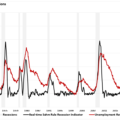

| The PPI number came in weaker than expected with lower input prices. Today's CPI report (a 0.2% monthly increase = 3.2% annual rate) weakness could spur the Fed to lower rates, although to what extent remains unknown. The upcoming Jackson Hole Economic Summit could also provide impetus for the Fed's action in September. Meanwhile, markets on Tuesday cleared the 100-DMA, and are looking for confirmation at the 50-DMA. Will he or won't he? Danny's coaching decision remains to be seen. Why market remain resilient after the sell-off. YouTube Chat Q&A: Dealing with Teacher Retirement Fund taxation & fees; the retirement plan variables: What to do with a 401k at Retirement? How 401k's killed pensions (a very bad idea). What to do with 401k when changing jobs. Why pensions should go away vs 401k's; 401k vs IRA flexibilities. 3:17 - No Reason to Be Bearish 14:40 - Why Markets Remain Resilient After Sell-off 30:17 - What to Do w Your 401k at Retirement 44:28 - Pensions vs 401k's - A Bad Idea? Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Danny Ratliff, CFP Produced by Brent Clanton, Executive Producer ------- Articles mentioned in this report: "Are Mega-Caps About To Make A Mega-Comeback?" https://realinvestmentadvice.com/are-mega-caps-about-to-be-a-mega-buy/ "Market Crash – Is It Over?" https://realinvestmentadvice.com/newsletter/ ------- The latest installment of our new feature, Before the Bell, "No Reason to be Bearish" is here: -0&list=PLwNgo56zE4RAbkqxgdj-8GOvjZTp9_Zlz&index=1 ------- Our previous show is here: "Four Reasons Mega-Caps Are Not Dead Yet" https://www.youtube.com/watch?v=-uTqIghDtTw&list=PLVT8LcWPeAugpcGzM8hHyEP11lE87RYPe&index=1&t=5s ------- Get more info & commentary: https://realinvestmentadvice.com/newsletter/ -------- SUBSCRIBE to The Real Investment Show here: http://www.youtube.com/c/TheRealInvestmentShow -------- Visit our Site: https://www.realinvestmentadvice.com Contact Us: 1-855-RIA-PLAN -------- Subscribe to SimpleVisor: https://www.simplevisor.com/register-new -------- Connect with us on social: https://twitter.com/RealInvAdvice https://twitter.com/LanceRoberts https://www.facebook.com/RealInvestmentAdvice/ https://www.linkedin.com/in/realinvestmentadvice/ #PPI #CPI #Inflation #InterestRates #RetirementFunds #401k #Pension #IRA #RithIRA #Bonds #MegaCaps #MarketCrash #RealTimePricing #InvestmentAdvice #UnexpectedEvents #MarketPredictions #MarketValuation #RiskAssessment #FinancialStrategy #MarketDynamics #MarketTrends #InvestmentStrategy #PricingMechanisms #MarketBehavior #SpeculativeAssumptions #FinancialMarkets #SurpriseFactors #MarketOutcomes #InvestmentPlanning #EconomicFactors #Markets #Money #Investing |

2024-08-14

8-14-24 Looking for Rate Cut Clues in CPI Data

Lance Roberts

New tó the show, looking forward to being a daily watcher, let's go! Love your contribution to zero hedge

Reply

Bingo Danny. This is why I would leave my 401k instead of rolling it. Low fees and good investment choices – funds not individual stocks. Fine, I have no business stock picking myself; I am too distracted with other things right now. We also do backdoor Roth contributions, so we can’t have trad IRAs right now.

We do have a financial adviser. We just pay her fees directly to review everything annually.

When we are ready, then yes, we will roll to an IRA managed account, so timing is a factor here.

Reply

Wish I got up early enough to join Larry here.

Reply

Let me know your view for Gold lol

Reply

I always kept my "financial house" in order & stayed out of debt so for me it would be better if they left interest rates alone & let the market determine interest rates..

Reply

Thanks for your excellent work Lance and RIA! It is really useful! I read all your blogs, newsletters and listen to all your shows here on YouTube.

If you can make updates more often about bonds (TLT, EDV, 10 years T-rates) on a technical perspective, it would be greatly appreciated. Because you talk every day about SP500, but just time to time about bonds, like yesterday.

Thanks!

Reply