Tag Archive: tariffs

Invest Or Index – Exploring 5-Different Strategies

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

Read More »

Read More »

Weekly Market Pulse: Tune Out The Noise

Okay, I confess. It was my fault. I decided to take a couple of days off. I took my eye off the ball and the stock market fell a quick 2% while I was relaxing, eating too much, and seeing some great art in the Holy City, Charleston, SC. I promise it won’t happen again, at least until my wife tells me where we’re going next.

It is a running joke within Alhambra that every time I go away for a few days the market takes a hit. Of course, that isn’t...

Read More »

Read More »

Weekly Market Pulse: Is The Honeymoon Over Already?

President Trump’s first week on the job was a good one for markets. The S&P 500 was up 1.75%, with tech stocks taking the lead as the President welcomed a group of leading technology CEOs to D.C. to announce big investments in AI.

Read More »

Read More »

S&P 500 – A Bullish And Bearish Analysis

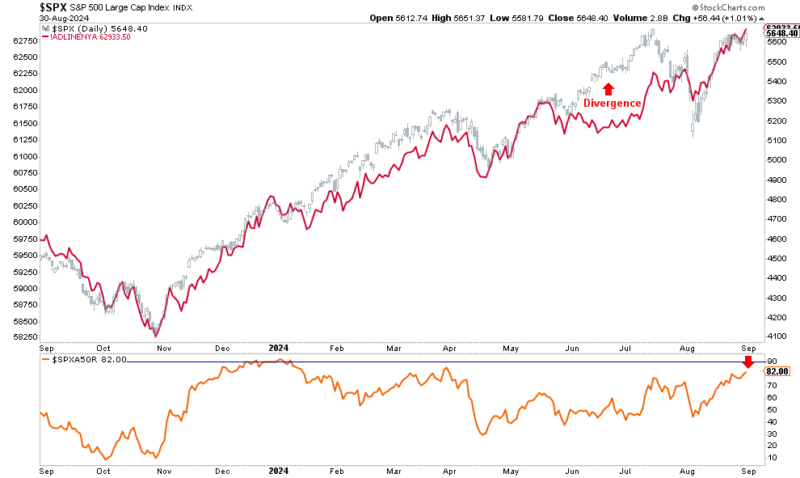

The S&P 500 index is a critical benchmark for the U.S. equity market, and its performance often dictates investor sentiment and decision-making. Between November 1, 2022, and September 6, 2024, the S&P 500 experienced a significant rally but not without volatility. Currently, investors have very mixed views about where markets are heading next as concerns of a recession linger or what changes to monetary policy will cause.

However, as...

Read More »

Read More »

Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever.

Economists and experts have long argued that technological advances drive...

Read More »

Read More »

Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

Read More »

Read More »

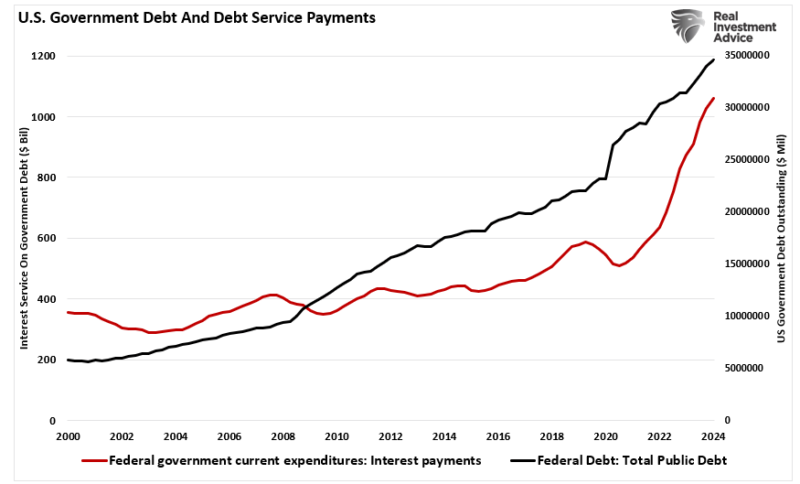

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »

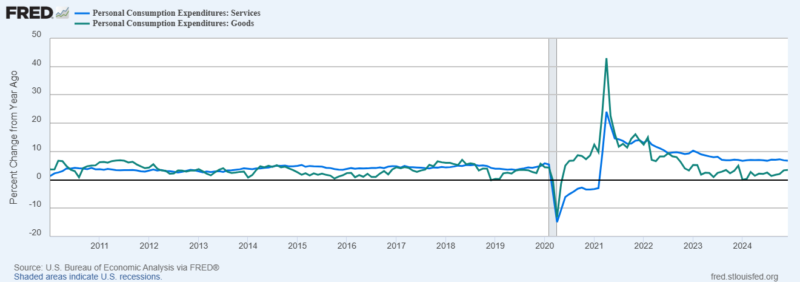

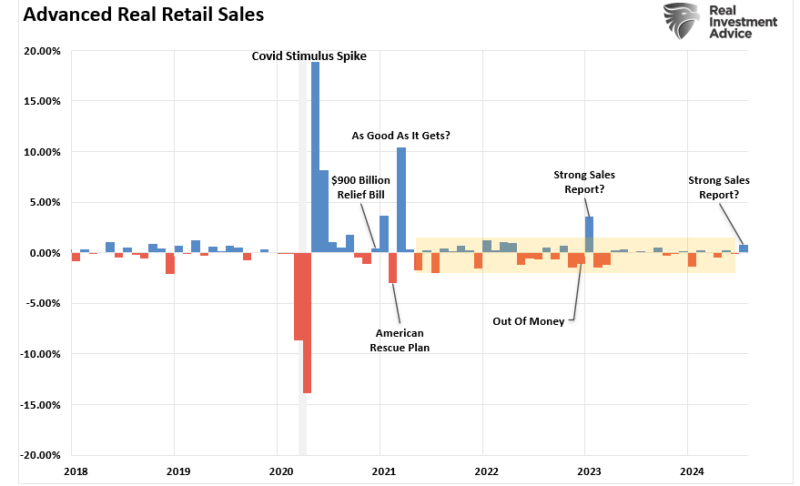

Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and...

