If the upcoming referendum “Save our Swiss gold” wins, then the SNB must increase gold holdings from less than 10% to 20% of its balance sheet. This possibly implies an end of the CHF cap. The referendum will take place on November 30th.

(post originally published in March 2013, continuously updated, avg. 600 views per day in the last two months)

The “Save our Swiss gold” referendum

According to the upcoming referendum “Save our Swiss gold”.

- The SNB should never be allowed to sell gold again.

- The gold has to be stored in Switzerland.

- Gold should represent at least 20% of the SNB assets.

Did you know:

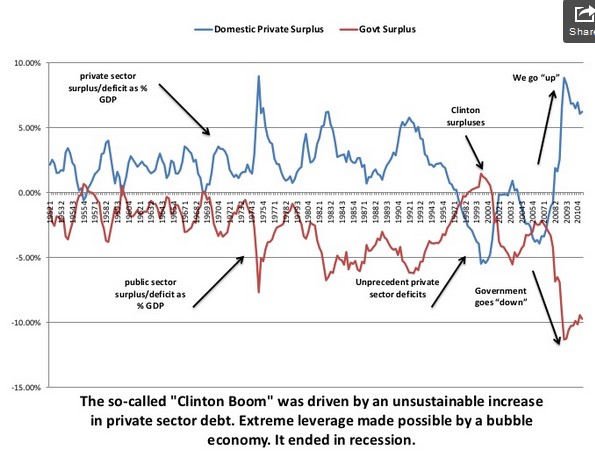

|

|

|

With it the Swiss people will decide if the SNB should be obliged to hold gold with a minimum percentage of 20% of its total assets. Currently the SNB holds only 10% gold. With the weaker gold price this ratio has fallen to 7.8% in 2014.

The link to the gold initiative.

The accumulation and sale of Swiss gold reserves

Until the end of Bretton Woods, the Swiss managed to accumulate large gold reserves thanks to continuous current account and trade surpluses. For years the Swiss and the SNB resisted the rather Keynesian mindset of the International Monetary Fund (IMF), and joined this institution only in 1992. IMF membership implied that the Swiss had to change their constitution: until 1999 the franc was officially bound to gold. In a referendum, leaders convinced the Swiss to remove this dependency.

In the year 2000, the IMF intensified the “demonetization of gold” campaign that had started in the 1970s in the strong belief that the “New Economy” and the strength of the anchor currency of the global monetary system, the US dollar, and the newly created euro would be able to defeat any future supply-side and inflation issues. Many believed that the euro would be the garant of strong European growth given that even Italy could borrow at low rates. In a period of strong U.S. growth, relatively high interest rates and low inflation, the central bankers thought that it was a “barbarous relict” to hold gold. Even if officially independent of governments, central bankers suggested that government bonds were the better deal, because “bonds generate income“.

Many central banks, like the Bank of England or the SNB, sold masses of gold, and most of the proceeds were invested in bonds denominated in the newly created euro. Germans, French and Italians, however, decided to keep their big gold reserves, possibly to give the euro better credibility.

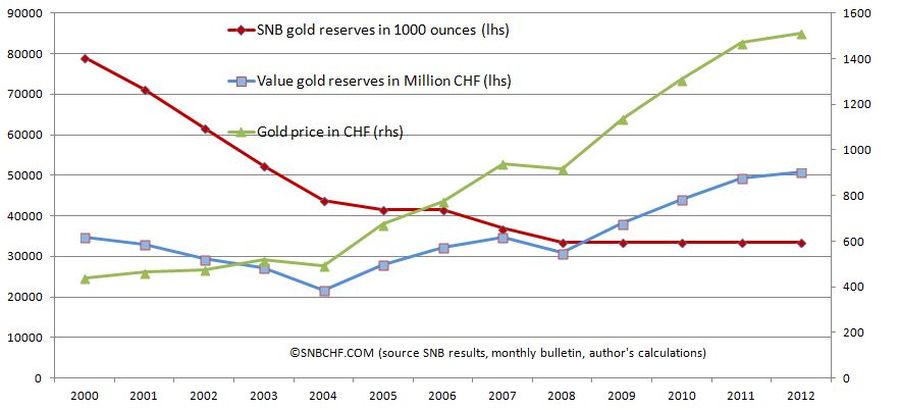

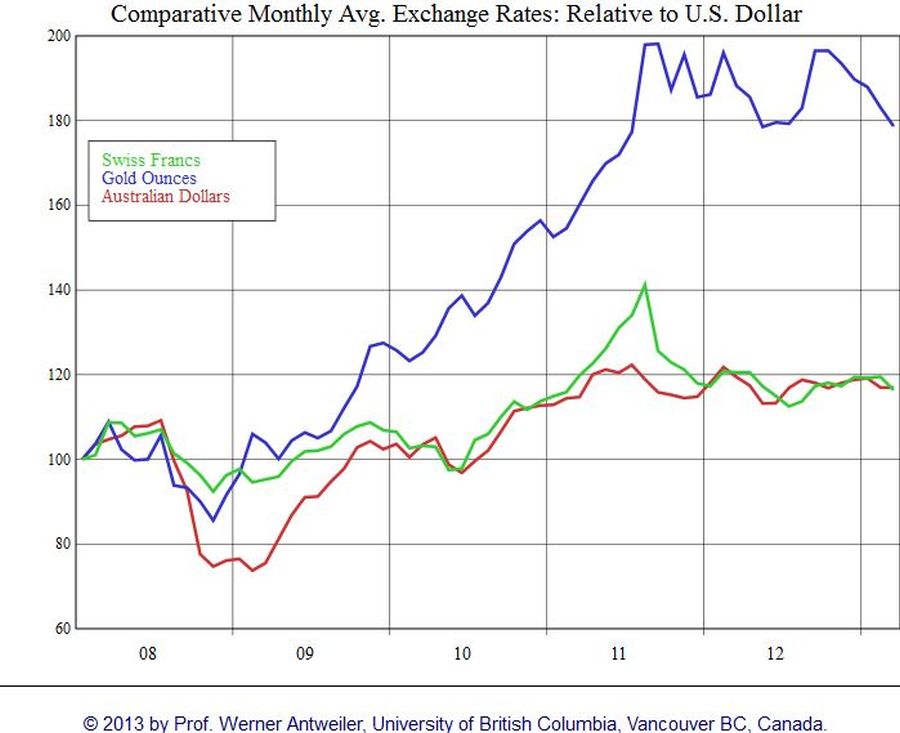

Since the last gold sales in 2007, the Swiss have maintained the same quantity of gold. Despite the strong rise of gold prices between 2008 and 2012, the SNB never bought more gold. But people and central banks in China, Russia, India and other emerging markets purchased more. The gold price improved with higher oil prices, rising incomes and the demand from those “barbarous” countries. Many central banks had capital gains on gold thanks to those rising incomes in Emerging Markets.

If the upcoming referendum "Save our Swiss gold" wins, the SNB must increase gold holdings from 10% to 20% of its balance sheet. Gold purchases and/or sales of fiat money implies an end of CHF cap. - Click to enlarge

Gold sales propped up finances of Swiss cantons

Between 2001 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Average price of Swiss gold sales: CHF 16,241 per kilo

Price of gold end 2012: CHF 48,815 per kilo

Difference: CHF 32,573 per kilo

MINIMUM cost of to sell 1300 tons of Swiss gold: 42 Billion CHF

(source SNB 2005 , the gold price is based on the SNB 2012 results)

For the proponents of the gold referendum, the SNB gold sales were the destruction of what their parents and grandparents achieved during the Bretton Woods period. As the year 2010 SNB results show, the remaining Swiss gold holdings prevented higher losses. Unfortunately, the quantity of gold was less than half of that from the year 2000; otherwise, gains on the gold price would have completely neutralized losses on fiat currencies.

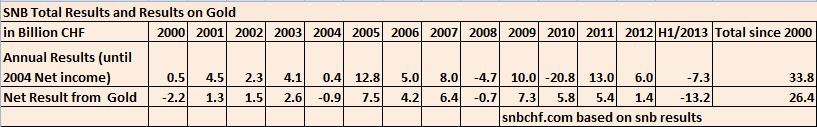

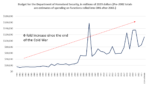

Percentage of SNB gold holdings has fallen from 45% to 8%

The percentage of gold holdings to total balance has fallen from 30% in the year 2000 (despite low weak prices!) to 10% in 2012. The referendum proponents want to raise it to 20%.

Due to the fact that the gold price fell between 1995 and 2000, the SNB gold share was even 45% in 1995.

