Tag Archive: Switzerland

Blockchain Reaches Operational Maturity at Swiss Banks, with Stablecoins Becoming the New Strategic Priority

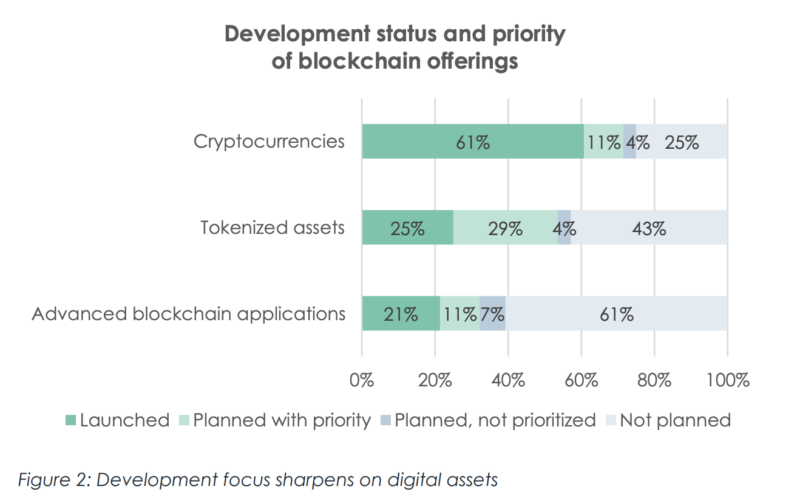

In the Swiss financial services sector, formal blockchain strategies have become standard practice and cryptocurrency services are now live, a new study by the Center for Financial Services Innovation at the University of St. Gallen, ACK, mintminds, PwC and vision&, found.

This underscores the country’s transition from blockchain experimentation to operational maturity.

The study, which polled 28 banks and financial service providers in...

Read More »

Read More »

“Sometimes, the only winning move is not to play”

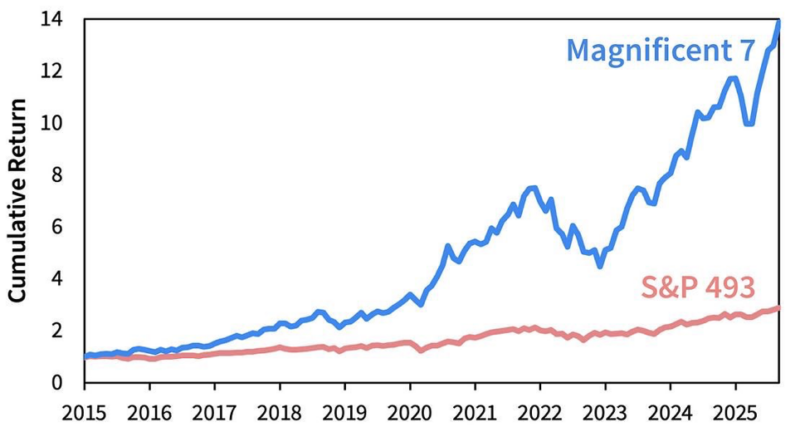

This was the conclusion of the assessment of legendary investor Michael Burry regarding the current market conditions. To be precise, his take as recently posted on X, in full, was “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.” The insight behind these words is something that a lot of investors could use at this time. The unrestrained, unjustifiable and unrealistic...

Read More »

Read More »

Gold’s flashing warning: The end is nigh for fiat

Gold’s spectacular performance has drawn a lot of attention and invited endless analyses and commentaries. There are many theories out there as to why the yellow metal is surging like never before in modern memory, however most of them are shortsighted, or tend to miss the forest for the trees. The metal’s meteoric rise is not merely sending message about inflation expectations or rate policy. It’s flashing a clear warning sign about the...

Read More »

Read More »

A conversation with Catherine Austin Fitts

I recently had the great pleasure of (virtually) sitting down with Catherine Austin Fitts, investment banker, President of Solari, and former US Assistant Secretary of Housing and Urban Development for Housing, and having an extremely interesting conversation about the outlook for gold and silver. It was a fascinating discussion, especially given our current economic, monetary and geopolitical context: there so many risks and challenges ahead, that...

Read More »

Read More »

Investing in times of policy volatility

At the end of last month, a shock announcement came from the US Customs and Border Protection (CBP), declaring that one-kilogram and 100-ounce gold bars imported from Switzerland would be subject to a hefty 39% tariff, under the country’s “reciprocal tariffs” policy, which had already applied broadly to Swiss goods. This CBP decision came in response to a Swiss refiner’s request for clarity and guidance on whether gold would be part of the wider US...

Read More »

Read More »

Geopolitical theater and implications for investors (or lack thereof)

The last month has been truly remarkable for modern human history – at least if one was paying attention to mainstream news headlines and TV anchors. Apparently, we came extremely close to World War III and we very likely had a very tight escape from an all-out nuclear holocaust that could have forever changed the our species’ trajectory and annihilated millions.

It all started with Israel’s surprise bombardment of Iran (which wasn’t really a...

Read More »

Read More »

A Politically Incorrect “Where Are We Now?”

