Tag Archive: Technical Analysis

Q2-2025 Earnings Season Preview

Next week, the Q2-2025 earnings season will begin in earnest as a barrage of S&P 500 companies report, starting with the Wall Street money center banks on Tuesday and Wednesday. Since earnings drive the market by supporting investor expectations, what […] The post Q2-2025 Earnings Season Preview appeared first on RIA.

Read More »

Read More »

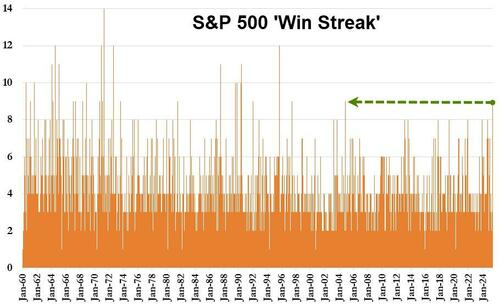

The Bull Market Is Alive And Well

The bull market is alive and well, even amid widespread talk of the “death of U.S. exceptionalism.” Early 2025 saw a sharp shift in investor sentiment. Concerns over erratic trade policy, soaring debt, and weakening dollar pressure challenged America’s long-standing market dominance. Markets fell sharply in April and May, feeding a narrative of declining "US …

Read More »

Read More »

SLR: Could It End The Bond Bear Market

On June 25th, the Federal Reserve quietly announced a significant change to the Supplementary Leverage Ratio (SLR). While the headlines were muted, the implications for the U.S. Treasury market were anything but. For sophisticated investors, this technical shift marks a subtle but powerful pivot in monetary mechanics. It could create demand for Treasuries, improve market …

Read More »

Read More »

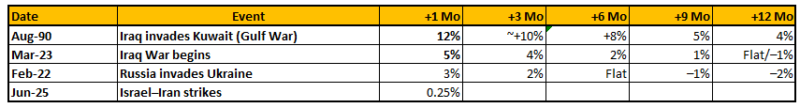

Iran Stuck By U.S.: Markets, Risk, and Rational Investing

Over the weekend, the U.S. launched strikes against Iran's nuclear facilities. Currently, I only have the details reported by major mainstream outlets. However, given that stock market futures are trading sharply lower on Sunday, I wanted to get something in print before the market opens relating to navigating this event over the next few days.

Read More »

Read More »

The Iran-Israel Conflict And The Likely Impact On The Market

The Iran-Israel conflict and equity markets are now in sharp focus. As direct strikes escalated in June 2025, global financial markets responded immediately. Israel’s airstrikes on Iranian nuclear and energy infrastructure triggered retaliatory missile and drone attacks from Iran. The Dow dropped nearly 2%, the S&P 500 lost over 1%, and oil prices surged by …

Read More »

Read More »

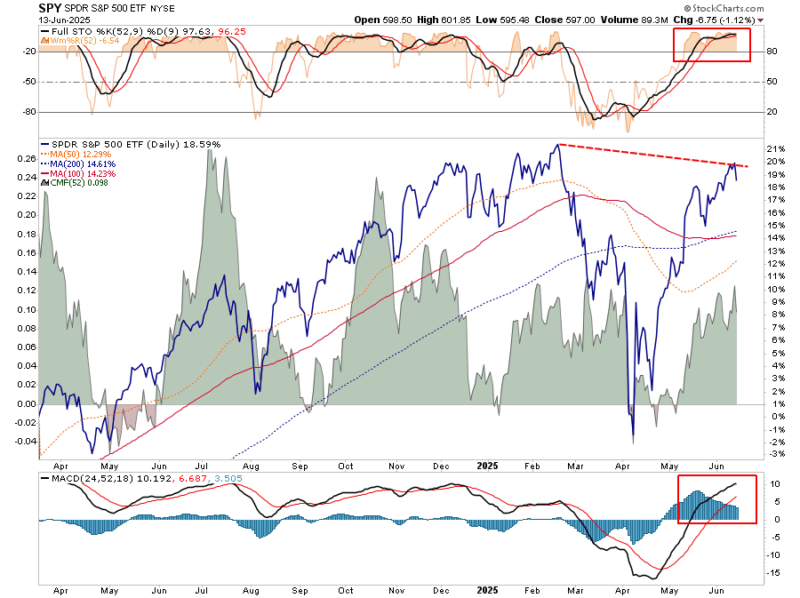

“Buying The Dip” – Here’s A Technical Way To Do It

Recently, I did an interview about "buying the dip" in the market, which generated many comments. Most were, "You're stupid; the market is going to crash," but one comment deserved a more thorough discussion. "When buying the dip, how do you know when to do it, or not?" That is the right question. Of course, you will never know … Continue...