Switzerland is not the only country where the gold share as percentage of central bank assets has strongly fallen: Germany had a gold share of 20% of total assets still in 2002 despite weak gold prices. Despite Germany not selling gold, the explosion of the Bundesbank balance sheet with EUR denominated claims, called Target2, let this percentage fall to considerably under 10%.

Why was the gold price so low in 1999/2000?

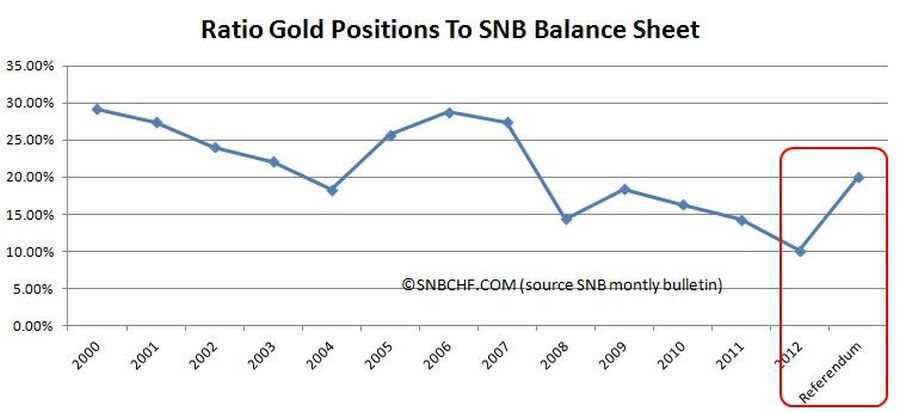

Domestic Private Surplus, Govt Surplus

During that period, private spending and private debt went into two different directions, more private spending and private debt in the U.S. as opposed to less private spending growth and less debt in the rest of world. This helped to make US GDP grow more quickly than growth abroad. Full details about low gold prices in 1999 and 2000.

A referendum “Yes” implies a Swiss franc appreciation, end of the franc cap?

If the referendum is accepted by the Swiss people, then the SNB would need to:

- Either double the quantity of gold holdings, (i.e. buy it expensive after selling it cheap). That would be around 1783 tons of gold.

- Sell half of its fiat money reserves

- Or a mixture of both, like selling euros and dollars for the total of around 68 bln.$ to buy gold.The initiative gives the SNB five years to raise its gold share to 20%.

In the first case, the gold price should rise and with it the gold-correlated Swiss franc. In the second option, the Swiss franc should rise even more.

Previously the franc was correlated to gold mostly thanks to low Swiss inflation and the (formerly) strong monetarist ideas inside the SNB.

Now the CHF is correlated to gold thanks to global trade surpluses produced by Swiss multinationals that correspond to rising global gold demand.

The Australian dollar is a similar currency that profits on Chinese and global growth. Both the Swiss and the Australian currencies are often used as proxies for Chinese expansion, because they provide assets related to China without having the obligation to invest directly in Chinese companies. While CHF represents the safe variant of global growth thanks to a high savings rate and current account surpluses, the Aussie is the risk-on variant with a higher propensity to consume, high interest rates, current account deficits and a negative international investment position.

SNB has considerable concerns

A spokesperson for the SNB said the central bank has “considerable concerns with regard to the monetary policy implications of the demands in the initiative“.

They provide three major arguments:

- Buying so much gold would destroy the “ability to do independent monetary policy” and implicitly the EUR/CHF peg.

- Gold generates no income as opposed to bonds (see above).

- The gold price has a “far higher volatility”. Effectively Quantitative Easing provoked a strong improvement in the gold price and the reverse movement, the “tapering” a strong weakening. Based on this these two strong price movements, SNB officials claim that gold is too volatile and too risky.

In the current 0% inflation environment, the SNB still has popular support for the euro peg, this could change when inflation rises again. Many Swiss are very adverse to inflation and this is one reason why many Swiss private investors actually possess gold. During the early SNB gold sales, Swiss private investors were “officially” invited to buy the gold that the central bank sold. SNB does not protect the Swiss against strong inflation any more, investors should do this themselves if they think that there is such a risk. This, however, leaves the poor without protection.

We understand why the SNB has concerns with the referendum. But looking back at cheap SNB sales of expensive gold or the financial crisis of 2008, the Swiss farmers’ shrewdness and gut feelings might be able to beat the mathematical models of (central) bankers once again.