Read More »

Read More »

Consolidative Tuesday

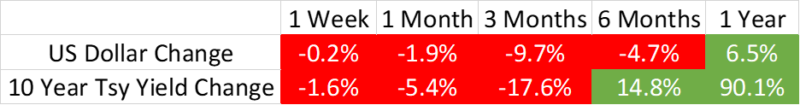

Overview: The dollar is consolidating but with a somewhat

heavier bias today. The G10 currencies are firmer but for the New Zealand and

Canadian dollars, which are slightly softer. Most emerging market currencies

are also firmer, except for a handful of Asian currencies. The news steam is

light. Equities are trading off. The MSCI Asia Pacific Index

snapped a seven-day rally, and Hong Kong shares and the mainland shares that

trade there led the...

Read More »

Read More »

Jump in Japanese Bond Yields Fails to Lift the Yen

Overview: The foreign exchange market is quiet. Most

of the G10 currencies are +/- 0.1% against the dollar. The crash that took the

of Iran's president and foreign minister may have helped lift gold to new

record highs ($2450), the impact seems more muted, as poor weather rather than

foul play, seems to be main narrative. July WTI reached nearly $80, its best

level since May 1 but is hovering around unchanged levels (~$79.50). Canadian

markets are...

Read More »

Read More »

The Dollar Continues To Recover

Overview: The dollar's recovery begun yesterday has

extended into today's activity. The greenback is higher against all the G10

currencies and most emerging market currencies, but the Indian rupee and

Mexican peso. The BOJ did not reduce its bond buying at today's operation and

the market sold the yen on the news. After reaching JPY153.60 yesterday, the

greenback is near JPY156 now. New initiatives to support the beleaguered

property market was not...

Read More »

Read More »

Will USD be Bought on the Fact after Being Sold on Expectations of a Softer CPI?

Overview: The

dollar is trading heavily against the G10 currencies and most of the currencies

from emerging markets. The market expects softer US CPI (and retail sales)

today. Any decline in the year-over-year core rate would put it at its lowest

level since April 2021. Still, this has been anticipated, and the market seems

vulnerable to "sell the rumor, buy the fact" type of activity. After

all, the Fed will see another employment and...

Read More »

Read More »

Weekly Market Pulse: A Fatal Conceit

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

The Dollar Jumps and the Euro Slips under $1.03

Overview: The dollar is soaring today, and the euro is trading at new 22-year lows having traded below $1.03. Even a 50 bp hike by the Reserve Bank of Australia has failed to prevent a sharp drop in the Australian dollar.

Read More »

Read More »

Risk Appetites are Fickle

Overview: Yesterday’s strong US equity gains failed to carry over into today’s session. Japanese and Australian shares fared the best among the large Asia Pacific market, with the Nikkei off less than 0.4% and the ASX off less than 0.25%.

Read More »

Read More »

US-EU Rapprochement, Can France and UK Do the Same?

Overview: It is mostly a quiet start to the new month. Most of Europe is closed for the All -Saints holiday and the week's key events start tomorrow with the Reserve Bank of Australia meeting. News that the Liberal Democrats retained a majority in the lower chamber of the Diet helped lift Japanese indices by 2%. Most of the large regional markets gained, though China and Hong Kong markets fell. US index futures are trading with a higher bias...

Read More »

Read More »

FX Weekly Preview: An Eventful Week Ahead

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year.

Read More »

Read More »

FX Daily, December 3: US Brandishes Tariff Weapon and Weakens Animal Spirits

Asia Pacific equities mostly declined in sympathy with yesterday's large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia's 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the move lower. Europe's Dow Jones Stoxx 600 fell 1.6% yesterday, the largest loss in two months, and is extending the losses for a third session today.

Read More »

Read More »

United States: The ISM Conundrum

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding.

Read More »

Read More »

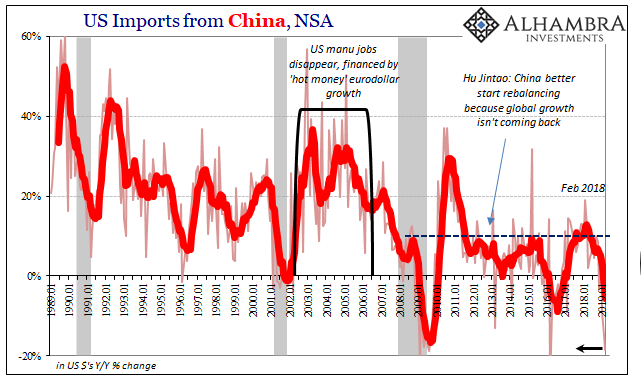

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »