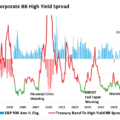

| The race is on for dominance in the artificial intelligence arena with China's release of DeepSeek. Markets initially nose-dived Monday, but ended up slightly higher (with the exception of Nvidia). This volatility underlines the necessity for portfolio diversification. The pullback in an oversold market was not unexpected. The news resulted in the biggest single-day market cap loss for Nvidia, due in part to its massive market cap. Lance discusses what may be the positive results of thie "Sputnik moment" for the US. The markets' response also underscores the importance of Bonds in overall portfolio management. Lance & Jonathan discuss the fallacy of high-watermark comparisons in portfolios, and how to properly review portfolio performance. A discussion on how stocks are actually traded, on and off the exchanges, and the proper use of stop-loss settings in a portfolio. 3:13 - Markets' Response to DeepSeek 16:18 -The Positive Results of DeepSeek 30:28 - How to Properly Review Your Portfolio 44:42 - How Stocks Are Traded & Stop Losses Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO Produced by Brent Clanton, Executive Producer ------- Articles mentioned in this report: "DeepSeek DeepSinks Bullish Exuberance" https://realinvestmentadvice.com/resources/blog/deepseek-deepsinks-bullish-exuberance/ "Strategic Crypto Stockpile And Political Uncertainty" https://realinvestmentadvice.com/resources/blog/strategic-crypto-stockpile-and-political-uncertainty/ "Inauguration Sends Confidence Surging Higher" https://realinvestmentadvice.com/resources/blog/use-drone-mentality-to-financial-success/ ------- The latest installment of our new feature, Before the Bell, "CDeepSeek Reaction: Why Diversification Works ," is here: &list=PLwNgo56zE4RAbkqxgdj-8GOvjZTp9_Zlz&index=1 ------- Our previous show is here: "DeepSeek or Deep Sink?" -VsY&list=PLVT8LcWPeAugpcGzM8hHyEP11lE87RYPe&index=1&t=1045s ------- Get more info & commentary: https://realinvestmentadvice.com/newsletter/ -------- SUBSCRIBE to The Real Investment Show here: http://www.youtube.com/c/TheRealInvestmentShow -------- Visit our Site: https://www.realinvestmentadvice.com Contact Us: 1-855-RIA-PLAN -------- Subscribe to SimpleVisor: https://www.simplevisor.com/register-new -------- Connect with us on social: https://twitter.com/RealInvAdvice https://twitter.com/LanceRoberts https://www.facebook.com/RealInvestmentAdvice/ https://www.linkedin.com/in/realinvestmentadvice/ #DeepSeek #AI #TechnologyStocks #China #Nvidia #Apple #PortfolioRisk #PortfolioDiversification #Chips #Technology #FinanceTips #InvestmentStrategies #MarketAnalysis #EconomicOutlook#InvestingAdvice #Money #Investing |

2025-01-28

1-28-25 The DeepSeek Knee Jerk

Lance Roberts

always appreciate the perspective from lance <3

Reply

Too much tech and not enouch bonds

Reply

Elon Musk has an AI called Grok- 3 which actually crushes the performance of Deep Seek.

Reply

Thank you very much…

Reply

us stock markets are a rigged overinflated ponzi bubble

Reply

GREAT segment on stop loses. Please make that a stand alone video. That was great information.

Reply

Seriously! That should be a required watch for anyone doing short term trading

Reply

👍👍

Reply

You are the best

Reply

Thanks, great update.

Sputnik is pronounced “spootnik” not “spahtnik”. 😊

Reply

Good discussion about the high water mark

Reply

I think you guys need to adjust your settings on your camera or upgrade if it isn't 4k – sharpness and color seem way off. I'm sure it will improve your views.

Reply

John is so good looking and his voice is so deep 😅😂

Reply

You said a few months ago 60/40 portfolio doesn’t work anymore But today you said you 60/40 portafolio did very well yesterday ??? Please explain why

Reply

I only listen to your show (and sometimes Adam's show). I stopped listening to everything else.Thanks for the great show, and always love the humor.

Reply

"Buy the dip." Deepseek still had high est end NVidia chips in the teacher model. They also did everything that every other AI researcher can now do.

All that happened was that the AI race just went to afterburner.

Reply

So glad you are someone talking about the danger/ security issue of people using Deep Seek for there app of choice ..

Reply

Use Akash, they implemented the code on an open source and decentralized system with no accounts or app required, just web-based. Does not mean it is private btw but much better.

Reply

I really only watch this show to watch Lance troll his own team

Reply

Yaaaaaabiy ever day.

Reply

The key is risk analysis. The markets are and has always been unpredictable. Thus the important point is not how much one might make but what one could lose. trading and holding on speculative stocks/Crypto and even great stocks can test ones ability in the arena of our ability to control ones loss aversion bias…buy high sell low…The market is overvalued by almost all measures like the CAPE and Buffett indicator. Speculation is high with things like meme stocks (are they dead yet?), our kitty dude, Ai dreaming and all…. It is all about how much one can lose during times like these. Does that mean don't invest, of course not but one must access the risk and have a way out if the tide goes out…..I've been engaged in active trading and managed to grow a nest egg of around 2.6B'tc to a decent 24B'tc….I'm especially grateful to Seren Wintersun, whose deep expertise and traditional trading acumen have been invaluable in this challenging, ever-evolving financial landscape.

Reply

SHE IS ON TELE GRAM.

Reply

@Serenwintersun

Reply

In a field as rapidly evolving as cryptocurrency, staying updated is crucial. Seren’s continual research and adaptation to the latest market changes have been instrumental in helping me make informed decisions.

Reply

Always backup your trading with a good strategy.

Reply

The same high-yield potential exists in both bullish and bearish situations; what matters is how information and technique are used. Not neglecting professional advice.

Reply

Lance mentioined there is national security concerns with deepseek. Is it open source? Just examine the code and you'll figure it out. Is OpenAI code available for us to examine?

Reply