Read More »

Read More »

Does Consumer Spending Drive Earnings Growth?

It would seem evident that most investors would understand that consumer spending drives economic growth, ultimately creating corporate earnings growth. Yet, despite this somewhat tautological statement, Wall Street appears to ignore this simple reality when forecasting forward earnings. As discussed recently, S&P Global's current estimates show earnings are growing far above the long-term exponential growth …

Read More »

Read More »

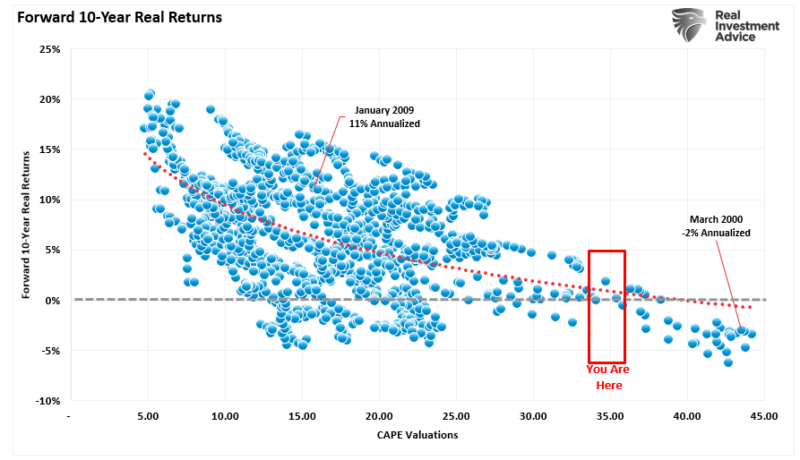

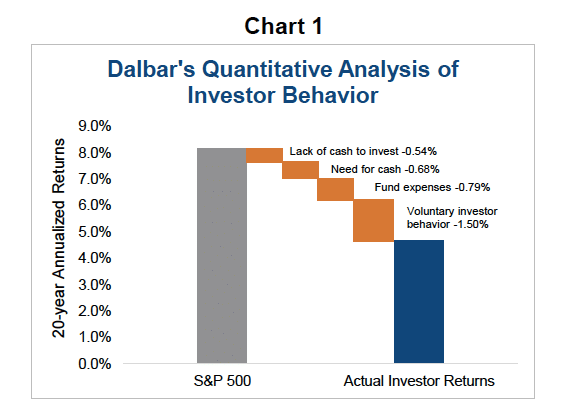

Buying Stocks Is Always Hard

Buying stocks is always hard. Particularly during corrections. Or, near market peaks. Or, when stocks are falling. And when they are rising. Oh, buying stocks is also tricky when valuations are high. And when they are low. You get the point. There is never the right time when it comes to buying stocks. I recently … Continue reading »

Read More »

Read More »

