?

Keynes called for “the euthanasia of the rentier” by government suppression of the interest rate (chapter 24 of General Theory). Bernanke did the same with pensioners, he threw them under a bus with low interest rates; still he “was concerned about those seniors as well.”

Read More »

Read More »

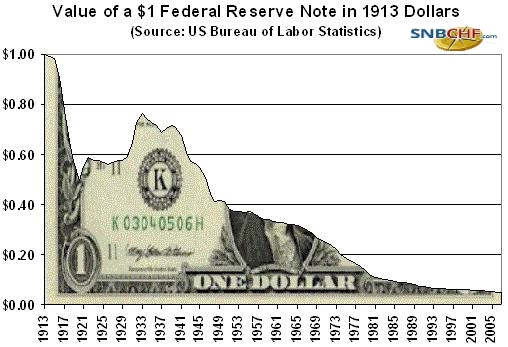

Goethe Predicted Dollar Slavery

In 1809 Goethe wrote "None are more hopelessly enslaved than those who falsely believe they are free." According to Keith Weiner, this is today's status of American workers, stuck with debt and the losing value of the dollar.

Read More »

Read More »

A Gold Man In Monetarist Territory

Keith Weiner suggests that one should abstract from economic variables like CPI, U6 unemployment measure, M0 or GDP. We know that the Fed manipulates key variables of the economy; hence we live in a world of central planners, a socialist world, not much better than the period of Mao or Stalin. The gold standard is free of central bank manipulation.

Read More »

Read More »

Three Unexpected Reasons Why We Use the Paper Dollar

Keith Weiner argues that there are 3 reasons why we use the dollar. One, people don't care about what money really is. Two, people are indoctrinated in the ideology of central planning. Three, many people like to get something for free and they want continue getting it for free. Endless borrowing is simply not possible in the gold standard, but only with paper money like the dollar.

Read More »

Read More »

Why Can’t The Fed Spot Bubbles?

The topic of whether the Federal Reserve can see bubbles in advance, and what they can do about them, is hotly debated. The price of an earning asset depends directly on the interest rate. This is because of time preference. It is better to have your cash today than tomorrow. The Fed’s problem is that the calculation depends on a rate of interest that it heavily influences. Its analysis is therefore circular and self-fulfilling. It’s like taking a...

Read More »

Read More »

Inflation=Counterfeiting

Keith Weiner explains why Inflation is, at root, a monetary fraud, it is finally caused by an increase in the money supply. The Fed deceives us into accepting this bad paper as currency by making its new dollars look like real currency. This is the very essence of counterfeiting.

Read More »

Read More »

The Fed’s Bubbles Destroy Capital

Keith Weiner explains the relationship between hoarding and lending. He advocates that interest rates should not be repressed artificially, otherwise bubbles will arise that destroy capital.

Read More »

Read More »