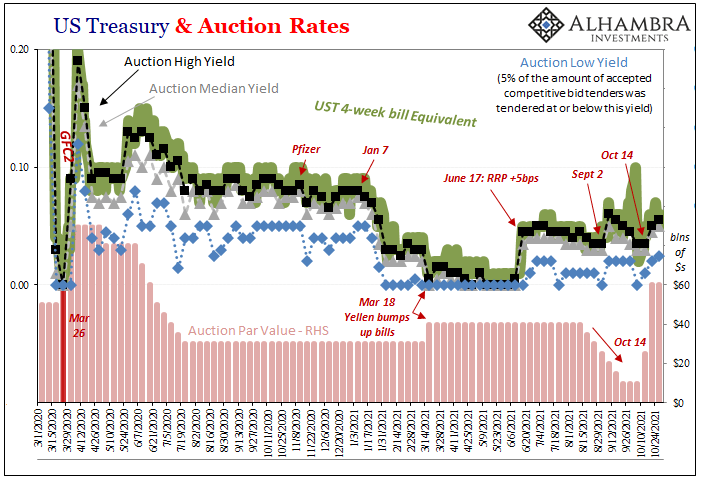

Treasury Secretary Janet Yellen hasn’t just been busy hawking cash management bills, her department has also been filling back up with the usual stuff, too. Regular T-bills. Going back to October 14, at the same time the CMB’s have been revived, so, too, have the 4-week and 13-week (3-month). Not the 8-week, though.

Read More »

Tag Archive: supply

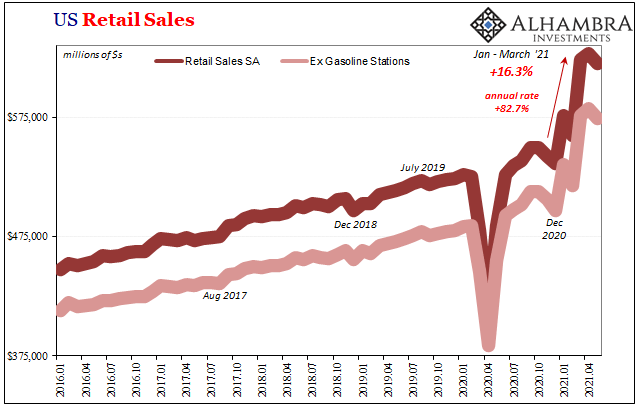

Another Round of Transitory: US Retail Sales & (revised) IP

Same stuff, different month. We can basically reprint both what was described yesterday about supply curves not keeping up with exaggerated demand as well as the past two months of commentary on Retail Sales plus Industrial Production each for the US. Quite on the nose, US demand for goods, anyway, is eroding if still artificially very high.

Read More »

Read More »

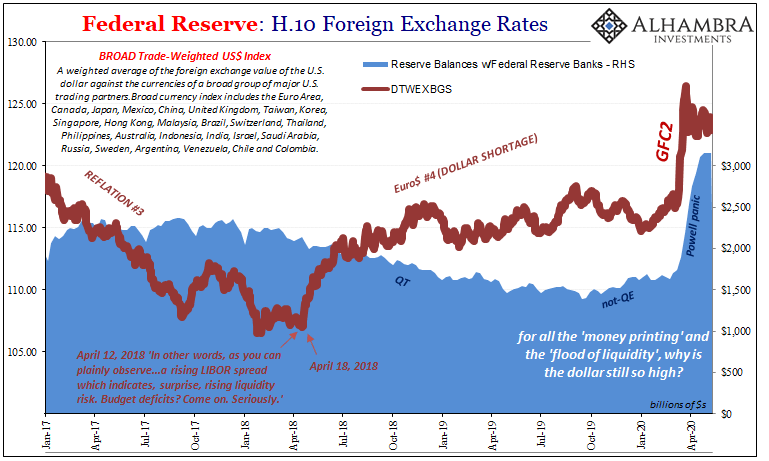

So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal.That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected.

Read More »

Read More »

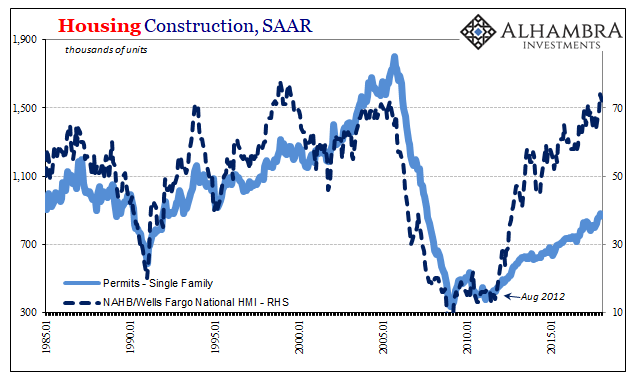

New Home Sales (Predictably) Fall Out of the Boom, Too

New home sales were down sharply again in January 2018. For the second straight month, the level of purchase activity fell substantially despite what are otherwise always described as robust or even booming economic conditions. Like the sales of existing homes, the sales of newly constructed units should be both moving upward as well as being significantly more than stuck at this low level.

Read More »

Read More »

Harvey’s Muted (Price) Impact On Oil

The impact of Hurricane Harvey on the Gulf energy region is becoming clear. There have been no surprises to date, even though the storm did considerable damage and shuttered or disrupted significant capacity. Most of that related to gasoline, which Americans have been feeling in pump prices.

Read More »

Read More »

All About Inventory

Andy Hall has been called the God of Oil. As chief of Astenbeck Capital, he has proven at times that even gods can be mortal. In the “rising dollar” period, for example, after making money on the way down Mr. Hall went bullish.

Read More »

Read More »

Why Aren’t Oil Prices $50 Ahead?

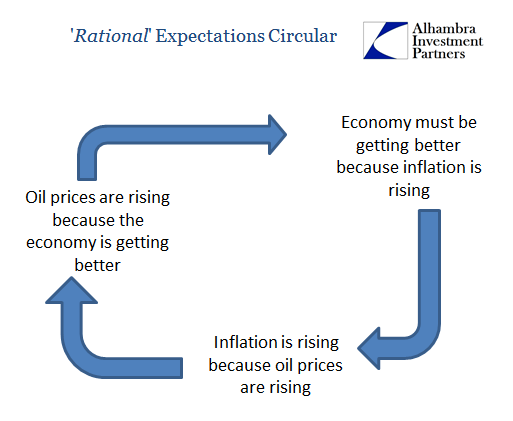

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even 2014, it may at times seem the...

Read More »

Read More »

The Six Major Fundamental Factors that Determine Gold and Silver Prices

Gold and silver are the most complicated assets to price. Stocks, currencies, commodities mostly depend on their fundamental data, supply and demand. Gold and silver, however, are priced indirectly.

Read More »

Read More »