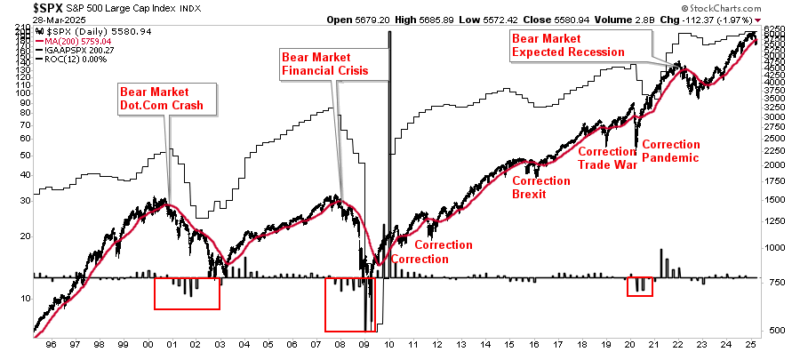

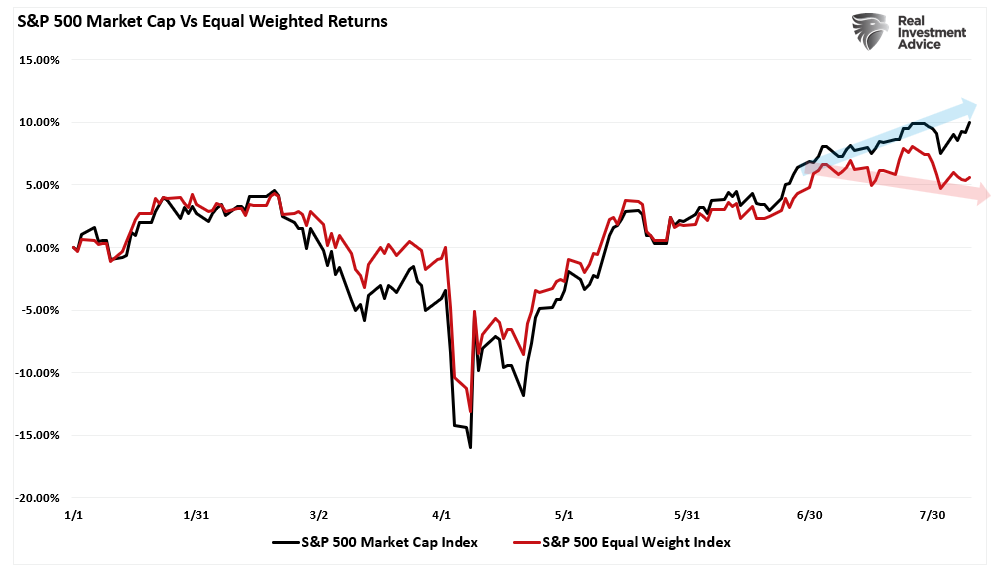

The Stealth Bear Market

Is this a "stealth" bear market? Of course, you may be asking yourself what I mean by that. Historically, bear markets have tended to be pretty evident, as highlighted in the chart below. These bear markets are often more protracted affairs that lead to investors developing profoundly negative sentiment towards markets. This article will use …

Read More »

Read More »

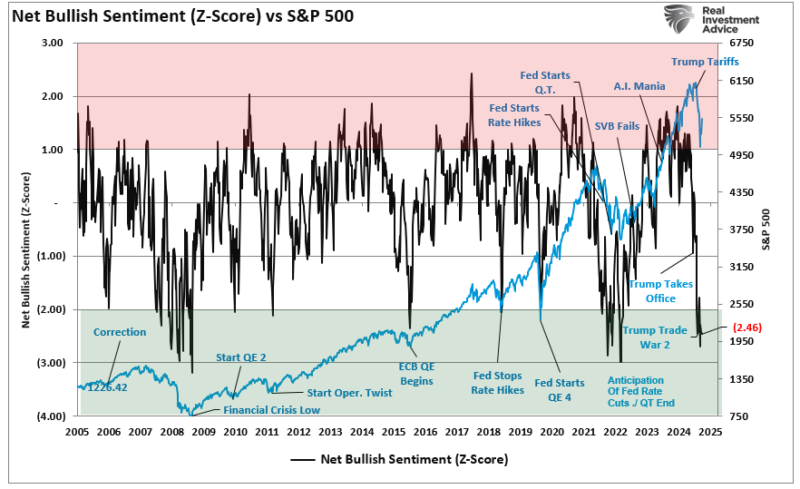

The Anchoring Problem And How To Solve It

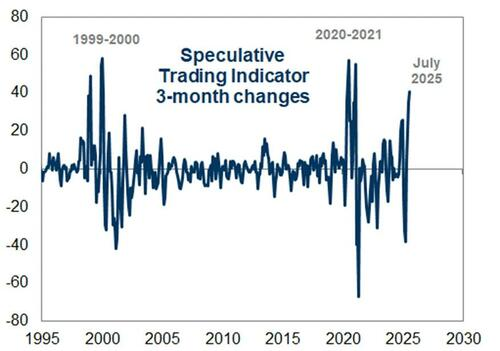

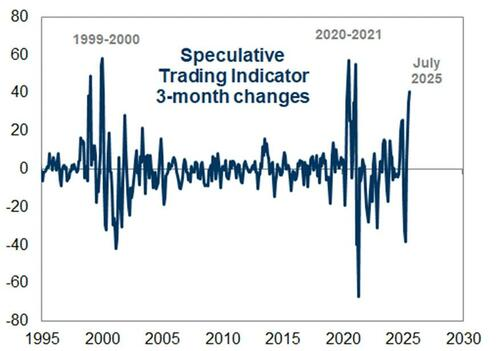

Market perspective is essential in avoiding investing mistakes. With the media constantly pushing a “Markets In Turmoil” narrative, it’s no wonder that investor sentiment recently reached some of the lowest levels since the financial crisis. The following chart is the z-score of the retail and professional investor sentiment composite index of bullish sentiment. Notably, we …

Read More »

Read More »

