Tag Archive: U.S. Household Debt

United States: Lack Of Industrial Momentum Is (For Now) Big Auto Problems

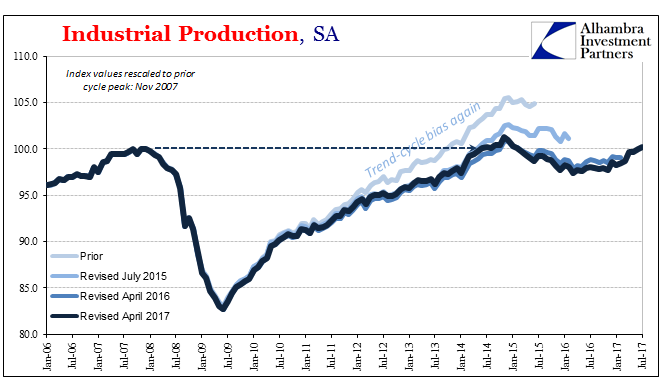

Industrial Production disappointed in the US last month, dragged down by auto production. Despite the return of an oil sector tailwind, IP was up just 2.2% year-over-year in July 2017 according to Federal Reserve statistics. It marks the fourth consecutive month stuck around 2% growth. The lack of further acceleration is unusual in the historical context, especially following an extended period of contraction.

Read More »

Read More »

Le prix de l’or est manipulé. Egon von Greyerz

La léthargie estivale des marchés a tendance à insuffler un sentiment de fausse sécurité. Les actions et l’immobilier approchent de leurs plus hauts historiques, les taux d’intérêt sont à un plus bas de 72 ans, et la plupart des investisseurs se sentent plus riches que jamais. Les banques centrales envoient les signaux d’économies fortes en annonçant des hausses de taux et une réduction de leurs bilans.

Read More »

Read More »

The Three Headed Debt Monster That’s Going to Ravage the Economy

Mass Infusions of New Credit. “The bank is something more than men, I tell you. It’s the monster. Men made it, but they can’t control it.” – John Steinbeck, The Grapes of Wrath. Something strange and somewhat senseless happened this week. On Tuesday, the price of gold jumped over $13 per ounce. This, in itself, is nothing too remarkable. However, at precisely the same time gold was jumping, the yield on the 10-Year Treasury note was slip sliding...

Read More »

Read More »

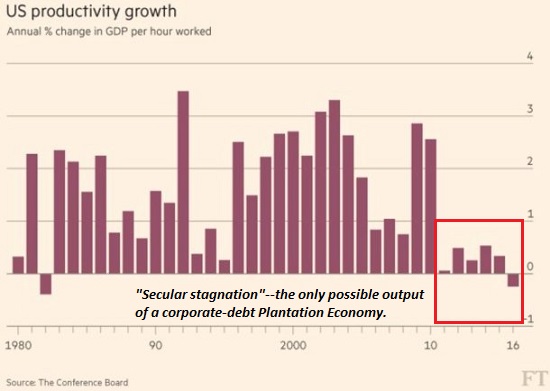

Our State-Corporate Plantation Economy

I have often discussed the manner in which the U.S. economy is a Plantation Economy, meaning it has a built-in financial hierarchy with corporations at the top dominating a vast populace of debt-serfs/ wage slaves with little functional freedom to escape the system's neofeudal bonds.

Read More »

Read More »