Read also:

Why was the gold price so low in 1999/2000?

The full details, Swiss Franc History: The SNB Sells a big part of the Swiss gold reserves at cheap prices.

In Favor of a Yes: Swiss Gold Referendum: Latest News, Parliamentary Speech Lukas Reimann

In Favor of a No: SNB chairman Jordan, his speech in PDF format

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

11 comments

1 ping

Skip to comment form ↓

DorganG

2013-04-21 at 07:42 (UTC 2) Link to this comment

From Whisper:

[br]

First I wanna give some input on the gold initiative article: The gold

initiative has it’s intellectual roots in the book “Gold Wars” by

Ferdinand Lips, a former executive for the Banque Privee de Rothschild

Suisse. It contains of whole chapter on the stupidity of the Swiss

federal government and the SNB apparatchicks. In your article, you

missed the point about repatriation which would mean that the SNB can no

longer lease gold into the market via the NY FED, the BOE in London and

their private sector partners JPM and HSBC. Leasing (or even selling)

is the only reason to “store” gold abroad in the post cold war age. It’s

also the only reason why the German Bundesbank needs 7 years to

repatriate a few hundred tons form the NY FED. The impact of a de facto

gold standard (at least 20% of reserves in gold, all the time) on the

IMF membership of Switzerland was also not understood in that article.

If the IMF interprets it’s own charter strictly, Switzerland would have

to be expelled. IMF members are not allowed to run a gold standard,

thanks to the Keynesian mindset of the IMF. You also didn’t properly

explain the impact of potential gold purchases on the EUR/CHF exchange

rate in my humble opinion. If the SNB would just use it’s abundant fx

reserves, especially EUR, there would not be an impact on EUR/CHF but

rather just on XAU/EUR and XAU/CHF, ie gold would go up in both of these

currencies.

MichaelGlenn1

2014-10-17 at 19:18 (UTC 2) Link to this comment

Gold is a real-time currency all on its own now that bullion values are free to float. This market valuating feature combines the virtues of debt-free store properties with the scalable liquidity of any currency in history. Weight would be the unit of account and the denomination that moves from account to account, whether the weight be real or virtual (and fully backed).

Debt-free store of value meets real-time digital liquidity.

You cannot pour new wine into old wineskins

Goldbear

2014-10-30 at 11:38 (UTC 2) Link to this comment

There is an easy solution to the volatility in the price of gold: the SNB could adopt the same valuation methods as the Federal Reserve Bank and the Bundesbank which do not mark to market their gold reserve. This means that gold is valued at purchased price. This would make sense for the SNB, particularly if it is barred from selling gold as stipulated in the initiative.

George Dorgan

2014-10-31 at 07:18 (UTC 2) Link to this comment

The recent years have shown that gold is very volatile. The reason is again the Fed. When they decided to reverse course in June 2013, Emerging markets did not have the cheap money supply from the U.S. anymore. Instead central banks of these countries kept money tight, which increased costs for businesses, for credit and personal spending. This slowed them significantly that hindered their wage and spending expansion, oil and commodity prices.

Read more at: https://snbchf.com/gold/swiss-gold-location-gold-initiative/

MichaelGlenn1

2014-10-30 at 16:08 (UTC 2) Link to this comment

Goldbear …. the SNB could do what you suggest but the rate of change is an important consideration for the trade value of gold , given the fragile state of the debt based fiat system. Best to let the market morph that one , IMO. Don’t want any sudden exoduses from the fiat system. The market is charged with the struggle of bringing gold to a level where it “finds it price” for the rationale of monetization in what will eventually culminate into a monetary Yin-Yang of debts and assets that circulate in a symbiotic relationship of stability. We need to inflate a deflated Yang.

Just add assets and stir gently … that’s all.

It is light that comes out of darkness, is it not ?

Rather than the political approach taken by the Swiss , I think the Canadian approach by way of the market is better and safer.

Take a look at this recent release by the mint and pay special attention to the face (legal) value of the coin versus the bullion content. You’ll see a complete departure from the norm. This one could make for good circulation. It’s NOT an investment , simply a good trade of debt paper for debt-free metal. It’s also “down in the grass” where serpents are wise.

http://www.mint.ca/store/coins/50-for-50-fine-silver-coin-snowy-owl-2014-prod2090035?lang=en_CA&rcmeid=BWS-BAN_CAN-SNOWY-OWL-50FOR50-EN_Ad-728×00-en_GOOGLE-Canada#.VDaNGhYzJXK

foxenburg

2014-11-02 at 15:36 (UTC 2) Link to this comment

I have my fingers crossed that the people of Switzerland will be the first to rebel against the quantitative easing, currency devaluing, gold manipulating bankers and politicians in the West. My entire life until recently I have had instinctive respect for the Swiss Franc. Everyone respected it as a benchmark.