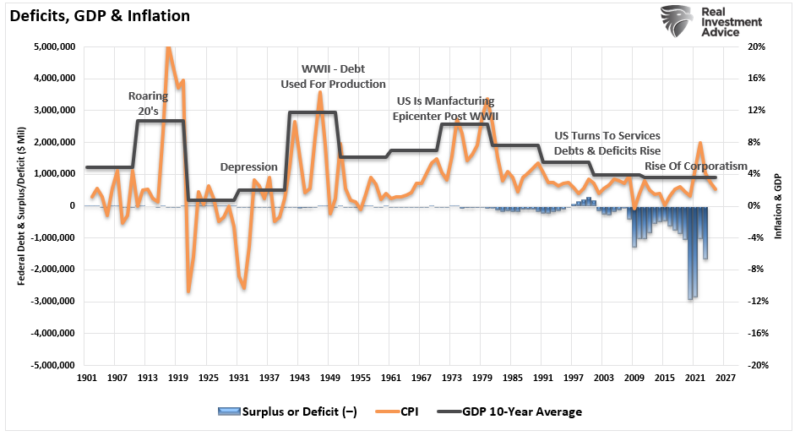

Moody’s Debt Downgrade – Does It Matter?

This morning, markets are reacting to Moody's rating downgrade of U.S. debt. For those promoting egregious amounts of "bear porn," this is nirvana for fear-mongering headlines that gain clicks and views. However, as investors, we need to step back and examine the history of previous debt downgrades and their outcomes for both the stock and …

Read More »

Read More »

Corporate Stock Buybacks – Do They Affect Markets?

Fisher Investments recently wrote an interesting article asking whether corporate stock buybacks affect markets. Here is their conclusion: "Yes and no? Stocks move on supply and demand. Stock buybacks, where a company buys and takes shares off the market, theoretically reduce supply.

Read More »

Read More »

A Bear Market Rally? Or, Just A Correction?

Assessing a bear market rally proves challenging when you experience it firsthand. It is only in hindsight that the complete picture reveals itself to investors. Of course, after a bear market rally, investors tend to review their investments and speculate on what they should have done differently.

Read More »

Read More »

“Resistance Is Futile” – For Both Bulls And Bears

"Resistance is futile" was a sentence that struck fear in the hearts of Trekkie fans during "Star Trek: The Next Generation," specifically in both of the "Best Of Worlds" and "First Contact" episodes. In those episodes, the "Starship Enterprise" crew encountered a species called the "Borg." The Borg's primary purpose was to achieve "perfection" by assimilating other beings …

Read More »

Read More »