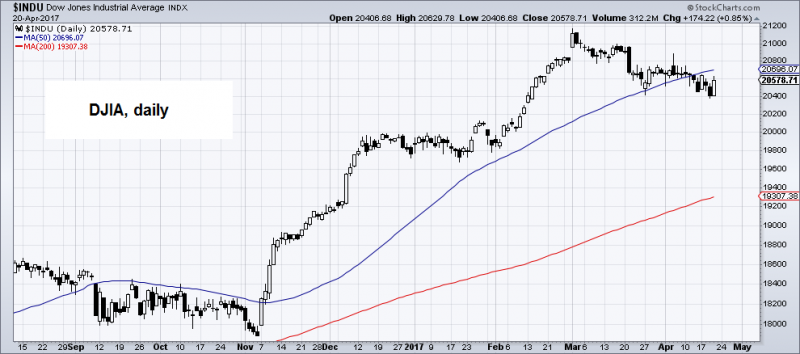

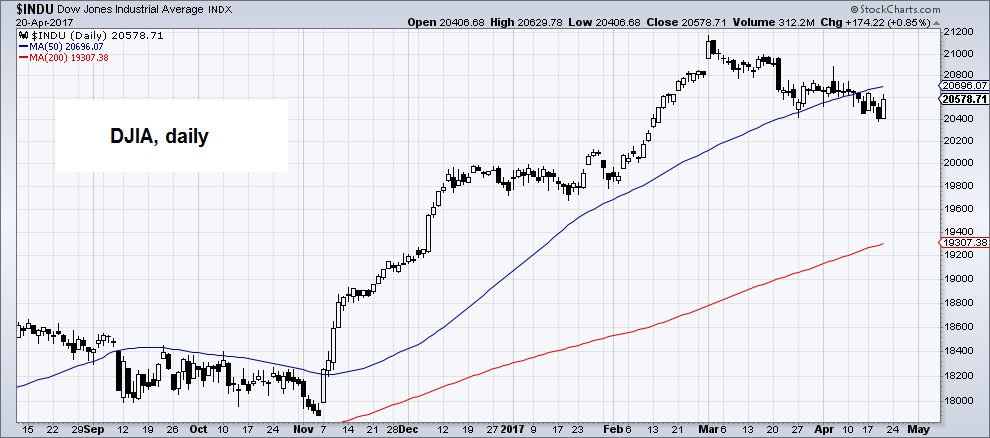

Central Banks Have a $13 Trillion Problem

GUALFIN, ARGENTINA – The Dow was down 118 points on Wednesday. It should have been down a lot more. Of course, markets know more than we do. And maybe this market knows something that makes sense of these high prices. What we see are reasons to sell, not reasons to buy.

Read More »

Read More »

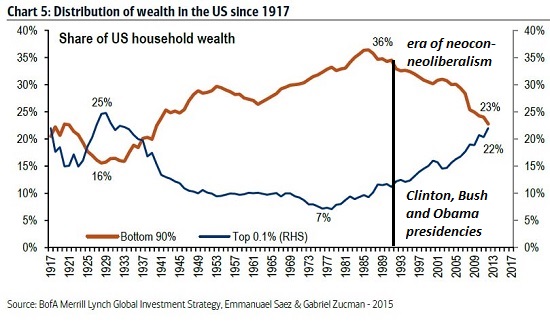

Do the Roots of Rising Inequality Go All the Way Back to the 1980s?

Unless we change the fundamental structure of the economy so that actually producing goods and services and hiring people is more profitable than playing financial games with phantom assets, the end-game of financialization is financial collapse. I presented this chart of rising wealth inequality a number of times over the past year. Do you notice something peculiar about the inflection points in the 1980s?

Read More »

Read More »

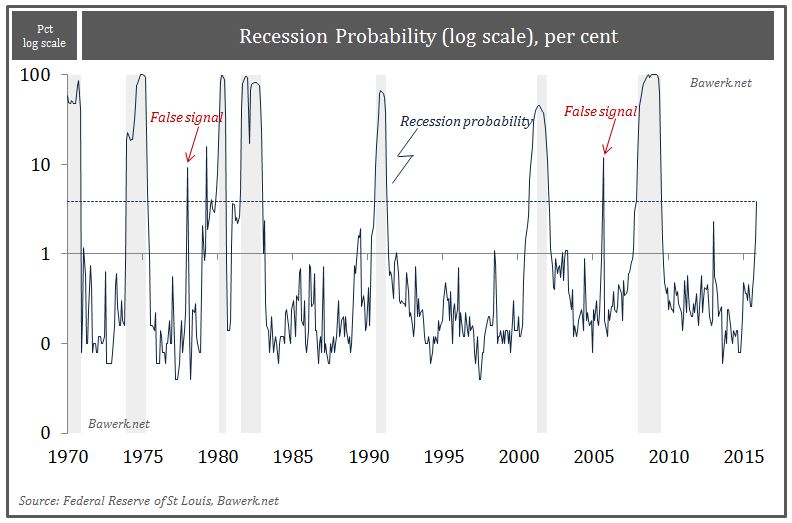

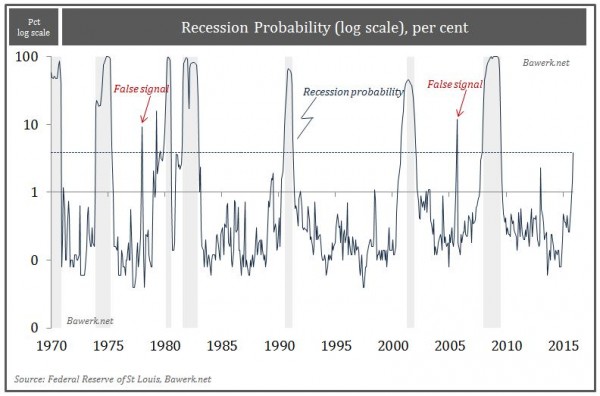

Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beg...

Read More »

Read More »