Let’s get that situation back and hope the Swiss vote YES.

MichaelGlenn1

2014-11-02 at 20:14 (UTC 2) Link to this comment

foxenburg I’m a gold bug …. a 21st century real-time gold bug, as a matter of fact. I think the political approach of the referrendum is far too abrupt and overt for the currency market’s good. A more sublime organic method via the economic model would make much more sense and we’re now seeing this with the leading edge coming from the Canadian mint. This is not an investment approach to minting coin…. this is a monetary approach, primarily lodged in the face (legal tender) value of this coing and the fact it’s debt-free.

It is only bullion that circulates (debt-free) that can allow for the purging of existing fiat based debt and have it banished to the nothingness it was created from.

$50 of debt for $50 of debt-free metal.

http://www.mint.ca/store/coins/50-for-50-fine-silver-coin-snowy-owl-2014-prod2090035?lang=en_CA&rcmeid=BWS-BAN_CAN-SNOWY-OWL-50FOR50-EN_Ad-728×00-en_GOOGLE-Canada#.VFZ0HMnsorn

We must be as wise as serpents yet as gentle as doves.

foxenburg

2014-11-08 at 15:05 (UTC 2) Link to this comment

MichaelGlenn1 Sorry, I don’t buy your method at all. Incidentally, I buy UK Mint silver £20 coins, which sound similar in proposition to your Canadian ones, ie they have a legal tender value of £20 and they are made of sterling silver – but you can’t escape the fact that they only contain about £4 worth of silver at best. They are more comforting than a wad of paper, but that’s hardly the point. Abrupt and overt suits me fine! Yours, with respect, foxenburg.

MichaelGlenn1

2014-11-08 at 17:33 (UTC 2) Link to this comment

foxenburg MichaelGlenn1 Taking a top-down and very overt approach to bullion reintroduction risks a flight from the fiat/debt system. I’m not cheer-leading debt-currency. I’m a gold bug but I’m also a 21st century real-time gold-as-currency advocate who appreciated rate of change. We don’t want any crashes of the legacy (debt) system. It would be incredibility painful. This is the reason we see the USA so staunchly defending the USD in various ways (yes, they include war) because at the end of the day, what we will end up with is a symbiotic yin-yang of circulating debts and assets … a hybrid.

veraciti

2014-11-25 at 15:40 (UTC 2) Link to this comment

The truth about the

Gold Initiative:

The SNB is an

integral part of the Bankster Matrix ruling the planet, regardless whether it

is a privately owned institution like the Fed and many other CBs, or majority owned

by the Kantons, they all play ball in the tight knit world of Banksterism and

follow the dictate of the alpha male in the pack; the USG/WS/City/Bankster

Families who own the Fed and hence the US$, which allows them to exploit and

rule the entire planet!

The question of

Gold or no Gold as a reserve asset is clear: Gold has been the only enduring

store of wealth for 5,000 years and every attempt of just printing a digit on a

piece of paper and forcing the people to accept it as their ‘store of wealth’

has failed and went to its intrinsic value: zero!

A good, must read background

on the whole question about the Swiss Gold here:

http://one-just-world.blogspot.com/2014/11/the-swiss-gold-initiative-and-its.html

veraciti

2014-11-25 at 15:46 (UTC 2) Link to this comment

@DorganG The wording of the

Initiative is that 20% of the SNB’s assets must be in gold, not a 20% backing

of the currency!

But you’re exactly

right on all your other points, it is just a ruse to avert the rise of Gold and

keep the Fiat Currency Crime Racket going as long as possible, even though it

is pre-programmed to self-implode!

There is much more

background to this question here:

http://one-just-world.blogspot.com/2014/11/the-swiss-gold-initiative-and-its.html

"SNB Concerned": Does a Yes to the Swiss Gold Referendum Imply an End of the CHF Cap? | Gold Review

2013-03-22 at 16:12 (UTC 2) Link to this comment

[…] Go to this article […]