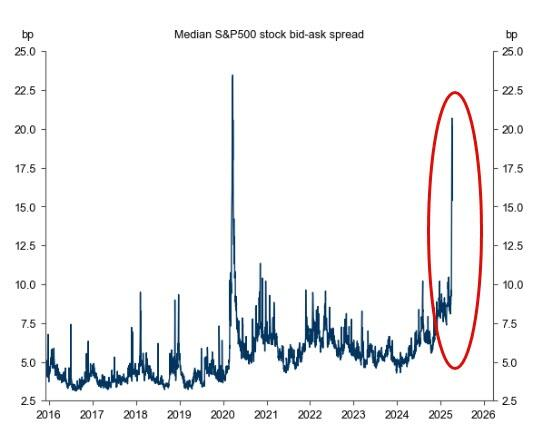

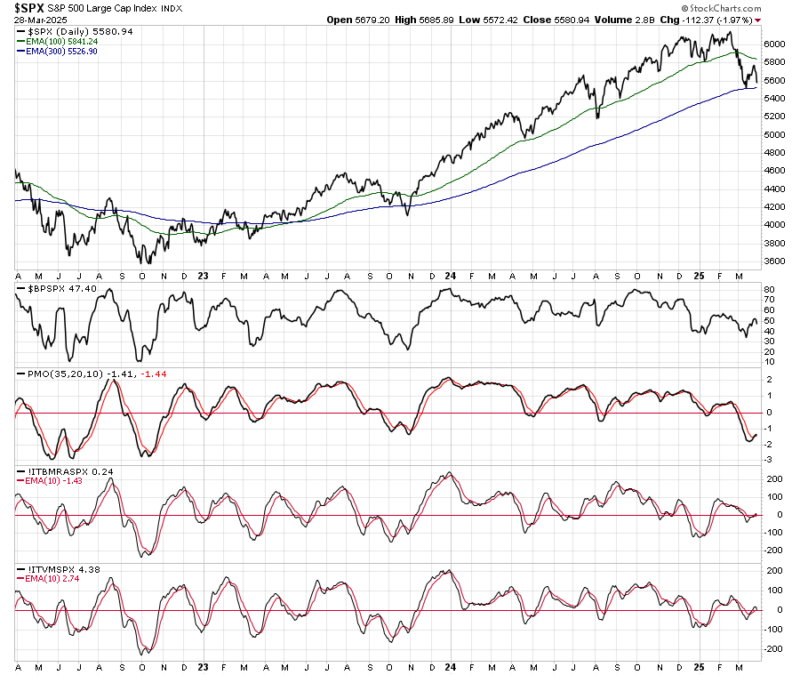

Correction Continues – The Value Of Risk Management

Despite the recent rally, the correction continues. While wanting to "buy the dip" is tempting, there has been enough technical damage to warrant remaining cautious in the near term. As we have discussed, managing risk requires discipline and the emotional ability to navigate more volatile markets until a more straightforward path for risk-taking emerges. The …

Read More »

Read More »

The Death Cross And Market Bottoms

In financial markets, few technical patterns generate as much attention and anxiety as the death cross. This ominous-sounding term refers to a crossover on a price chart when a short-term moving average, most commonly the 50-day moving average (50-DMA), drops below a long-term moving average, usually the 200-day moving average (200-DMA). The "death cross" is a fantastic …

Read More »

Read More »

Yield Spreads Suggest The Risk Isn’t Over Yet

In November last year, I discussed the importance of yield spreads, historically the market's "early warning system." To wit:" "Yield spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often …

Read More »

Read More »

The Market Crash – Hope In The Fear

Last week, we noted that "nothing good happens below the 200-DMA," and the tariff-induced market crash this past week confirmed that statement. However, we also noted that over the last 30 years, previous failures at the 200-DMA have also often been buying opportunities. That is unless some "event" of magnitude creates a massive shift in analysts' estimates. …

Read More »

Read More »

Failure At The 200-DMA

In last week's post, "Is the correction over?" we wrote about the potential for a rally back to the 200-DMA. However, the failure of that test increased short-term concerns. As we noted in that post, there were early indications of buyers returning to the market. To wit: "The chart below has four subpanels. The first … Continue reading...

Read More »

Read More »

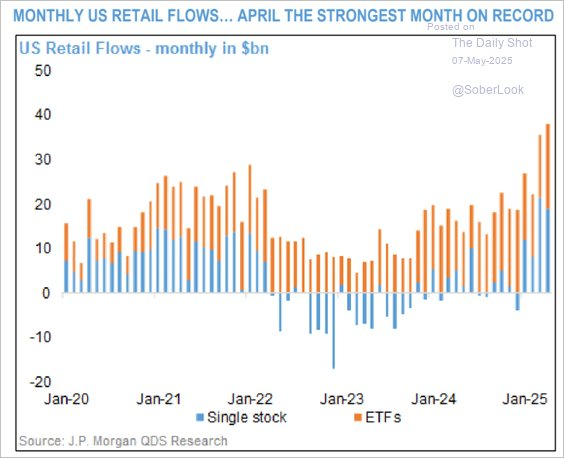

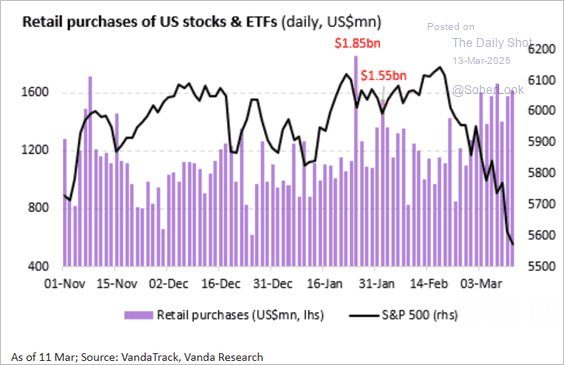

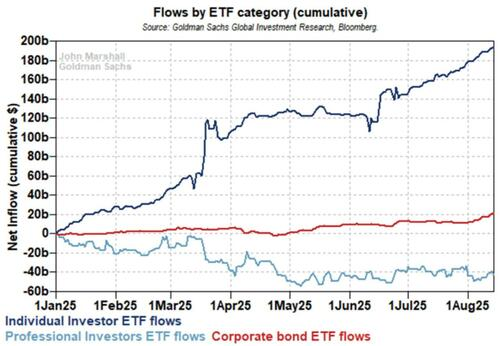

Retail Investor Buys The Dip Despite Bearish Sentiment

It has been an interesting correction. The average retail investor was "buying the dip" despite having an extremely bearish outlook. This is an interesting point because, as shown, the retail investor used to be considered a "contrarian indicator" as they were prone to be driven by emotional behaviors that led them to "buy high and sell low." …

Read More »

Read More »