A few days ago, I had the great pleasure to sit down again with my good friend James Patrick in person, in Monte Brè. It was a truly spontaneous and unfiltered conversation about the current state of the world, the bizarre geopolitical situation and the tragicomical moment in history that we find ourselves in. We talked about the extreme, and likely unprecedented, risks we face in the global economic and financial system and I’m very glad we...

Read More »

Read More »

Swiss Crypto Associations Unveil 12-Point Manifesto to Strengthen Switzerland’s Leadership in Blockchain

Three crypto industry organizations in Switzerland, namely the Swiss Blockchain Federation, the Crypto Valley Association, and the Bitcoin Association Switzerland, have joined forces to release a comprehensive manifesto aimed at reinforcing Switzerland’s position as a global blockchain hub.

Read More »

Read More »

Silver: A rare buying opportunity

The gold price recently surged to unprecedented levels, surpassing the $3,000 per ounce milestone. This remarkable surge has been attributed to escalating geopolitical tensions, the revival of the trade wars, mounting inflation concerns, and of course, a very uncertain and very worrying outlook for the global economy and for the markets. As they always do, investors have once again flocked to the safe haven that gold unmistakably provides, pushing...

Read More »

Read More »

Top 12 Fintech Courses and Certifications in Switzerland in 2025

Fintech is one of the fastest growing industries in the world. The Boston Consulting Group (BCG) estimates that the market will reach a size of US$1.5 trillion in revenue 2030, representing a roughly fivefold increase from 2024.

This growth has driven a surge in demand for fintech professionals, leading to the launch of a wide range of educational programs, courses, and certifications tailored to both young students and experienced professionals...

Read More »

Read More »

“Does The West Have Any Hope? What Can We All Do?”

Share this article

Interview with Godfrey Bloom

I recently had the great pleasure of being interviewed by my good friend Godfrey Bloom, whose point of view and sharp assessment skills of economic and political events I have consistently found illuminating throughout the years.

It’s always extremely refreshing talking to Godfrey, because his questions cut through the noise and concentrate on what is actually important. I find his views and...

Read More »

Read More »

“Does The West Have Any Hope? What Can We All Do?”

Interview with Godfrey Bloom

I recently had the great pleasure of being interviewed by my good friend Godfrey Bloom, whose point of view and sharp assessment skills of economic and political events I have consistently found illuminating throughout the years.

It’s always extremely refreshing talking to Godfrey, because his questions cut through the noise and concentrate on what is actually important. I find his views and arguments are also...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Part II of II

Business as usual” will simply not cut it anymore. The “print and spend” policies of the past, the QE lifelines, the liquidity injections, the zero and negative interest rates, the blatant debasement of the currency, the market manipulation and all the direct and indirect bailouts will not work as they did before.

And it’s not only because the central bankers have overused these “weapons” and have by now exhausted all their...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Share this article

Part II of II

Business as usual” will simply not cut it anymore. The “print and spend” policies of the past, the QE lifelines, the liquidity injections, the zero and negative interest rates, the blatant debasement of the currency, the market manipulation and all the direct and indirect bailouts will not work as they did before.

And it’s not only because the central bankers have overused these “weapons” and have by now...

Read More »

Read More »

Bailey Weighs on Sterling

Overview: The dollar enjoys a firmer tone today. The escalating conflict in the Middle East is keeping the market on edge. And then there is tomorrow's US employment report. Among the G10 currencies, sterling has been the hardest hit. It is off around 1% after Bank of England Governor Bailey seemed to signal that after pausing last month, the central bank may turn more aggressive here in Q4. Nearly all the emerging market currencies are...

Read More »

Read More »

The road to Serfdom: are we on the final stretch?

Share this article

An attempt at an analysis from the perspective of a free Swiss individual

What you’re about to read is the abridged and condensed English translation of a speech I gave in Munich in November 2023. You can find the full speech, in German with English subtitles, here.

It tackles the very difficult, but also very crucial, subject of individual freedom, or what is left of it these days, and it seeks to offer a constructive...

Read More »

Read More »

Interview with Executive Global: “The Return of Marxism in the West”

Our special interview on Swiss Wealth Advisor with CLAUDIO GRASS, CEO and Independent Precious Metals Consultant, explores the manner in which astute investors may preserve wealth against the backdrop of debilitating central economic planning and monetary inflation.

Read More »

Read More »

Dollar Recovers from Yesterday’s Slide, but Slumps Against the Yen

Overview: The dollar's losses scored after yesterday's disappointing ISM manufacturing report were extended initially in Asia Pacific turnover earlier today before it recovered. The recovery has stretched the intraday momentum indicators, warning against expected strong follow-through dollar buying in North America, without fresh impetus.

Read More »

Read More »

Is gold too expensive to buy right now?

Share this article

This question has been at the center of a great many conversations I’ve been recently having with clients and friends. The way I like to answer it is with another question: Expensive compared to what?

Despite its recent surge to record highs, there are compelling reasons why purchasing gold right now is a prudent decision, with strong indications that its value is poised to climb even higher. Making investment decisions...

Read More »

Read More »

Private property rights under siege

People invest in gold for many different reasons. Many do so out of concern over economic, monetary or political uncertainty. Others seek a hedge against inflation, a way to protect and preserve the real purchasing power of their savings.

Read More »

Read More »